- ETH’s Lengthy/Brief Ratio elevated, suggesting an increase in bullish sentiment.

- Nonetheless, market indicators remained bearish.

Ethereum [ETH], like most different cryptos, has been displaying much less volatility in the previous few days. Nonetheless, a key metric registered an enormous uptick within the final 24 hours, hinting at a development reversal within the coming days.

Is Ethereum prepared for a comeback?

After a 2% weekly rise, ETH’s value volatility dropped. On the time of writing, the token was buying and selling at $3.38k, with a market capitalization of over $407 billion.

Although this regarded bearish, the continuing development would possibly change quickly.

Coinglass’ information revealed that Ethereum’s Lengthy/Brief Ratio shot up sharply within the final 24 hours. Because of this there are extra lengthy positions available in the market than brief positions, which can lead to a bullish development reversal.

Ali Martinez, a well-liked crypto analyst, posted a tweet revealing how traders have been optimistic about ETH’s value rise within the coming days.

The tweet talked about that 78.30% of merchants on BitMEX with open Ethereum Futures trades have been betting on the worth going up!

Other than this, EtherNasyonal, one more well-known analyst, posted a tweet suggesting that Ethereum might transfer in direction of $4.7k quickly.

Odds of Ethereum recovering

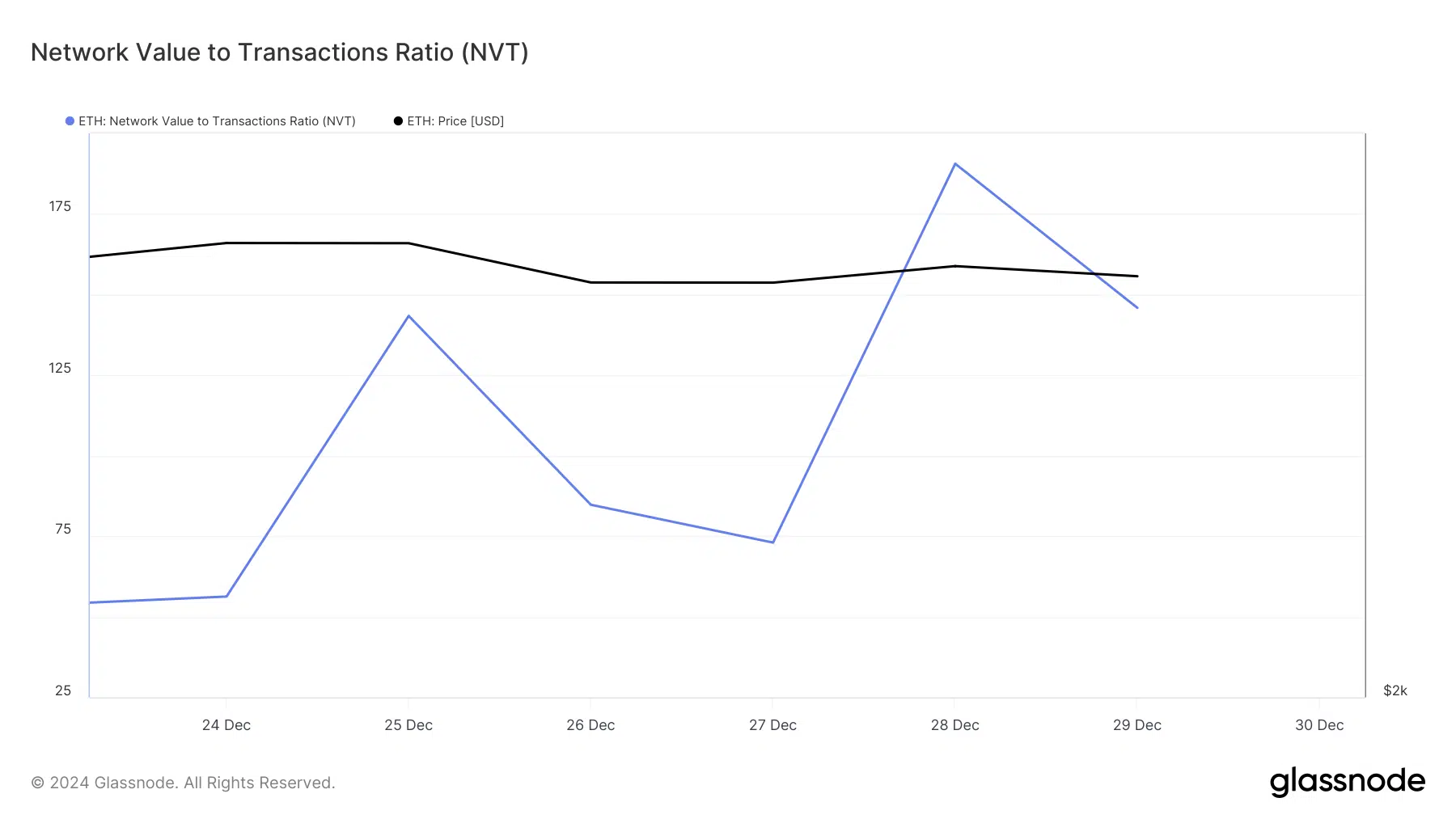

The potential of Ethereum as soon as once more gaining bullish momentum was excessive, because the token’s NVT ratio declined after a pointy uptick.

At any time when the metric drops, it implies that an asset is getting undervalued, which ends up in value hikes.

The king of altcoins’ alternate reserve was additionally dropping, which meant that purchasing stress on the token was rising. Issues within the derivatives market additionally regarded fairly optimistic.

This was evident from Ethereum’s rising Funding Price — an indication that the market is optimistic, and merchants anticipate costs to rise.

Although these aforementioned metrics recommended a development reversal, technical indicators remained bearish. The MA Cross displayed a bearish benefit available in the market, because the 9-day EMA was nicely under the 21-day MA.

The MACD additionally painted an identical image of a bullish higher hand available in the market.

Learn Ethereum’s [ETH] Worth Prediction 2025–2026

In case of a continued bearish development, traders would possibly first anticipate the token drop to $33.7 within the close to time period, as per Coinglass’ liquidation heatmap.

Nonetheless, if bulls take cost, Ethereum would possibly first goal $34.56 earlier than it eyes $4.7k within the coming weeks or months.