- Crypto buyers have reportedly shifted focus to the current Chinese language inventory rally

- Because the fairness uptrend falters, will buyers revert to crypto buying and selling?

Chinese language shares’ rally has tapered after a disappointing stimulus package deal, elevating hopes of a possible shift to Bitcoin [BTC] and crypto buying and selling.

Since late September, Asian shares have rallied amid stable Chinese language authorities stimulus packages and expectations that the insurance policies may proceed in 2024.

In accordance with Alex Kruger, an economist and market analyst, markets anticipated the Chinese language authorities to announce an additional $1.4 trillion fiscal package deal. Nonetheless, solely a $14 billion package deal was introduced.

This dampened market optimism, triggering most Chinese language shares to retrace current positive factors. How does that have an effect on BTC and crypto buying and selling?

China’s affect on crypto buying and selling

In accordance with a current Bloomberg report, the Chinese language inventory rally might need tipped some crypto buyers to reallocate capital to those booming equities. The report cited Tether’s USDT low cost relative to the U.S greenback (USD) since late September as a vital indicator.

One knowledgeable famous that this coincided with China’s quantitative easing program and may sign “panic buying” of Chinese language shares.

“If the traders are rushing to exchange back into fiat currency, it can be inferred that they are panic buying Chinese stocks.”

Ergo, buyers might need offered their USDT to purchase Chinese language shares. Now that the Chinese language fairness market rally has briefly stifled, will they shift focus to BTC and crypto buying and selling once more?

In accordance with Singapore-based crypto buying and selling agency QCP Capital, the waning Chinese language inventory rally may enhance BTC. The agency said,

“As the Chinese rally wanes, we anticipate capital reallocation back into crypto, reflecting the industry’s growing maturity as an alternative risk-on asset.”

Nonetheless, it added that the upcoming incomes season and September US CPI knowledge scheduled for 10 October could possibly be draw back dangers. They might complicate the crypto market’s outlook.

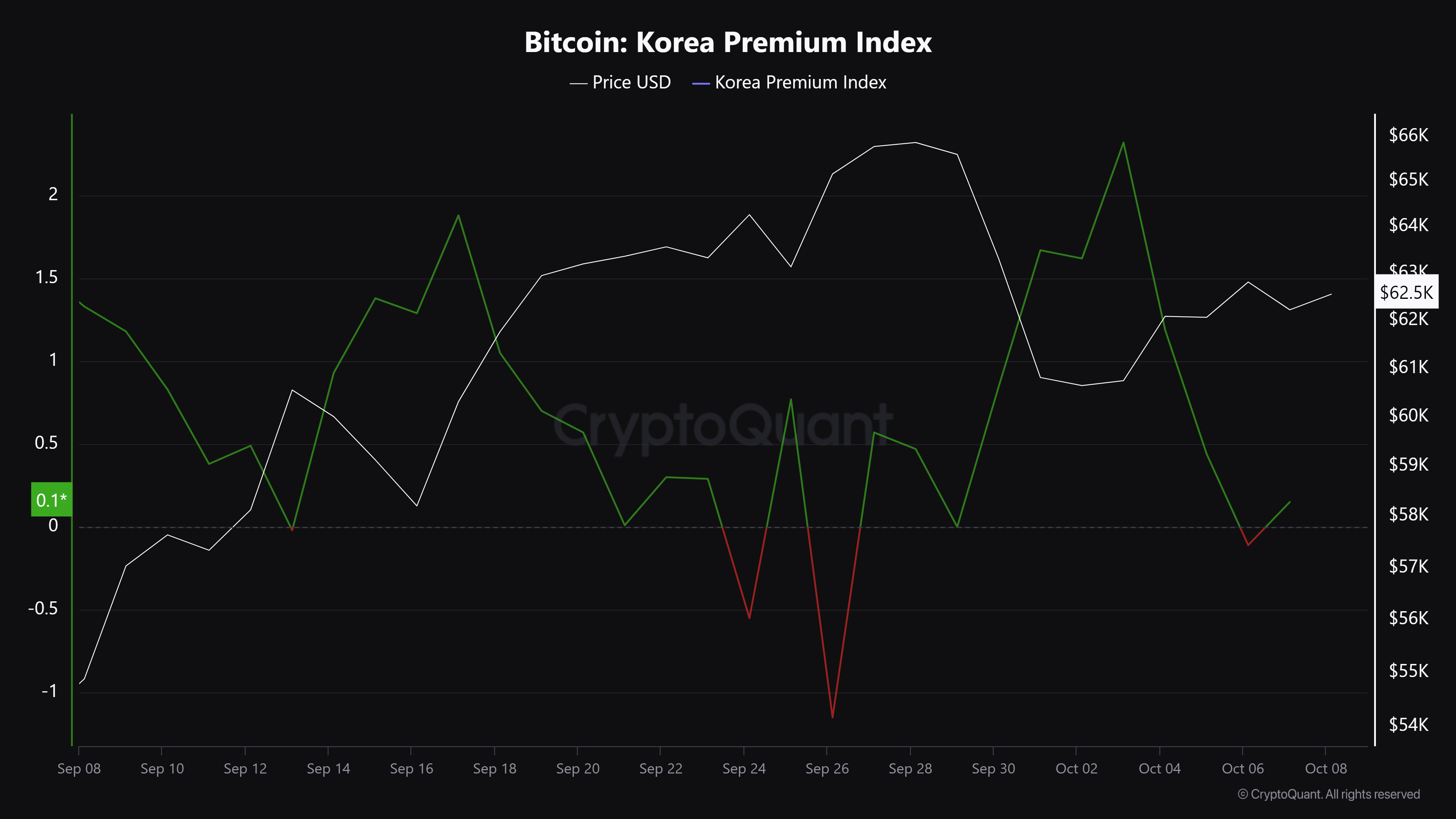

In the meantime, the BTC Korean Premium Index fashioned a V-reversal sample at press time. It was above the impartial degree after dropping within the first week of October.

The metric, also referred to as Kimchi Premium, tracks BTC worth variations between South Korean and overseas exchanges. A better premium would counsel a stronger demand for BTC in Korea than abroad.

The aforementioned constructive studying prompt little Korean demand for the asset. On the time of writing, BTC was valued at $62.5k, down about 1% on the weekly charts.