- Mara bought BTC value $249 million.

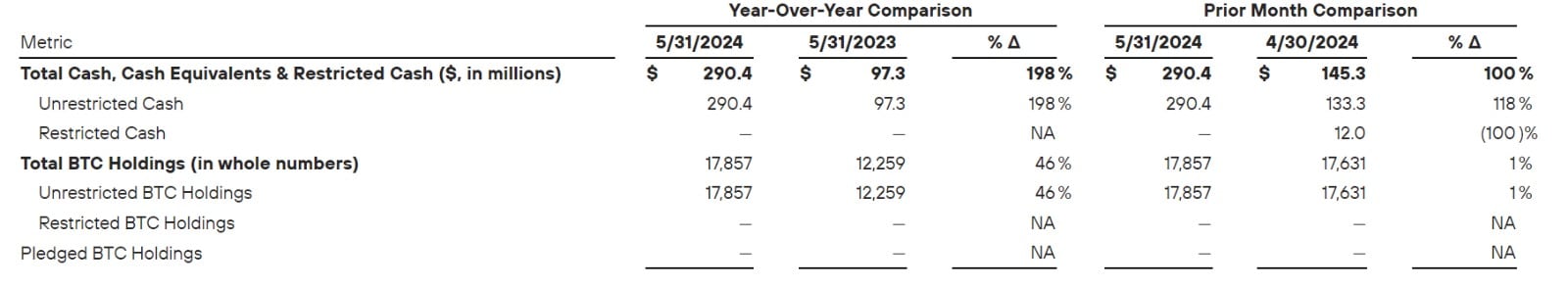

- Latest purchases of 4144 BTC introduced Marathon’s whole holding to 25000 BTC.

The crypto market is frequently evolving amidst elevated acceptability and institutional curiosity. With elevated consideration in the direction of crypto by the federal government, and politicians, crypto miners are re-energized.

All year long, main firms coping with crypto and Bitcoin [BTC] have been on a shopping for spree, betting on BTC’s future worth.

Notably, the biggest BTC miner Marathon is popping to its strategic open market buy to bolster its bitcoin reserves.

Mara buys $249m value of BTC

The mining type introduced the acquisition via its official web page, reporting that,

“MARA secures $300M via an oversubscribed providing of convertible senior notes. With proceeds, we bought 4,144 BTC (valued at approx. $249M), boosting our strategic Bitcoin reserve to over 25,000 BTC. “

The transfer is critical because the agency makes an attempt to safe its place as a robust chief in Bitcoin mining.

Within the buy, the corporate bought 4,144 BTC at a $59,000 common value, growing its whole holding to 25,000 BTC.

The senior observe providing observe for the acquisition gained buyers curiosity, incomes $292.5 million in web revenue. The observe providing is issued with a 2.125% annual rate of interest and is due in September 2031.

These gross sales are important because it affords the corporate monetary flexibility in operations.

Mara’s HODL technique

Undoubtedly, the acquisition certifies Mara’s technique for BTC accumulation.

As reported earlier by AMBCrypto, Mara is dedicated to HODL methods the place it’ll mine and mix with open market purchases to extend its reserve.

Consistent with the technique, MARA bought $100 million value of BTC final month. Subsequently, the miner wager on BTC’s future worth via accumulation with out promoting.

In line with the corporate, HODL’s technique displays its confidence within the long-term worth of BTC. Thus, BTC is the most effective treasury reserve asset which can frequently acquire worth, thus in flip profiting Marathon and buyers.

What it means for Marathon Digital and BTC

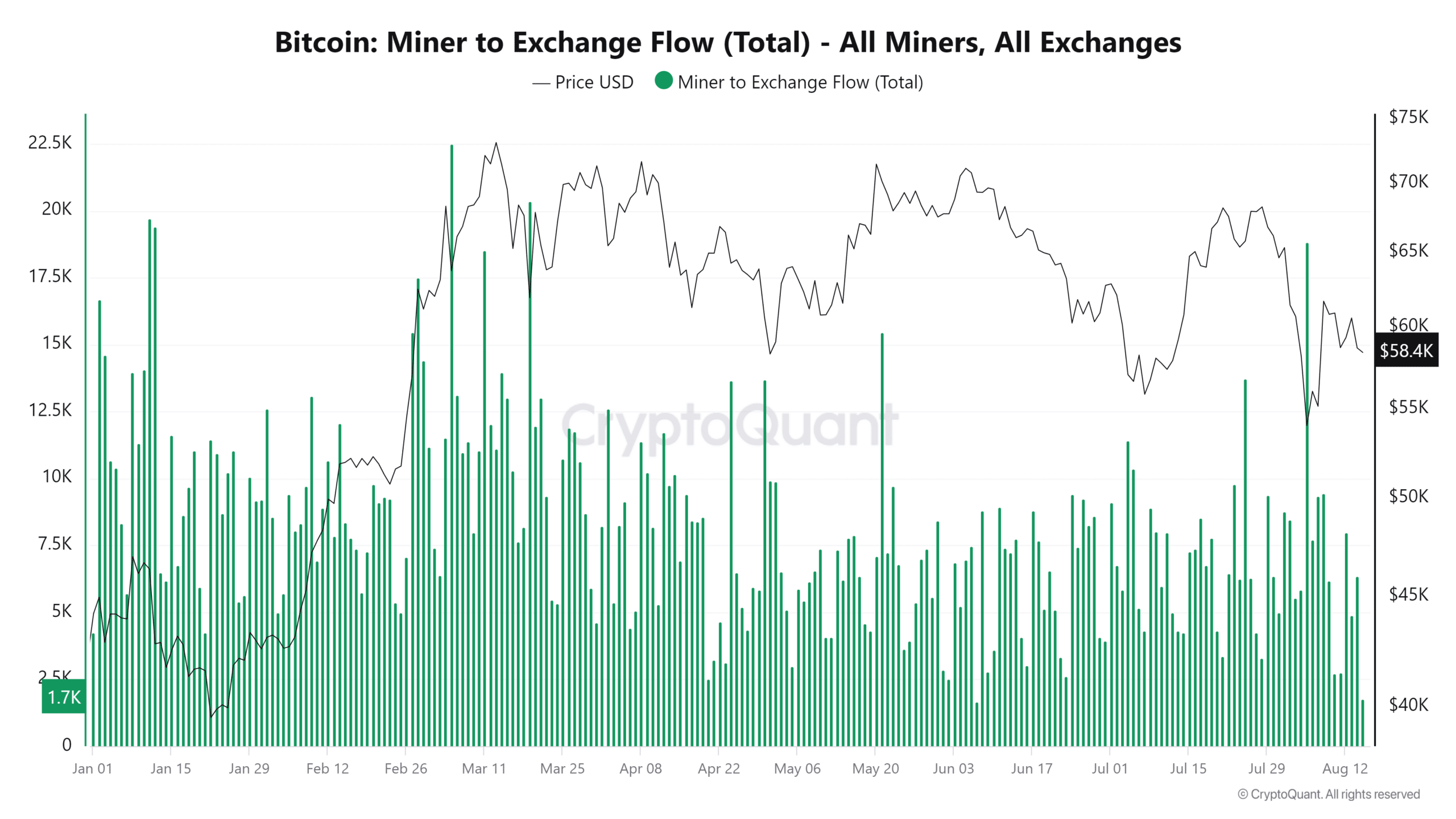

Earlier than returning to the HODL technique, MARA has offered a major quantity of BTC since October 2023. Between June and July, the miners offered 1400 BTC has different miners elevated gross sales.

Equally, in Might, the corporate offered 390 BTC.

Regardless of the gross sales, the corporate lowered its outflows to 31% in 2024 in comparison with 56% in 2023. Nevertheless, these gross sales have harmed Marathon Digital.

In line with Google Finance, the corporate inventory has declined by 33.97 12 months-to-date (YTD). The decline arises from elevated BTC volatility whereas its reserve declines.

Subsequently, the continued BTC accumulation after the current buy goals to spice up the corporate’s worth.

Since BTC is anticipated to extend in worth over time, continued accumulation will enhance Mara’s inventory, income, and profitability.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Equally, elevated institutional adoption is a win for the King coin because it’s positioned to extend demand, thus driving shopping for stress.

Usually, greater demand means greater costs, thus with institutional funding, the demand will skyrocket additional driving its worth greater.