- Bitcoin might surge in the direction of $139,000 if it repeats its previous efficiency throughout U.S. election cycles.

- The MVRV ratio additionally hinted at additional upside, because it exhibits that Bitcoin will not be but overvalued.

Bitcoin [BTC] is repeating historic worth patterns with its spectacular efficiency because the U.S. Presidential election on the fifth of November. Traditionally, U.S. elections have delivered important good points for BTC, and a repeat of this development might see it lengthen its rally to $139,000.

That is in line with analyst TechDev on X (previously Twitter). He famous that on election day, BTC traded at $69,400. Going by the good points posted through the 2012, 2016, and 2020 elections, the value might submit a 4.51x achieve to $139,180 by 2025.

Bitcoin, at press time, was buying and selling at $98,800, having gained by 42% since election day. Its market capitalization can also be inching nearer to $2 trillion. As bullish sentiment grows, will Bitcoin observe previous cycles, or will it derail?

Is Bitcoin repeating previous cycles?

An evaluation of Bitcoin’s weekly chart means that the rally, which began through the election week, may proceed. After the 2020 November elections, BTC began an uptrend that noticed it surge from round $13,700 to the 2021 ATH of $64,800 in lower than six months.

An identical rally, that began through the 2024 election week is presently underway, and if the bullish momentum continues, the value might surge previous $120,000 by April 2025.

The Relative Power Index (RSI) helps this outlook. This indicator had a worth of 77 at press time, suggesting that BTC will not be but overbought. Due to this fact, Bitcoin is but to seek out its high regardless of the latest surge, paving room for extra development.

MVRV indicator exhibits THIS

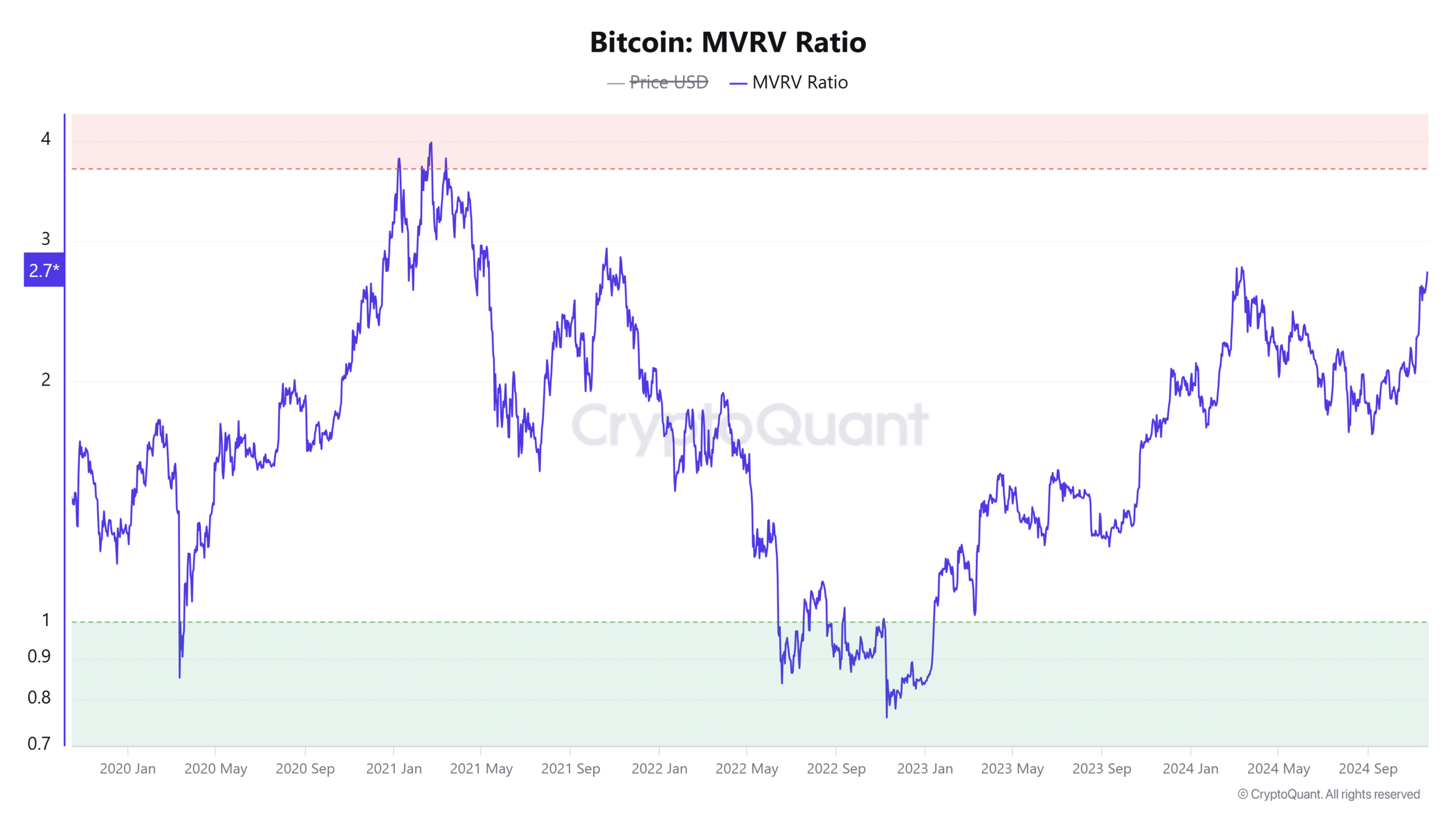

Bitcoin’s Market Worth to Realized Worth (MVRV) ratio additionally hints at additional good points. This metric had a worth of two.7 at press time, suggesting that BTC will not be but overvalued.

An MVRV ratio of two.7 additionally exhibits that Bitcoin remains to be within the early phases of a bull run and regardless of the successive ATH information, it has but to discover a native high.

Merchants ought to be careful for an MVRV climb previous 3.7, as it would point out that the coin has turn into overvalued. The final time that the MVRV ratio confirmed that Bitcoin was overvalued was in early 2021, just a few months after the 2020 elections.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Google Developments suggests retail FOMO

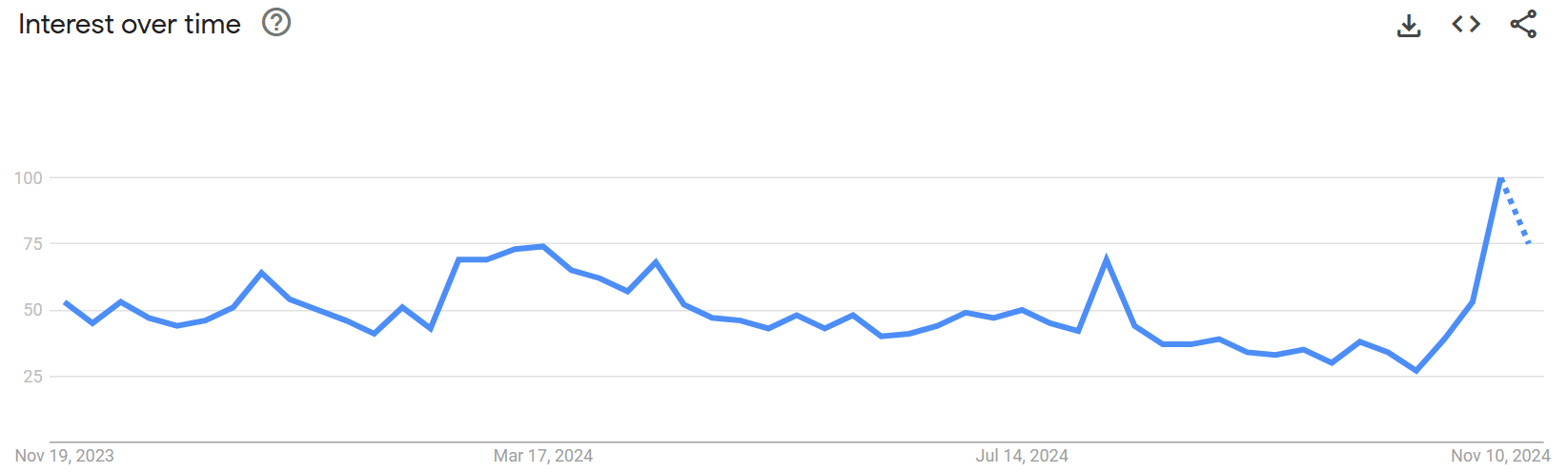

As Bitcoin attracts shut to a different ATH above $100,000, Google Developments exhibits that the concern of lacking out (FOMO) amongst retail merchants is considerably excessive. Search exercise for the time period “Bitcoin” is at its highest degree in a couple of yr.

A rating of 100 on Google Developments exhibits curiosity in Bitcoin is at its peak. It may additionally point out that the retail market is in euphoria.

Nonetheless, with Bitcoin’s rally exhibiting indicators of an early bull market, this rating might level towards rising adoption.