- Giant funds anticipated wild value swings however have been bullish on BTC potential.

- Nevertheless, analysts foresaw BTC sinking decrease earlier than a possible rebound.

The result of the US election is anticipated this week, and the market positioning of hedge funds in Bitcoin [BTC] stays arguably bullish regardless of total warning.

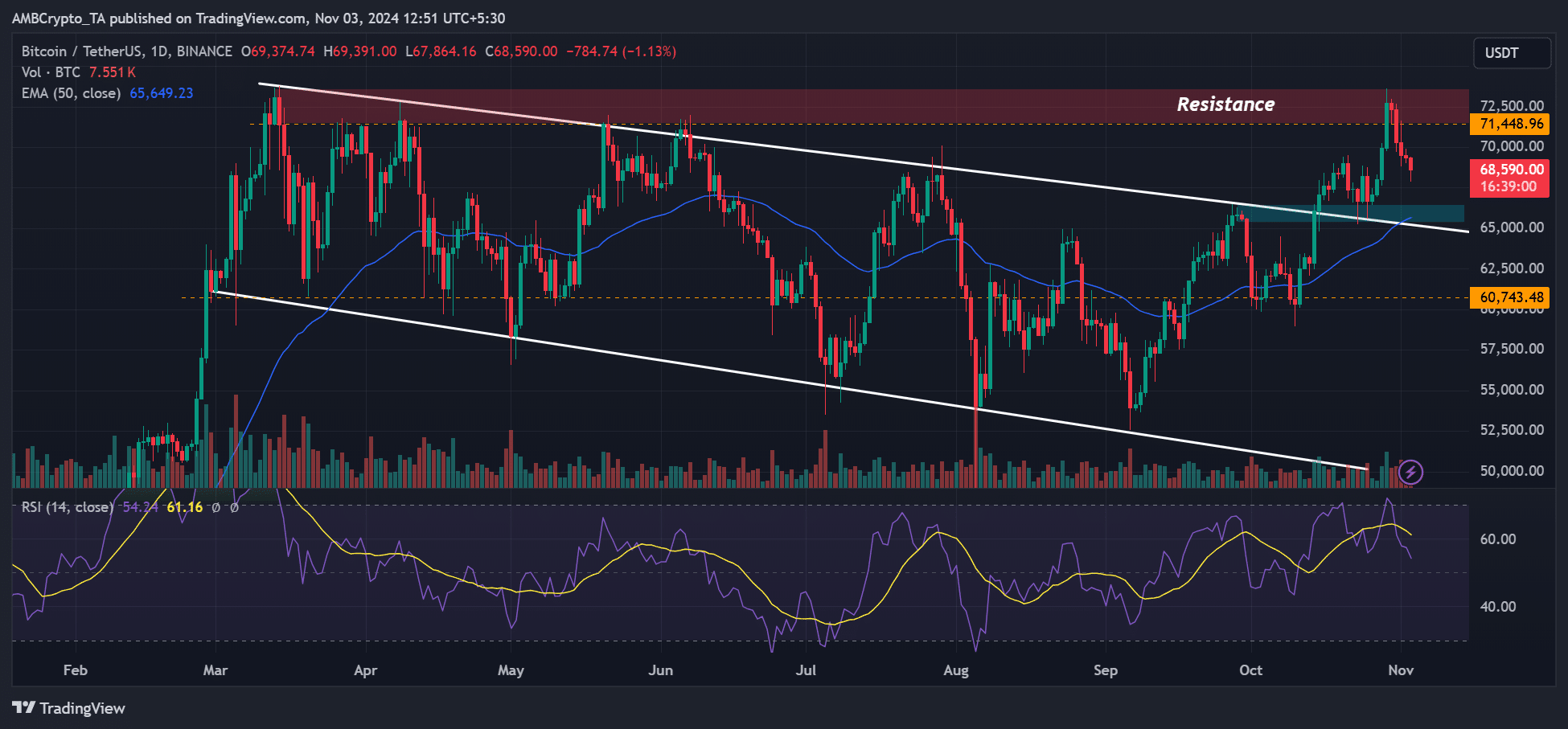

Final week, BTC teased an all-time excessive (ATH) after surging above $73K on sturdy BTC ETF demand and rising odds of Trump profitable.

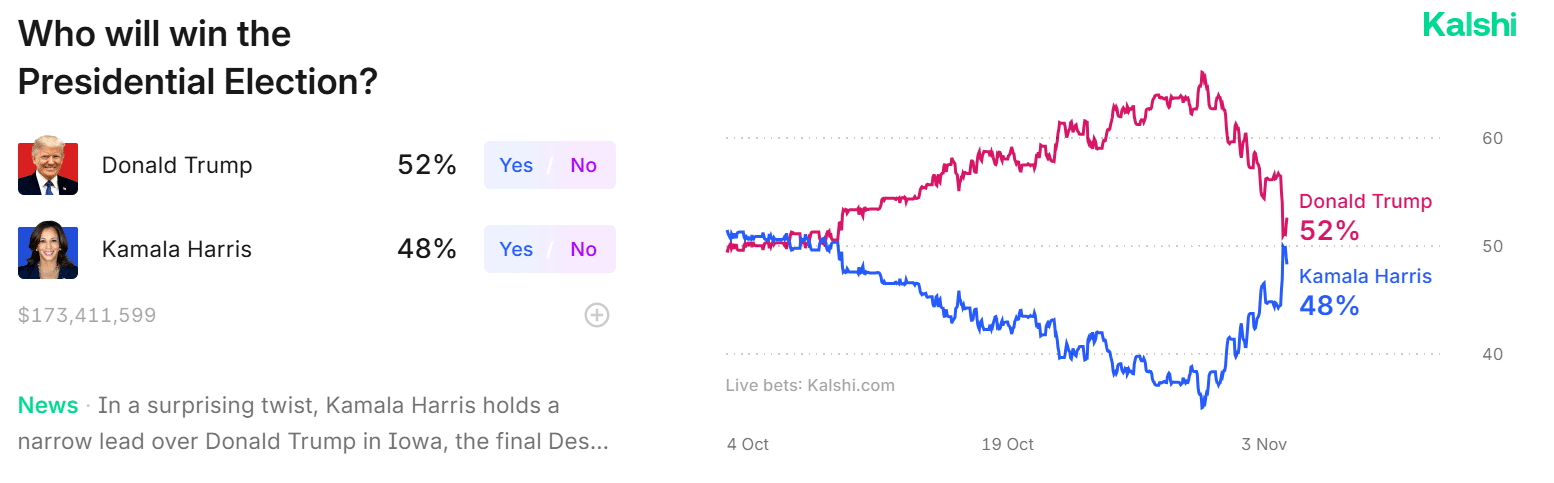

Issues have been completely different within the election week. As of the third of November, Kamala Harris had closed in on Trump’s odds on Polymarket and was virtually at 50/50 on Kalshi, one other prediction website. Briefly, it was a good race, and any candidate might win.

Giant funds eye $70k-$85k for BTC

Regardless of the tight race, hedge funds have been overwhelmingly bullish, however with masking on both facet of the market course as a precaution.

In keeping with the most recent Deribit knowledge, the choices market noticed huge shopping for of calls (betting on value upside) for $70K-$85K targets by November. A part of the agency replace learn,

“Overwhelming Option buying in the Election runup. Large Fund buying echoing (covering?) CME Nov 70+80+85k Call buying with Nov 74-85k Calls +Nov 70k Straddles.”

Moreover, the huge bids on straddles (betting enormous value swings) sign anticipated wild volatility round election day. Giant funds purchased each calls (upside safety) and put (draw back safety) to cowl for potential value swings in both course.

Probably election consequence delay?

Nevertheless, maybe a very powerful piece of the Deribit knowledge was that merchants have been shifting their focus from eighth November choice expiries to twenty ninth November. This signaled an anticipated extended election consequence delay, most likely on account of controversies or rigging claims.

“Nov 8 still has the bump, but larger flows in Nov 29, perhaps due to less theta decay in case of a prolonged result, have dominated over the week.”

This short-term cautious stance was maybe what led to the current de-risking seen within the spot market in direction of the tip of final week.

BTC dropped from final week’s excessive of $73.6K to under $68K, and a few analysts anticipated it to drop even decrease, citing historic patterns round election day.

One of many analysts, Eugene Ng Ah Sio, a crypto dealer, mentioned,

“Seeing constructive derisking happen just at the right time. The plot thickens…”

Eugene added that he would keep away from the markets till the election consequence is thought.

The cautious strategy was echoed by crypto buying and selling agency QCP Capital, warning that the election consequence could possibly be a sell-the-news occasion. It mentioned,

“Regardless of the outcome, we believe the Elections will be another sell-the-news action, replicating the Nashville Bitcoin conference.”

One other market observer and investor, Mike Alfred, shared an analogous sentiment however identified that this is likely to be the final week to purchase BTC under $70K.

“Every previous cycle, Bitcoin has made a low price the week of the US election that has NEVER been revisited again… This week will be the last time you can ever buy Bitcoin below $70,000.”

On the value charts, $65K remained a key degree (confluence space) ought to the pullback prolong decrease.

Nevertheless, the positioning of huge funds was a tell-tale signal of potential restoration for BTC regardless of the uncertainty of the election consequence.