- XRP and ETH are in a decent race to draw capital from Bitcoin as market sentiment turns cautious.

- XRP has the potential to carve out its personal asset class distinct from BTC by 2025.

As soon as once more, the crypto market’s resilience is being examined because the FOMC wraps up 2024 with a “speculative” twist. The third and last rate of interest lower of the yr—additionally the third in simply 4 months—sparked a pointy sell-off in Bitcoin [BTC]. An extended pink candlestick erased 5 days of positive aspects, dragging BTC’s worth under the crucial $100K mark.

However this would possibly simply be the beginning. The Fed’s “cautious” stance hinted that Trump’s conservative insurance policies may result in larger inflation within the months forward.

Traders didn’t take the information effectively. Because the market dipped, some altcoins took double-digit hits, however the prime cash stood agency, suggesting a robust rebound is probably going.

Right here’s the fascinating half: when it got here to driving the “Trump pump,” Ripple [XRP] emerged as the massive winner. Does this give XRP an edge in its battle towards Bitcoin and Ethereum?

The sport is on!

Proper now, XRP is experiencing a surge in sell-offs throughout a number of metrics. It’s clear that XRP hasn’t stayed proof against the market turmoil. In truth, the $3 mark is slipping additional out of attain, with XRP presently priced at $2.30 (on the time of writing).

However all will not be misplaced. December started on a robust notice for XRP, with the coin posting 4 consecutive inexperienced candles, every marking practically a 15% achieve and shutting close to $2.80 – a stage it hasn’t reached in three years. So, distributing XRP tokens appeared like a sensible transfer.

Then again, Ethereum’s each day chart is showcasing much more volatility, with sharp drops rapidly adopted by spectacular rebounds.

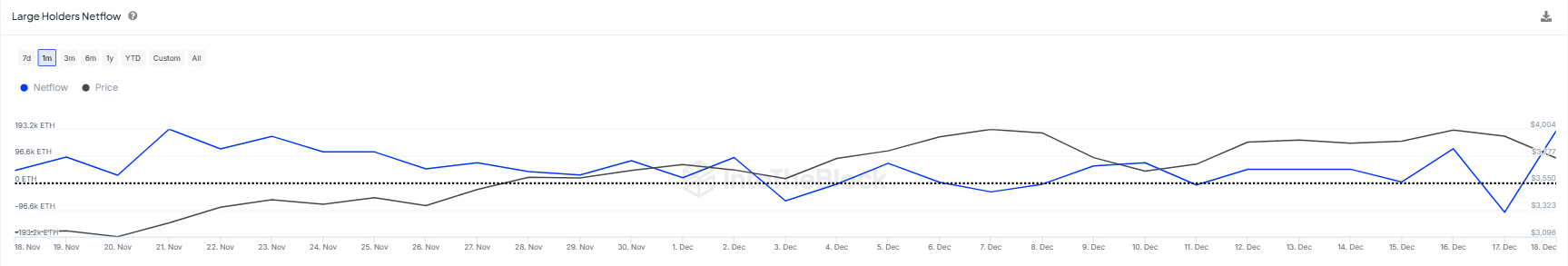

From mid-November to mid-December, every “dip” appeared strategically timed, adopted by a robust restoration. This means that any enhance in ETH provide was rapidly met with aggressive accumulation.

Now, each XRP and ETH race fiercely to interrupt by key resistance ranges. The competitors is tight. However the winner would be the one that may keep sturdy amidst uncertainty, supported by stable fundamentals. So, which one will break first – $3 for XRP or $4K for Ethereum? Or will Bitcoin steal the highlight, as an alternative?

XRP or ETH, whose “dip” must you dig?

The previous 24 hours have rocked the crypto market, with a mixture of elements coming collectively to set off a unstable chain response. Notably, it’s the small, retail buyers who’ve taken the toughest hit.

On this local weather, it’s clear that the FOMO might not return within the coming days. As an alternative, buyers are dashing to regulate their portfolios, hoping to interrupt even on their losses. The burden, it appears, is now on the massive gamers with deep pockets.

Right here’s the place issues get fascinating: the current dip has introduced each XRP and ETH near a crucial assist stage. If the massive gamers begin accumulating at this worth level, we may be seeing the beginnings of a neighborhood backside. This might set off a rebound, sparking confidence amongst smaller buyers.

With regards to ETH, whales have proven notably extra technique in comparison with XRP. They’ve been capitalizing on these dips, scooping up ETH at a reduction earlier than cashing out at a premium as soon as the $4K mark is nearby.

Now, with whales re-accumulating ETH, it’s doubtless that the worth will check $3.9K subsequent, however warning is warranted.

Nonetheless, the eye is shifting to Bitcoin, which lately noticed a robust upward transfer, reclaiming $101K— a bullish sign for the market.

Nonetheless, the current Bitcoin crash has introduced altcoins with a first-rate alternative to shine. It appears unlikely that we’ll see a retail surge for BTC within the quick future, regardless of whales and establishments capitalizing on the dip.

So, whereas ETH continues to battle with its infinite loop, XRP has a number of elements supporting its development: historic efficiency, whale backing, the SEC developments, and the RLUSD stablecoin initiative.

Learn Ripple [XRP] Worth Prediction 2024-2025

Because of this, XRP’s potential to carve out a separate asset class from BTC by 2025 is a singular benefit – one thing Ethereum has failed to perform since its inception.

Ought to XRP succeed on this, it might be in a first-rate place to learn from Bitcoin’s volatility within the yr forward.