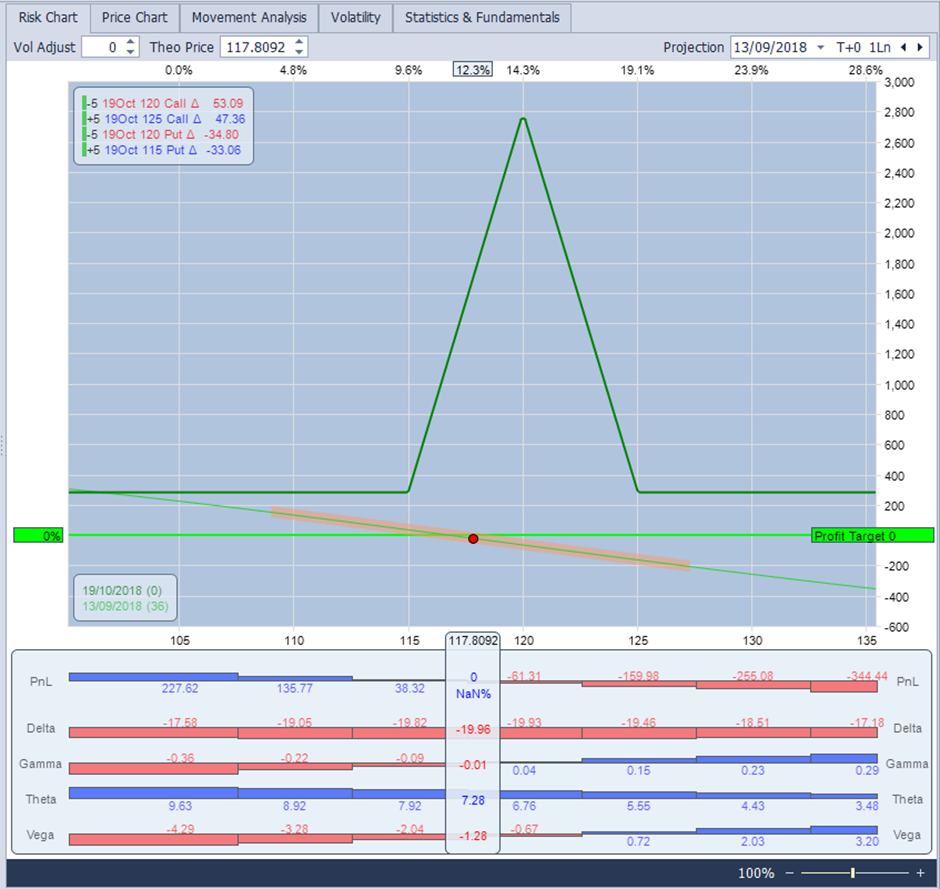

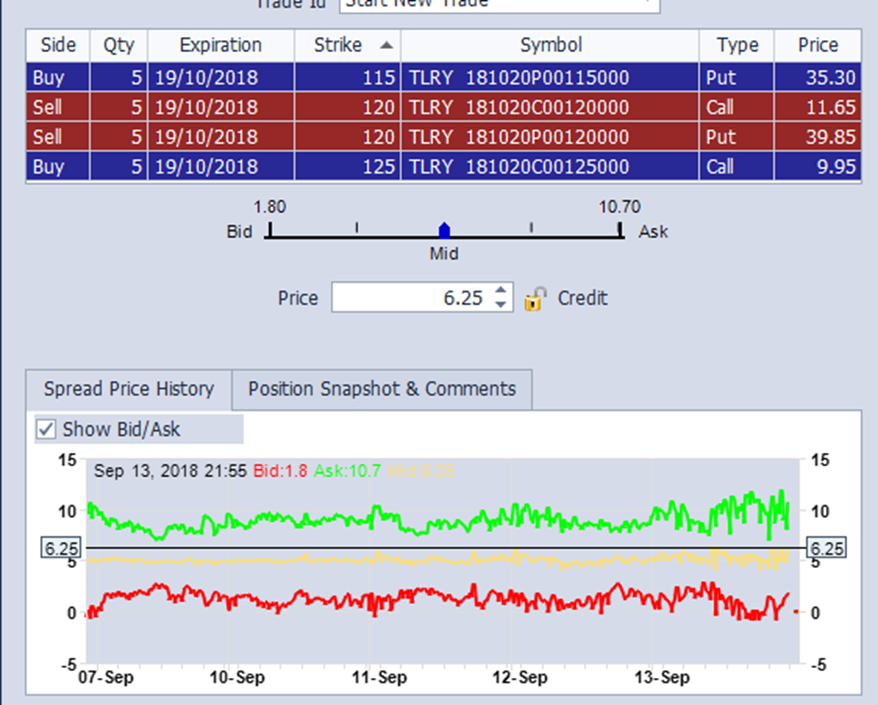

Determine 1 TLRY iron fly on 13 September 2018

Choices have infinite mixtures however the basic hypothetical danger free commerce is the credit score unfold with a wing width that’s smaller than the credit score collected. Naysayers will let you know that on this age of algos and massively automation pushed buying and selling such pricing variations and arbitrage are polished off instantly. The chart above – nevertheless – is an actual one and the pricing of the TLRY spreads endured over a reasonably intensive interval, it appeared in truth a free lunch was accessible.

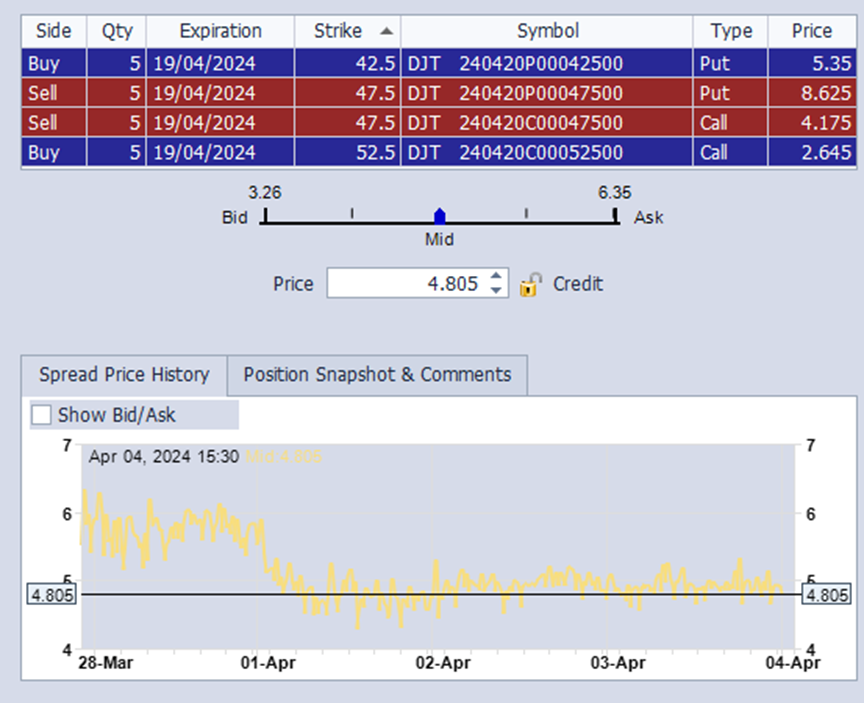

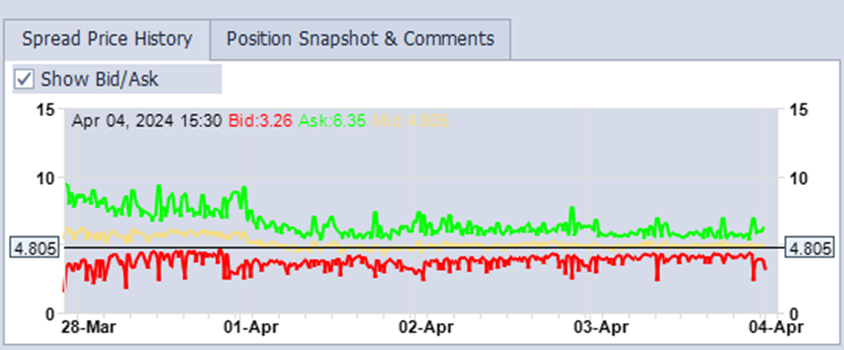

Others will argue that unfold variations set by market makers make coming into (or exiting) such positions on the theoretical revenue an impossibility or simply terribly uncommon. This argument too have to be rejected. Contemplate the chart beneath from a really latest NON OFFICIAL commerce on Regular Choices within the DJT:

Determine 2 DJT iron fly on 4th April 2024

Though much less pronounced than the TLRY instance one can see that the mid of this unfold traded above 5$ which is the width of the unfold – though bid/ask was slightly vast there was a substantial quantity of buying and selling that occurred above this degree. While one would possibly anticipate to see such variations at deep ITM or OTM ranges because of skew, it’s uncommon however not not possible to search out these sort of discrepancies.

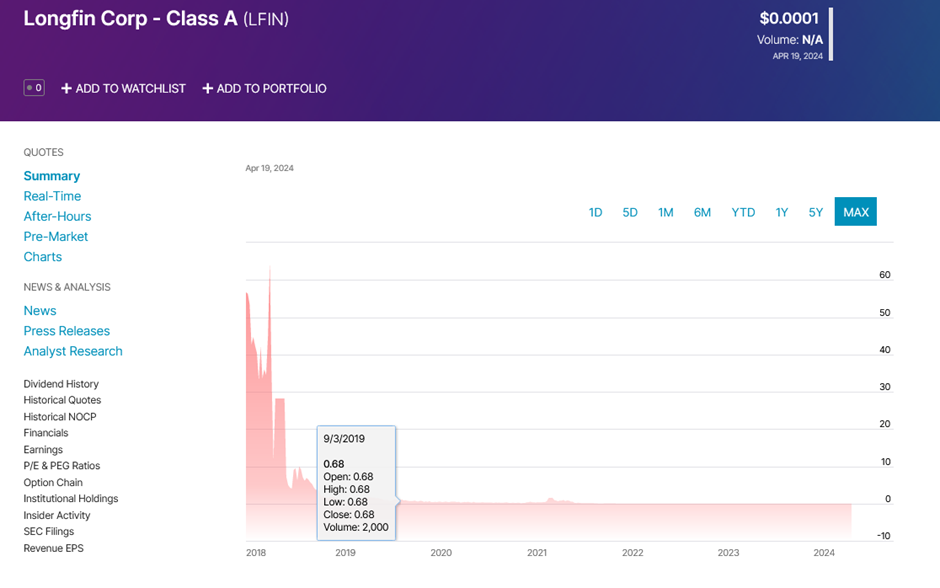

In fact ‘haters are gonna hate’; and a refrain of voices will rise as much as say that the above examples of mispricing are without delay artifacts and on prime of that can yield pennies solely. Trading and capital prices will get you at greatest a particular discounted menu at Taco Bell and by no means a correct dinner within the Ritz. That, nevertheless, can be unfaithful as properly – choices being leveraged devices have this superb capability to ship outsized – infinite even – returns in case you are proper on course. Typically it doesn’t take a genius to determine that one thing goes to zero. The true story of LFIN and its meteoric crash with a marketing strategy that was not far off the one of many South Sea Bubble: a promise of a future enterprise in crypto. At one level buying and selling over $140 the inventory reached a valuation of greater than $6B. Appropriately referred to as by legions of retail traders on Reddit’s r/wallstreetbets; places have been purchased by the bucket load and LFIN was buying and selling close to zero 6 months later leaving some merchants with credible 5 determine returns and % earnings of over 2000%.

Are you satisfied but? If you’re you should purchase us lunch!

Within the article beneath we’ll dive into the three trades talked about and conclude on some learnings points from them. Really, there by no means is such a factor as a free lunch however that doesn’t imply there isn’t a buck to made in case you are cautious.

When everyone was getting excessive

Butterflies are widespread possibility devices and sometimes they’re a little bit of a toss-up between the online debit you incur in opening them (or the credit score) and the width of the unfold you might have. A large triangle of revenue might be well worth the danger of the inventory ending underneath or over (relying in your unfold and the facet of the butterfly) your strikes. Usually because of name/put parity it isn’t doable to open a credit score unfold for greater than the width of the strikes, the reason being easy. Market makers (or different market gamers) may merely purchase or brief the inventory and create an reverse place that may successfully exploit this pricing distinction and it could be instantly arbitraged away.

But again in 2018 an observant Regular Choices member famous {that a} new inventory, TLRY, lately quoted was making a meteoric rise in the marketplace.

Determine 3 logarithmic TLRY inventory from 07/2018 to 11/2018

Unsurprisingly this meteoric rise went hand in hand with exploding implied volatility – what’s extra the IV differential between calls and places additionally turned insanely excessive. Determine 1 had a distinction of a minimum of 70pts between the IV of the ATM name and ATM put. Close to the shut on Thursday thirteenth of September 2018 the ATM 5$ vast unfold was buying and selling at over 6$ – this was a perform of the market closing nevertheless however a number of positions have been opened anyplace between 25c to 50c over the width of the wings.

Determine 4 TLRY possibility unfold ATM thirteenth September 2018 – 10mn earlier than closing

The overall presumption was that this mispricing couldn’t endure. This proved to be removed from the reality as the subsequent day(s) it turned clear that while it was doable to open this place – at a credit score over the wing width – closing it for the unfold width wasn’t working properly. It was additionally seen that the deeper within the cash you’ll open a ramification, the better it was to take action for a good credit score. A very valiant dealer opened 950 spreads over a a number of of strikes for such a credit score. This wasn’t a commerce to make the yr – it was the commerce to make retirement.

Doubts set in as absolutely there needed to be some hidden flaw which certainly might be learn in locations that possibility merchants hardly ever study: the borrow fee for TLRY.

Determine 5 Borrow charges for TLRY inventory on thirteenth September 2018

As might be seen from the inventory worth motion in determine 3 TLRY was transferring actually quick. Inside per week you needed to pay 20c for 400$ strike calls expiring in October and half a buck for the 50$ put in the identical expiry. A 350% borrow fee interprets at near 1% per day or $120 for each ATM unfold proven – the place is certainly assured to yield the excess over the wing width however it’s important to survive till expiry.

What folks began noticing – starting with ITM calls – was that brief calls began getting exercised. This meant that you simply had a number of selections with difficult outcomes:

- Train your lengthy name (if ITM) and simply danger the inventory not dropping to the put degree;

- Borrow the inventory and keep brief at a price of 1% per day;

- Shut the entire place at a loss since you cant get an affordable worth to your places and what’s extra train occurs exterior of regular buying and selling hours so the inventory might be anyplace if you do that due to further volatility.

An extra danger was rapidly recognized even in case you made it to expiry – with a inventory transferring a lot there was a danger that your place would finish between the strikes however that after market hours it could transfer out once more successfully locking in your loss with out enabling you to money in on what ought to have been a constructive place. As soon as once more simply the weekend value of carrying a brief in your account would wipe out any earnings in the very best of circumstances.

To say there was no free lunch was an understatement, the dealer that opened 950 spreads in truth took on a 27M$ danger when doing so. He misplaced 4 digit degree {dollars} on just some spreads that have been exercised over a weekend and even then he was fortunate because the inventory vaulted upwards afterwards. Some others with smaller positions did handle to get out – key was that they did so earlier than expiry neared. The nearer to a Friday one got here – the extra probably it was that ITM calls can be exercised – the chief danger coming from them.

The training from this commerce was not that it was basically flawed however there are a number of issues to be taken under consideration:

Choices mispricing at this degree are all the time a sign of an underlying phenomenon of some type that’s exterior of regular inventory buying and selling. On this case it was:

- The settlement in June 2018 to legalise pot in Canada which was to come back into impact mid October;

- The very latest IPO of TLRY which means that it had a slim free float and lots of limitations;

- What we might now name ‘meme-like’ euphoria relating to the prospects of pot shares;

The telling indicators that might be deduced from choices buying and selling have been:

- The acute volatility of the choices in query exacerbating worth variations;

- Extraordinary skew between calls and places making the mispricing extra probably;

- The truth that easy statement of open curiosity of ITM calls indicated that large exercising was occurring even when merchants saved opening new spreads.

The place was solely weak to early train which is a attribute of American model choices which are universally used for inventory buying and selling. Anybody who was not approach ITM got here out kind of unscathed from the positions opened however this was very difficult by the point TLRY hit $300 on 09/19/2018. Its arduous to present an accurate estimate however its probably close to 50% of ITM calls with greater than a month to go earlier than expiry have been exercised. The weekly expiry of 09/21/2018 was exercised in a single day from Wednesday to Thursday for even increased percentages. With the inventory halving once more by that Friday expiry anybody not agile sufficient would have been caught full within the cross fireplace.

Invoice Gross referred to as it: If you’re daring you promote premium on DJT

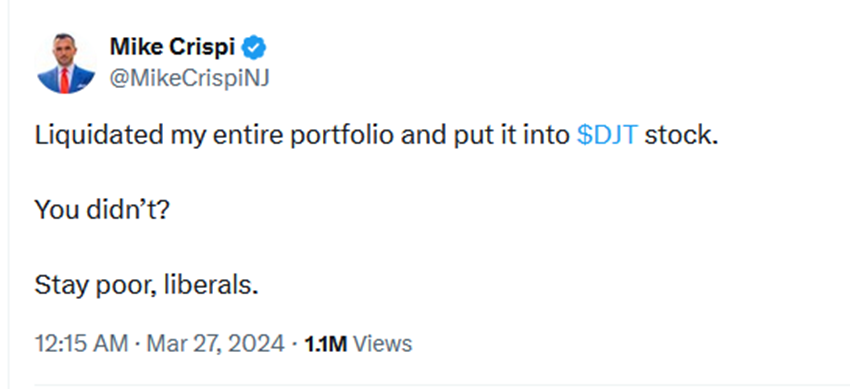

On twenty ninth of March 2024 DJT – the social media firm of Donald Trump – launched on the inventory market. Like TLRY it was a excessive visibility launch and the inventory was each praised and criticised from the beginning. New Jersey businessman Mike Crispi embodied the bullish sentiment greatest:

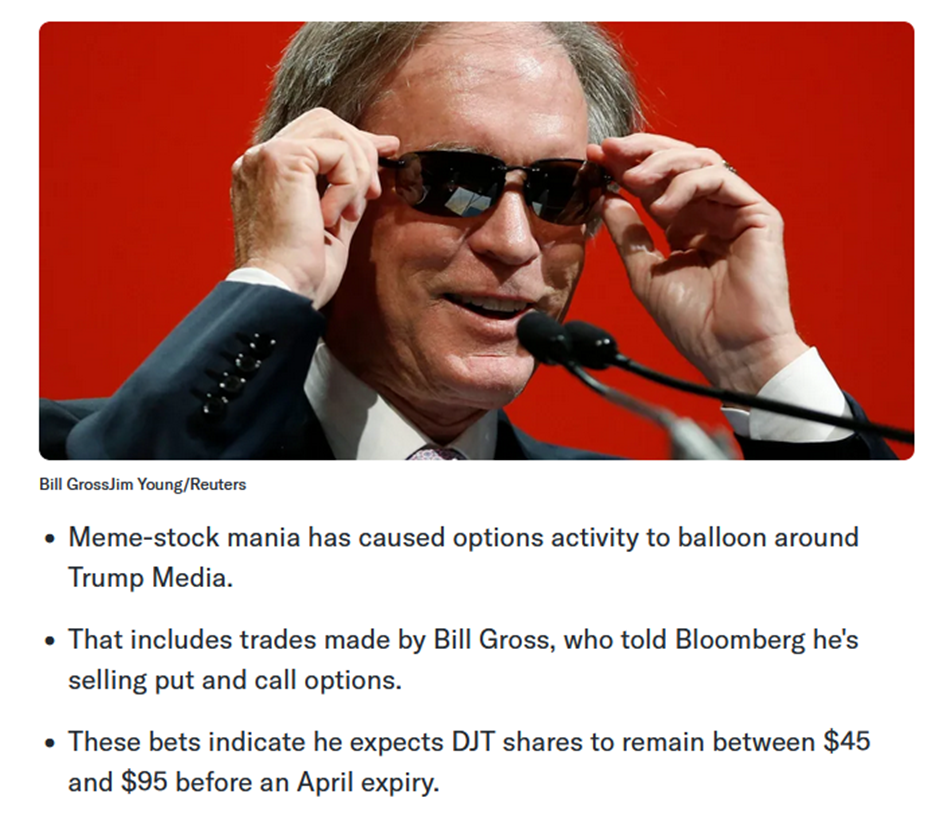

Noone would need to deny Mike his day within the solar however a extra fascinating quote got here from Bond King Invoice Gross who said that “A genius can have a high IQ or invest in the stock market during a bull market. A genius can also be an investor with the courage to sell DJT options at a 250 annualized volatility,”. It turned out that Invoice’s place probably had lots of similarity to a credit score unfold like an iron fly or condor as a result of Yahoo Finance discovered that:

Determine 6 Supply Yahoo Finance/Reuters

DJT had large volatility skew between places and calls

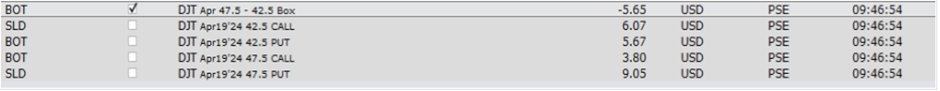

Month-to-month choices expiring in about 2 weeks had the ATM put 2.4 instances costlier than the ATM name. This massive skew up a possible arbitrage situation. For instance, with the inventory ~$47.5, the 47.5/42.5 name and put credit score spreads ought to cancel one another out and make this a mainly assured break-even commerce. However on this excessive volatility skew, this mixture of put and name credit score spreads could be opened for a credit score fairly a bit over the $5.00 wing width (and the quantity over the wing width can be a assured achieve at expiration). On April 4, the next commerce was opened utilizing the April 19 expiration, it is referred to as a Field combo. Notice how the ATM 47.5 strike put is a lot costlier than the 47.5 name, and the 42.5 name is shut in worth to the 42.5 put though the decision is round $5.00 ITM and the put is OTM.

This commerce yielded a $5.65 credit score on a field combo with a wing width of $5.00 (so the opening credit score was 13% above the wing width). Because of this at expiration, letting any ITM legs undergo task you’d wind up with a $65 revenue in any respect inventory worth factors.

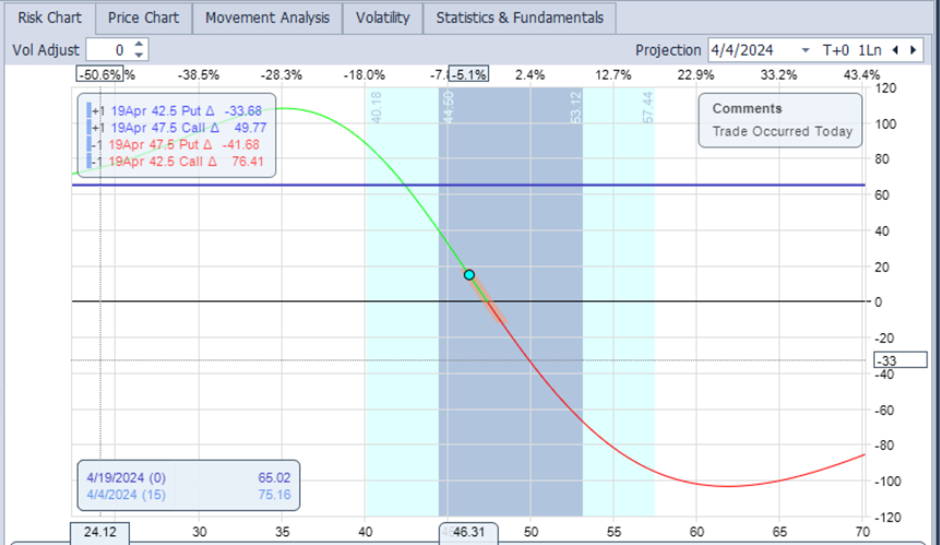

However are there any potential pitfalls with this commerce? The reply is sure, and it’s all as a result of early task chance with American model choices. The acute put vs name volatility skew that enabled this commerce to be opened for a credit score 13% increased than the wing width additionally created a commerce which is delta destructive previous to expiration. Right here is the PNL chart at commerce opening:

Notice how the thick blue line, which represents the revenue at expiration, is $65 in any respect inventory worth factors. Nevertheless, the skinny wavy line is the present standing which reveals a delta destructive commerce the place the place’s PnL improves if the inventory worth drops however reveals a loss if the inventory worth rises (it is because on this situation the OTM put credit score unfold holds onto a lot of its worth as a result of the put IV is a lot increased than the decision IV). However why does this matter if a revenue is assured in case you maintain the commerce till expiration?

If the inventory worth rises sufficient to make the brief 42.5 name have just a few cents of extrinsic worth (time worth) then there’s a excessive chance of getting assigned on the brief name. In this case you’d have to shut the decision facet for at or close to the $5.00 wing width and maintain onto the put credit score unfold and hope the inventory worth stays above 47.5 till expiration so the put facet expires nugatory. There can be fairly a little bit of danger right here because the inventory worth may very simply make a big downward transfer with such a excessive volatility inventory. If the inventory worth have been to make a major decline after closing the decision credit score unfold for close to $5.00, you could possibly wind up having to shut the put credit score unfold at a better worth and wind up with a dropping commerce.

On this explicit commerce, the inventory worth dropped (it moved in the fitting course for this commerce). On April 15 (4 days previous to expiration) with the inventory worth underneath $30, it was capable of be closed for a debit just below $5.00 thereby producing a achieve of simply over $65. Nevertheless, had the inventory worth risen by just a few {dollars} after the commerce was opened it could have become a way more tough commerce to handle. Ultimately, it did grow to be a free lunch commerce – however solely as a result of the inventory worth cooperated and moved within the right course.

The lead balloon that was LFIN

One among choices many nice points is you can categorical a view in the marketplace with out betting the farm and but with probably infinite returns. For comedic worth there isn’t a substitute for the story of the choice merchants and crypto pioneer LFIN (although RIVN and their criticism by Hindenburg Analysis come a detailed second). As soon as once more the mispricing that merchants took benefit of and later suffered their utter discomfiture on, was based mostly on occasions that hardly ever have an effect on ‘normal stocks’:

- A meme-like enthusiasm for this new factor referred to as crypto(?!?);

- A inventory market launch ostensibly backed by NASDAQ’s strict guidelines that positioned a inventory with very restricted (in truth inadequate) free float in the marketplace;

- The announcement of the ‘master stroke’ funding in an allegedly profitable (however in truth nascent) crypto platform;

- A very uncommon dropping of the ball by FTSE Russel Index managers that co-opted the inventory into their index with out respecting their very own guidelines.

All these parts put collectively boosted the inventory from 5$ to over 140$ (intraday) and billions in inventory market valuation. A vital difficulty was that the quantity of inventory required for the index funds was over half the alleged (inflated) free float. So a bona fide brief squeeze occurred and everyone began speaking about LFIN as in the event that they knew what these guys have been doing.

Because the insanity hit its peak, the CEO Venkata Meenavalli went on CNBC the place each common Joe may comply with the dwell prepare crash. Because the interview progressed, LFIN’s worth dropped some 16% in after-hours buying and selling, with CNBC helpfully displaying this sharp downward pattern in a chart subsequent to Meenavalli’s face. Should you ever did a presentation and thought your level didn’t come throughout, consider Venkata and also you received’t assume so poorly of your self.

Determine 7 LFIN CEO interview on CNBC 18th December 2017, with dwell AMC costs as he speaks

A couple of basic statements have been:

-

Q:What number of bitcoin transactions have you ever completed?

A: We personal 140 bitcoins (one coin was price about 10k); - ‘We are a profitable company.’ And likewise ‘We are a GEICO of this world.’

- ‘We have a team of quants.’

-

Q:’Is the 6B$ market valuation absurd?’

A:’Sure.’ - A minimum of 11 instances he repeated: ‘You have to understand that…’ adopted by some unintelligible comment.

For sure the choice merchants piled in and the put consumers have been seemingly quid’s in. Reddit fora have been stuffed with retail merchants having positions between 10-100s of put choices at strikes various from 50$ to 2.50$. Right here’s what occurred with LFIN:

The madness of this chart can’t be overestimated, LFIN had listed for five$ on fifteenth December 2017 and hit 142$ (closing at $72.38) on December 18th 2017 when the CEO made his ill-fated interview. If ever there was a purpose to purchase places on an organization the entire sorry interview in addition to a number of discoveries by i.a. Citron Analysis made it 100% plain this firm was one massive rip-off. All through late December and January folks purchased places and so they have been low cost on the worth. The overwhelming majority selected expiries in April and Could. As March got here across the bells of doom sounded louder and louder for LFIN, not solely was there an SEC investigation however FTSE Russel reversed its determination to incorporate them of their index and a number of different company lawsuits and NASDAQ investigations have been triggered. Throughout the area of some days the inventory went from respectable to being susceptible to delisting.

A T12 discover was issued finish of March and this successfully delisted the inventory. Now a trifecta of disasters confronted put holders – some with deep ITM positions opened for five$ on the 50$ strike for the April expiry:

- Institutional holders which had purchased 45% of the theoretical free float had not completed unloading all their inventory. With the halted buying and selling they might now not offload them;

- The CEO turned out to have lied in regards to the free float usually and the NASDAQ stopped 26M shares from being circulated in violation of a lock-up;

- Brief sellers and put holders held 250%+ of the free float – a sort of inverse brief squeeze.

Having taken hundreds of thousands of {dollars} in losses institutional holders realising the dearth of shares elevated borrowing prices to 3000%. Concurrently possibility holders – in the event that they have been fortunate – needed to train their places and pray that buying and selling would resume so they might fill their brief positions thus created. Ominously no T12 buying and selling halt had – as much as that time – ever been lifted in lower than 3 months. This may place the entire April, Could and June put possibility holders in a dilemma.

For one they have been required to place up the total sum of the worth of the shares that they had exercised places in opposition to. This was very arduous for any name holders that occurred to be lengthy strikes across the cash or had offered credit score spreads. Put holders likewise needed to train and pay the extortionate borrow charges of 250$+ a day with out figuring out after they may cowl the brief. Ultimately buying and selling OTC resumed on 05/28/2018 nevertheless it took one other month earlier than the inventory traded beneath 5$ not to mention close to zero. This meant that anybody that had gambled and exercised 2.50$ strike places have been out of luck.

The overall tenure within the stories of the retail merchants about their expertise is that even those that made 5 figures within the preliminary part of the collapse, had doubled down thus far after accumulating their winnings that they have been now out 6 figures. Because the proprietor of this web site famously wrote – place sizing is crucial for profitable buying and selling.

What shall we’ve for lunch?

The inventory market wisdoms that ‘there is no such thing as a free lunch’, ‘the market can stay irrational longer than you can stay liquid’ and so forth exist for a purpose. Mispricing in choices and alternative for arbitrage exist – the above examples present that this happens primarily in uncommon conditions the place it’s important to have in mind dangers which don’t exist if you commerce established and liquid shares. Black swan occasions like buying and selling halts and their penalties are hardly ever understood till you might be confronted with them.

Do you have to due to this fact draw back from buying and selling these alternatives? In fact not, the place is the enjoyable in that?

Nevertheless it’s best to have in mind that these trades are dangerous and dimension your place accordingly. Be ready additionally to take a fast buck slightly than wait to your ship to come back in. in case you are tempted to make a YOLO commerce, keep in mind the warning story of the ‘Man who couldn’t lose’. It was a brief story of a person that all the time received in casinos, on his deathbed when requested what his secret was, his reply was easy: ‘Observe the room until you find the guy that is about to lose everything, the house, the car, the wife, the kids on his last gamble. Then bet against him, because that guy ALWAYS loses.’ So it’s with any YOLO or retirement commerce, you’ll absolutely fail whereas in case you have been much less grasping you could possibly have joined us for lunch at Taco Bell.

Many because of our contributors @TrustyJules and @Yowster for this fascinating article.