- Bitcoin looking down any lengthy entries but it surely nonetheless will not be too late.

- Demand for crypto in US rising as MSTR makes a file BTC buy.

Bitcoin [BTC] lengthy positions entered throughout present uptrend are swiftly being “hunted” down, resulting in abrupt exits whereas the costs continues to rally.

This repeated sample indicated a unstable buying and selling surroundings the place lengthy positions are rapidly focused for liquidation significantly after Bitcoin hit the $90K stage.

The continued cycle of lengthy entries adopted by swift downturns prompt that merchants making an attempt to capitalize on the uptrend are going through vital dangers.

This buying and selling conduct prompts the query: with such aggressive focusing on of lengthy positions, is it at present too late, or nonetheless possible, to contemplate going lengthy on Bitcoin with out going through fast setbacks?

Bitcoin SOPR for STH

Analyses of the Brief-Time period Holders’ SOPR (STH SOPR) prompt a balanced market sentiment.

At present positioned halfway between the extremes of greed and concern, the SOPR indicated there was nonetheless potential for additional worth will increase with out the fast threat of a significant correction.

The evaluation, supported by the 30DMA, confirmed that whereas STHs had been certainly taking earnings, their actions weren’t indicative of market euphoria.

Traditionally, as soon as the SOPR ventures into ‘extreme greed’, it usually presages a pullback because the market turns into overheated.

Conversely, the ‘extreme fear’ zones have historically been the place vital market lows kind, providing prime shopping for alternatives.

The present average studying prompt a interval of regular development and cautious optimism amongst merchants. A swift transfer in the direction of the greed finish might sign the necessity for strategic profit-taking to preempt a downturn.

The interval provided a possibility for strategic investments, with a balanced method being essential to navigating the continued volatility and capitalizing on the uptrend.

Rising demand and MSTR’s file buy

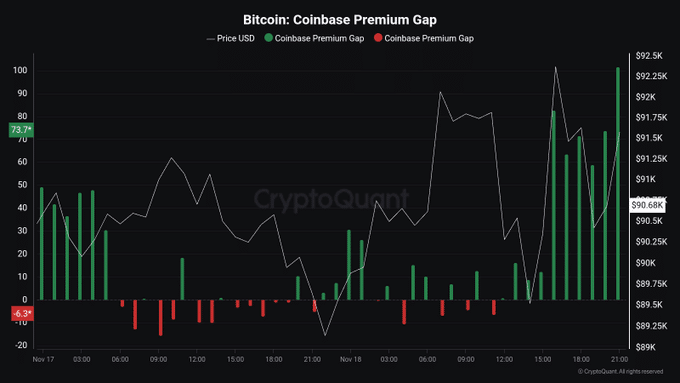

Publish-elections within the US continued to spark uptick in Bitcoin demand, as indicated by the surging Coinbase Premium Index. This gauge mirrored a heightened shopping for fervor amongst US merchants, sustaining the present bull run.

The info from the previous days confirmed vital premiums, with the index hitting peaks concurrently with Bitcoin’s worth pushing in the direction of $92,000.

This pattern indicated optimism and the potential for additional upside, suggesting that getting into lengthy positions now might nonetheless be opportune.

Moreover, establishments continued to purchase with Michael Saylor saying that they might elevate $42 Billion to purchase Bitcoin “much before” the three yr plan for MicroStrategy.

Learn Bitcoin (BTC) Worth Prediction 2024-25

MSTR has already purchased 66% of subsequent yr’s $10 Billion goal in simply 10 days.

The rise in demand and MSTR’s continued shopping for which have introduced one other proposal to purchase BTC reveals that it’s nonetheless not late to purchase BTC for the long-term run.