- BTC flashed bearish alerts forward FOMC assembly.

- Regardless of short-term warning, analysts remained bullish within the mid-term.

Bitcoin [BTC] led the crypto market with notable de-risking forward of the Fed fee choice as analysts ready for a potential ‘hawkish cut.’

The cryptocurrency declined from an all-time excessive of $108K to $103K simply hours earlier than the FOMC assembly. Markets had priced in one other 25bps rate of interest lower.

However analysts anticipated a ‘hawkish tone’ as a result of sticky U.S. inflation, which may have an effect on the Fed fee path into 2025.

The same outlook was shared by crypto buying and selling agency QCP Capital. The agency famous,

“The tone may be slightly hawkish, with inflation stabilizing above 2% and a strong labor market keeping the Fed cautious.”

What’s subsequent for BTC?

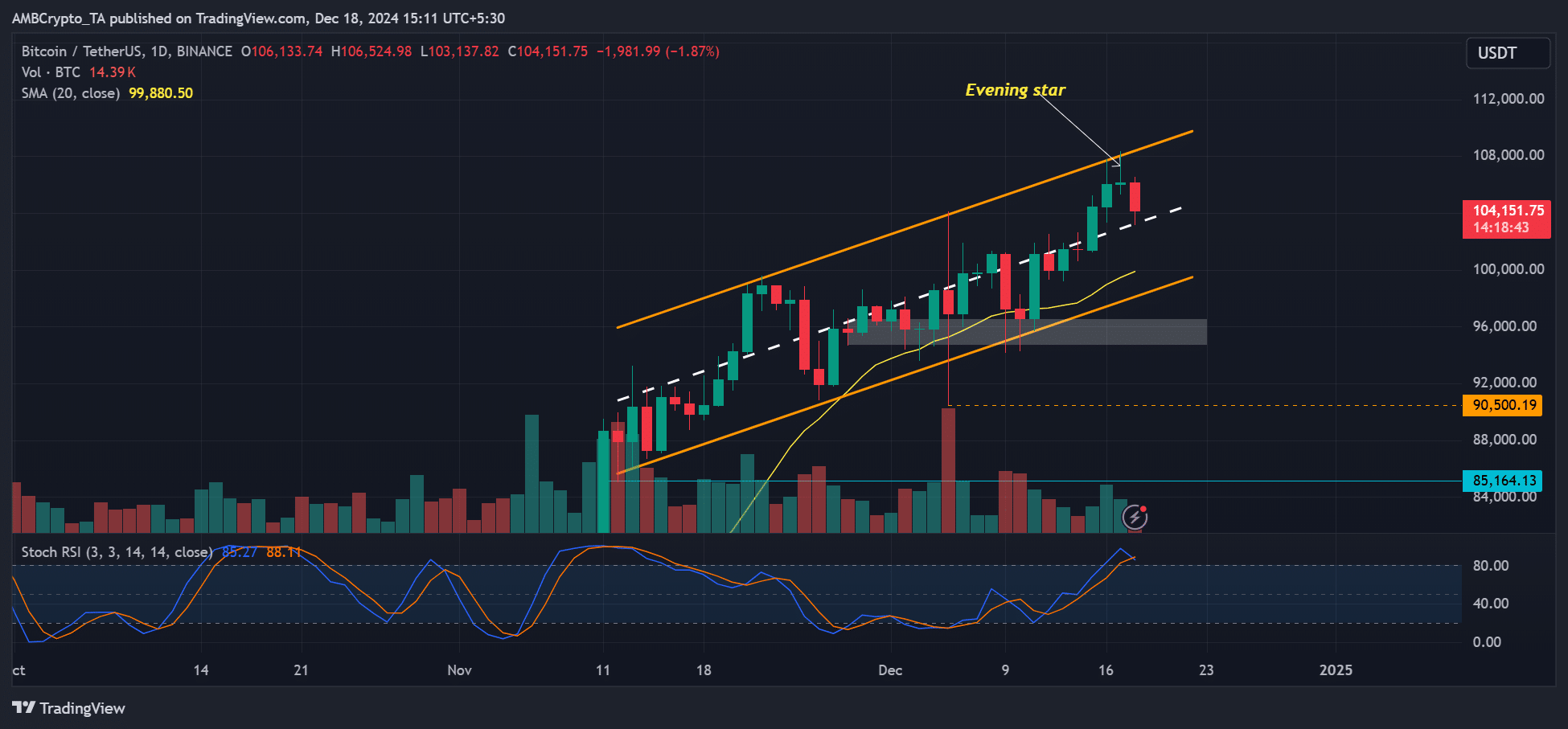

The agency added that the BTC chart flashed bearish indicators, together with a night star, a sign of potential development reversal.

“The technical outlook for BTC also appears cautious, with BTC printing an evening star on the daily timeframe and exhibiting bearish divergences.”

For the unfamiliar, the night star is a bearish reversal candlestick sample involving three candlesticks; a big bullish one, adopted by a smaller and eventually a big bearish candle.

This urged {that a} BTC crash might be seemingly within the quick time period.

Apparently, choices merchants have been cautious since final week. They most well-liked hedging for potential value declines by means of put choices than chasing value rallies as they did in prior weeks.

In reality, the latest BTC new highs of $107K and $108K have been met by short-term bearish sentiment from choices merchants.

At press time, Deribit’s 25-delta threat reversal (25RR) was damaging for choices expiring on Friday, twentieth December, underscoring bearish sentiment and the richness of put choices.

Put choices expiring on the third of January 2025 have been additionally buying and selling at a slight premium to calls (bullish bets). The remainder of Q1 2025 (as much as March) expiries have been buying and selling between 1-3 volatility factors.

This was fully completely different from a couple of weeks in the past, when the volatility factors may surge to 4-5 as choices merchants chased the rallies. Whether or not the development will change after the FOMC assembly stays to be seen.

That stated, QCP Capital maintained a long-term bullish outlook into 2025 regardless of the near-term warning within the choices market.

One other analyst, Stockmoney Lizards, echoed the bullish long-term outlook, stating that there was room for additional development for BTC primarily based on the month-to-month RSI studying.