- Bitcoin may rally larger above the $90K-108K vary.

- The choppiness index and lowered promote strain from long-term holders strengthened the breakout prospects.

Bitcoin [BTC] appeared set for a renewed uptrend, with key on-chain indicators suggesting a decisive breakout from the $90K-108K vary is imminent.

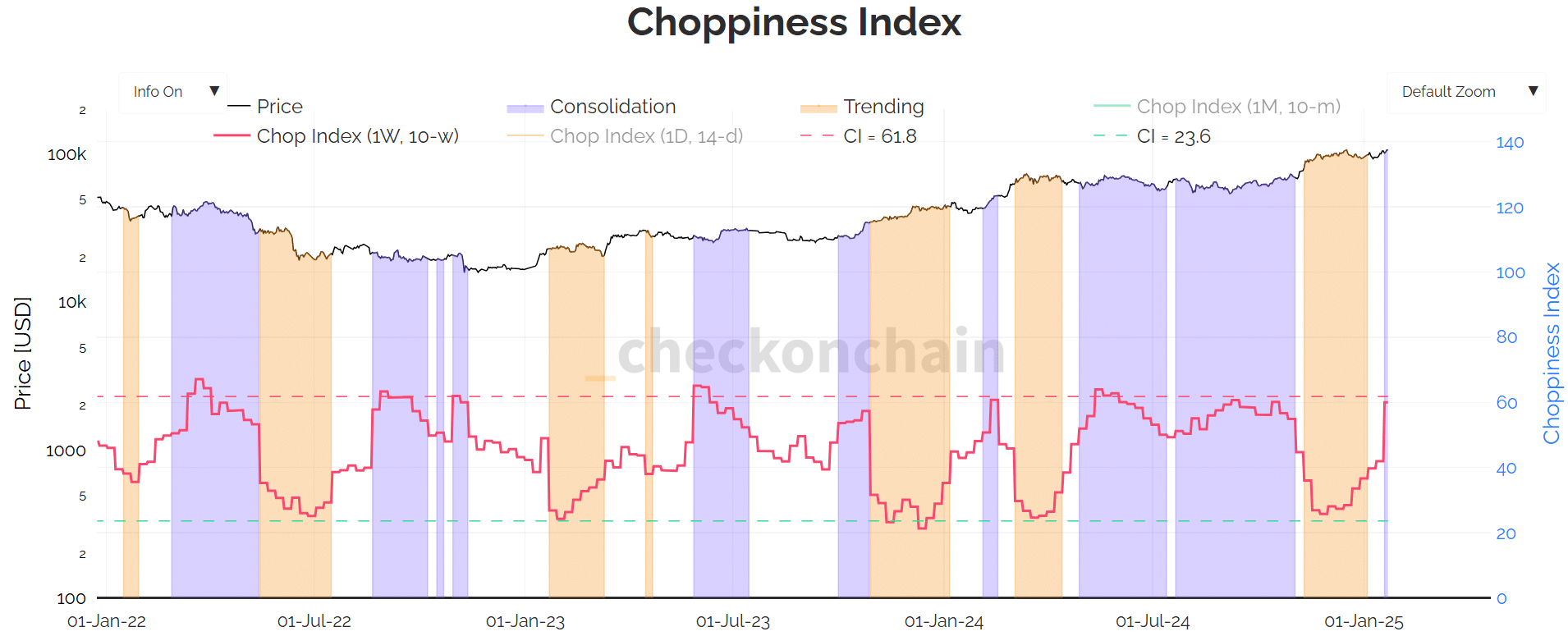

One of many metrics, the choppiness index (CI), which gauges BTC worth motion relative to its worth consolidation, implied that the continuing sideways motion was about to finish.

In reality, on-chain analyst Checkmate strengthened this outlook and said,

“The #Bitcoin Choppiness Index is fully gassed, and ready to trend. As covered back in late-Nov, the thesis was we likely had several weeks of chopsolidation before properly trending away from the $100k level. We’re there.”

Supply: CheckOnChain

Traditionally, per the hooked up chart, a pointy uptick within the weekly CI (purple) signaled consolidation (purple blocks).

Quite the opposite, a drop in CI coincided with sharp uptrends or downtrends (orange blocks). With the CI at an inflection level after a latest surge, a retreat would indicate a renewed BTC uptrend or downtrend.

Given the brand new pro-crypto Trump administration, the market leaned in direction of the previous (seemingly uptrend).

BTC provide strain eases

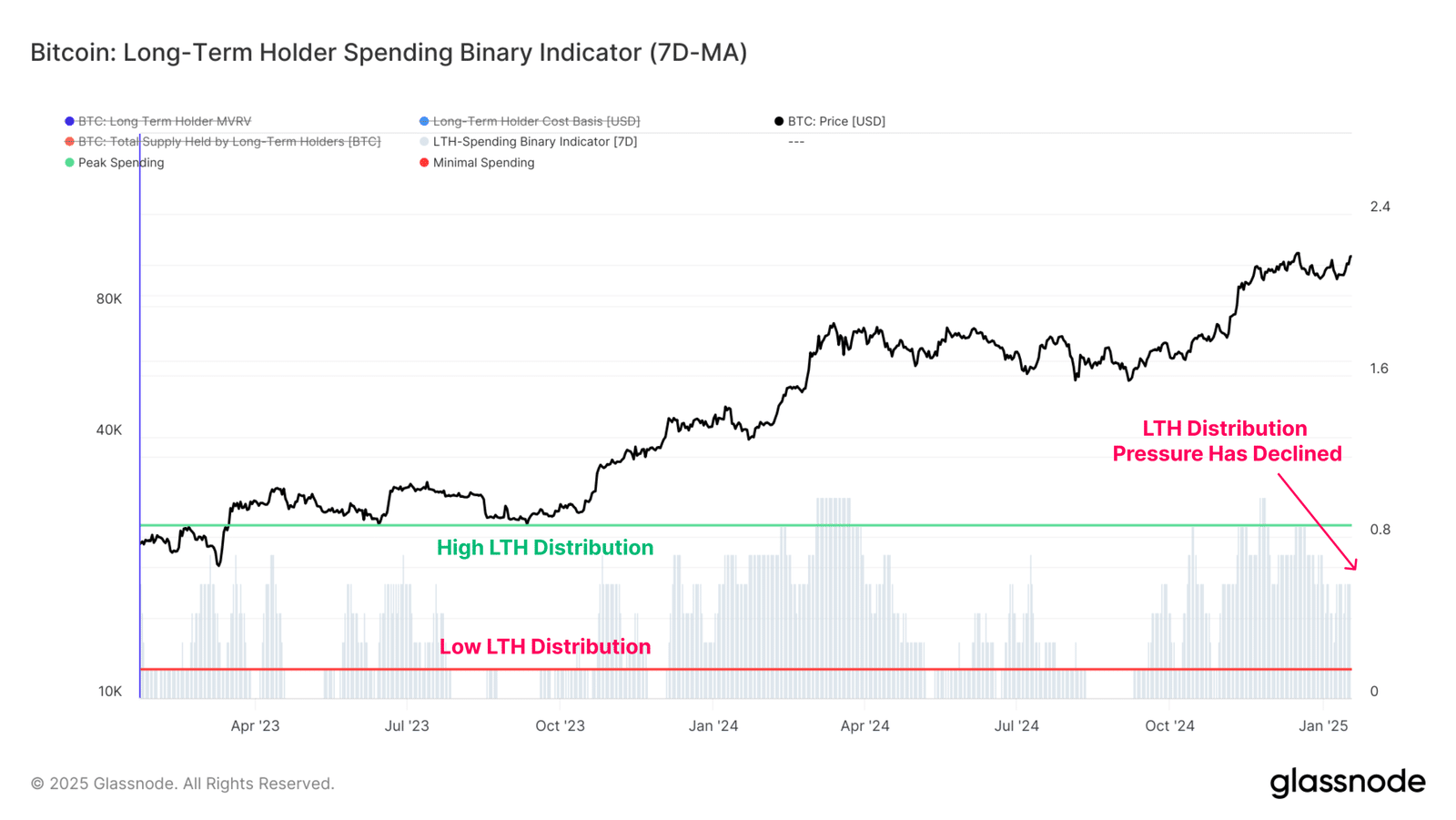

One other key bullish indicator was easing BTC provide strain from long-term holders (LTH). In its newest “weekly on-chain” report, Glassnode highlighted that promoting strain from LTH has considerably decreased.

“Sell-side pressure from long-term investors has also declined, alongside volumes deposited to exchanges for sale.”

The analytics agency famous that profit-taking from this cohort hit $4.5B in December however has dropped to under $400M in January. In consequence, the pattern leaned in direction of renewed BTC accumulation.

“Currently, the total LTH supply is starting showing signs of growth back to the upside, suggesting that accumulation and HODLing behaviour is now larger than distribution pressure for this cohort.”

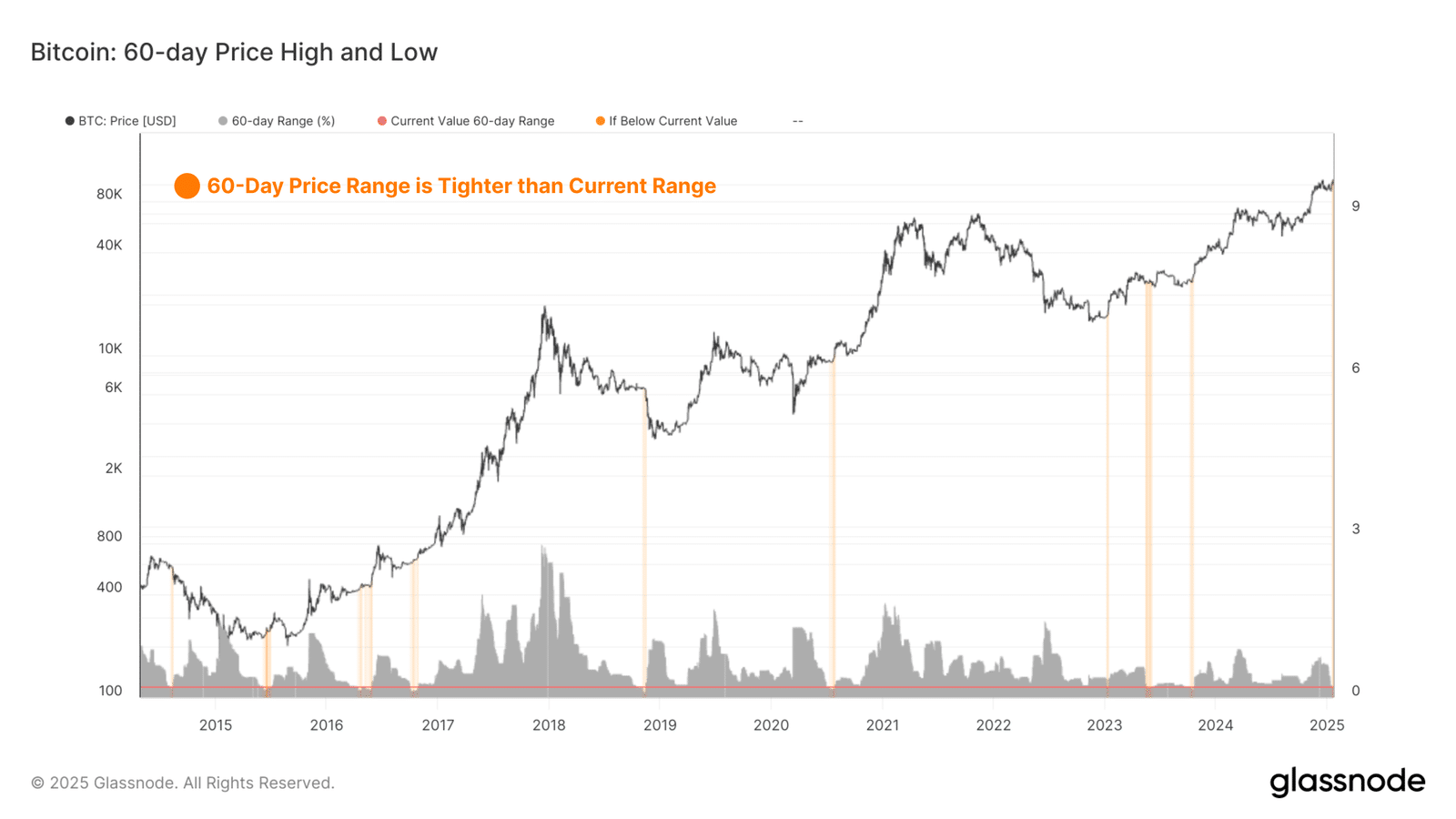

Lastly, the typical worth vary for a 60-day interval additionally signaled a possible breakout.

Glassnode added that the present sideways construction was tighter than the historic 60-day worth vary, which at all times precedes bullish breakouts.

“The chart highlights periods which have a tighter 60 day price ranges than the current trading range. All of these instances have occurred prior to a significant burst of volatility, with the majority being in early bull markets, or prior to late stage capitulations in bear cycles.”

Taken collectively, the above metrics revealed {that a} sturdy uptrend above $100K might be on the playing cards. Nonetheless, it stays to be seen how macro updates and Trump administration bulletins will impression this outlook.