- Bitcoin’s worth dropped by over 2% final week.

- A key indicator identified that BTC was close to a market backside.

Bitcoin [BTC] bears stayed forward of the bulls final week because the king of cryptos’ worth registered a decline. Nevertheless, if the most recent knowledge is to be thought of, BTC’s path forward may not have many break-throughs.

Let’s have a better take a look at BTC’s state to see what the upcoming week may be.

Bitcoin bears may take a break

CoinMarketCap’s knowledge revealed that BTC’s worth had dropped by greater than 2% within the final seven days. The coin’s worth turned bullish days after reclaiming $70k on the twenty fourth of Could.

On the time of writing, Bitcoin was buying and selling at $67,674.15 with a market capitalization of over $1.33 trillion.

Nonetheless, the upcoming days may look totally different. Milkybull, a preferred crypto analyst, lately posted a tweet highlighting an attention-grabbing improvement.

As per the tweet, from a short-term perspective, nothing is trying bearish, however moderately it’s gathering momentum for the subsequent transfer.

This was the case as BTC continued to commerce above its essential help at $66k. Furthermore, the thirteenth consecutive optimistic ETF influx was one other added benefit for the bulls.

AMBCrypto’s evaluation of CryptoQuant’s knowledge revealed that BTC’s binary CDD was inexperienced. This meant that long-term holders’ actions within the final 7 days have been decrease than common. Nevertheless, the remainder of the metrics regarded fairly bearish.

For instance, BTC’s web deposit on exchanges was increased in comparison with the final seven-day common. Its aSORP was additionally purple, that means that extra buyers are promoting at a revenue. In the course of a bull market, it could possibly point out a market high.

Is there a bull rally across the nook?

Other than this, BTC’s worry and greed index had a studying of 72 at press time, that means that the market was in a “greed” part. Every time the metric hits that degree, the adjustments of a worth correction are excessive.

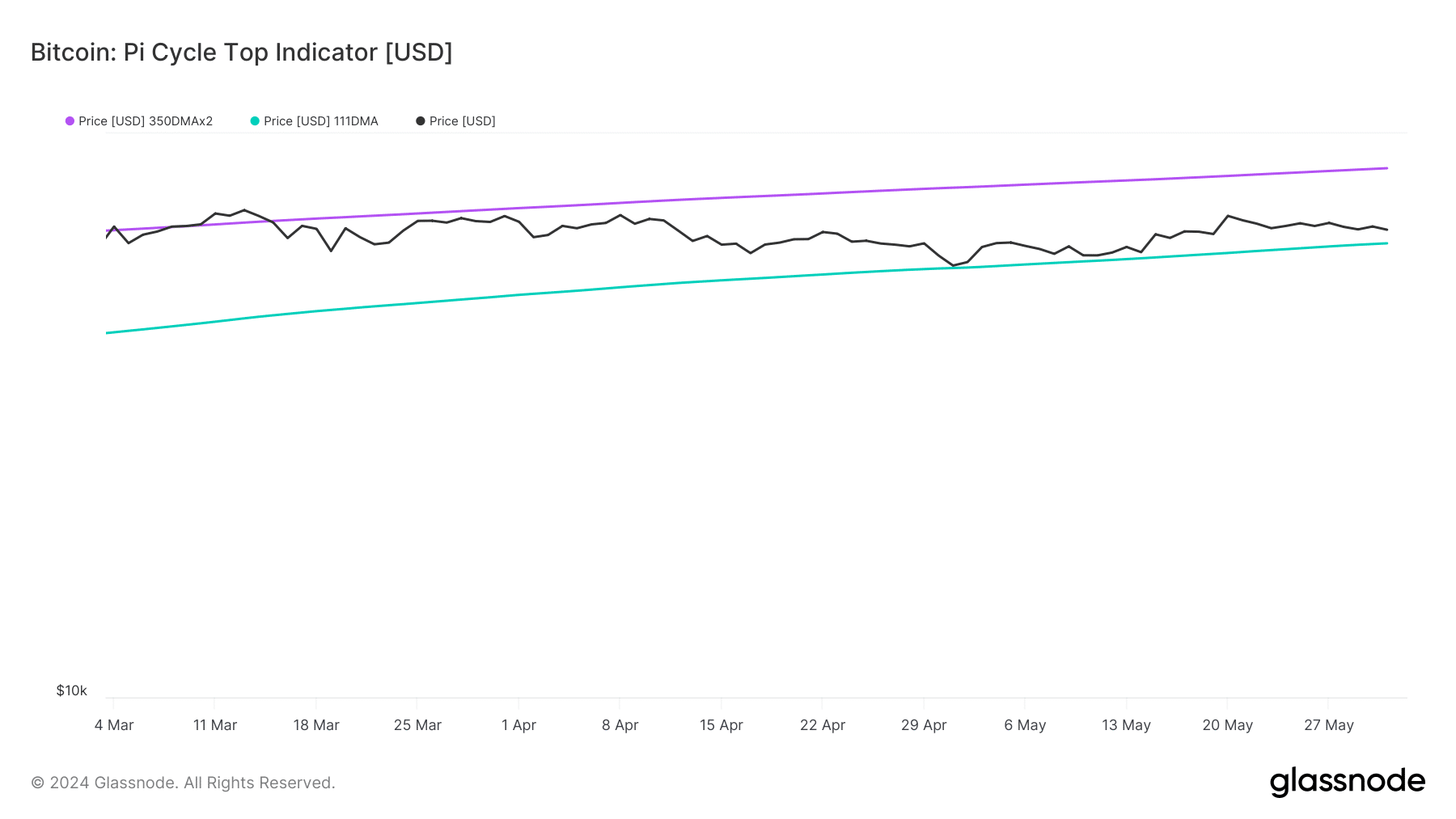

Nevertheless, Glassnode’s knowledge identified an indicator that hinted at a worth pump.

BTC’s Pi Cycle High indicator revealed that BTC’s worth was nearly to the touch the 111-day shifting common (MA). Due to this fact, the possibilities of a rebound are excessive after BTC touches that help degree, which signifies a market backside.

Learn Bitcoin (BTC) Value Prediction 2024-25

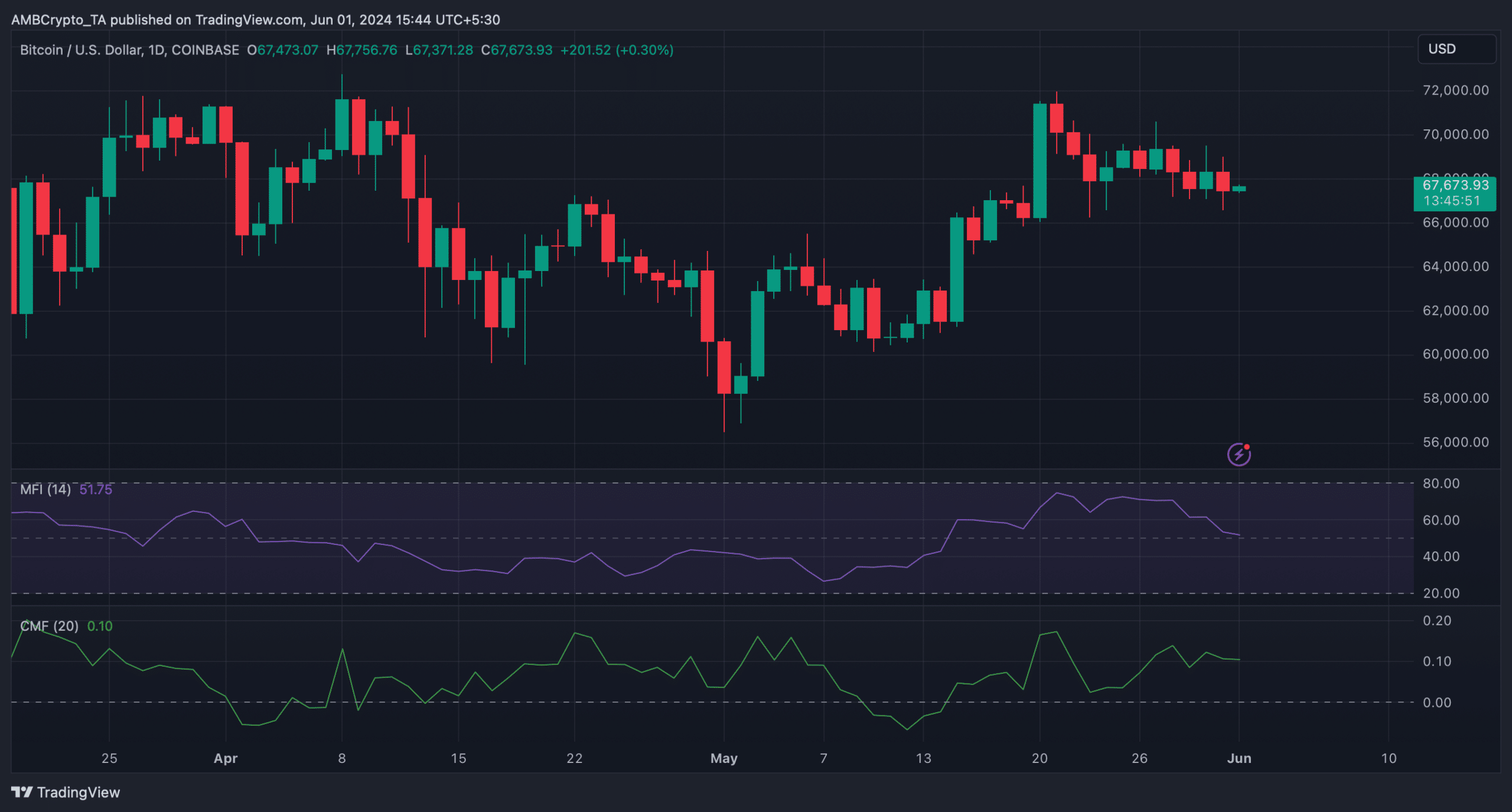

The potential for BTC touching its help degree appeared excessive because the coin’s Cash Circulate Index (MFI) registered a pointy decline. The king of cryptos’ Chaikin Cash Circulate (CMF) additionally adopted an identical declining pattern.

These indicators recommend that BTC may drop a bit extra earlier than it makes a comeback over the approaching days.