- The Puell A number of suggests Bitcoin is undervalued, indicating potential funding alternatives.

- Latest market volatility led to vital liquidations, with Bitcoin merchants dealing with over $71 million in losses.

Bitcoin [BTC], the pioneering crypto, lately skilled a rally that pushed its worth above $71,000 earlier this week.

Nevertheless, Bitcoin is at present seeing a decline of three.3% previously 24 hours, bringing its buying and selling worth all the way down to $67,197 at press time. Regardless of this, the asset has maintained an total week-long uptrend with a 2.3% improve.

Amid these fluctuations, Bitcoin has confronted vital modifications in market dynamics, together with changes in mining issue and hash charge, in addition to shifts in dealer conduct resulting in notable liquidations.

Insights into miner income and market valuation

Within the context of this worth volatility, a CryptoQaunt analyst has lately shared an on-chain information that has supplied insightful indicators of Bitcoin’s valuation.

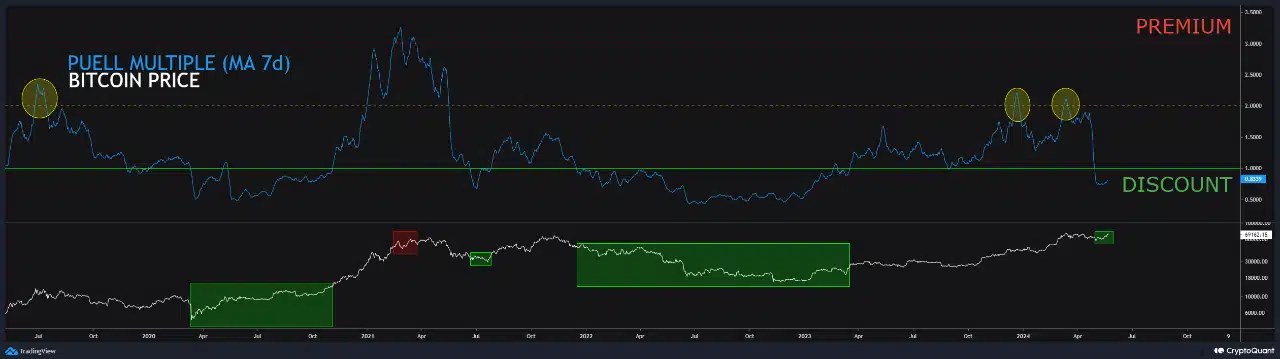

The Bitcoin Puell A number of, an on-chain metric that calculates the ratio of every day issuance worth of BTC to the 365-day shifting common of the issuance, has fallen into what’s historically thought of ‘undervalued’ territory.

This motion means that regardless of the value pullback, Bitcoin is likely to be buying and selling at a reduction, providing potential alternatives for traders.

The Puell A number of is particularly designed to gauge the financial well being of Bitcoin mining actions by evaluating every day miner revenues to a historic common.

Miners earn income by block rewards, that are constant in BTC phrases however fluctuate in USD worth, straight impacted by Bitcoin’s worth modifications.

When the Puell A number of is above 1, it usually signifies that miners’ earnings are greater than the typical, suggesting that Bitcoin could also be overvalued relative to historic norms.

Conversely, a Puell A number of beneath 1, as is at present the case, alerts that miners are incomes much less, which may suggest that Bitcoin is undervalued.

This drop within the Puell A number of coincides with the current Bitcoin halving occasion, which decreased miner rewards by half, considerably affecting the metric.

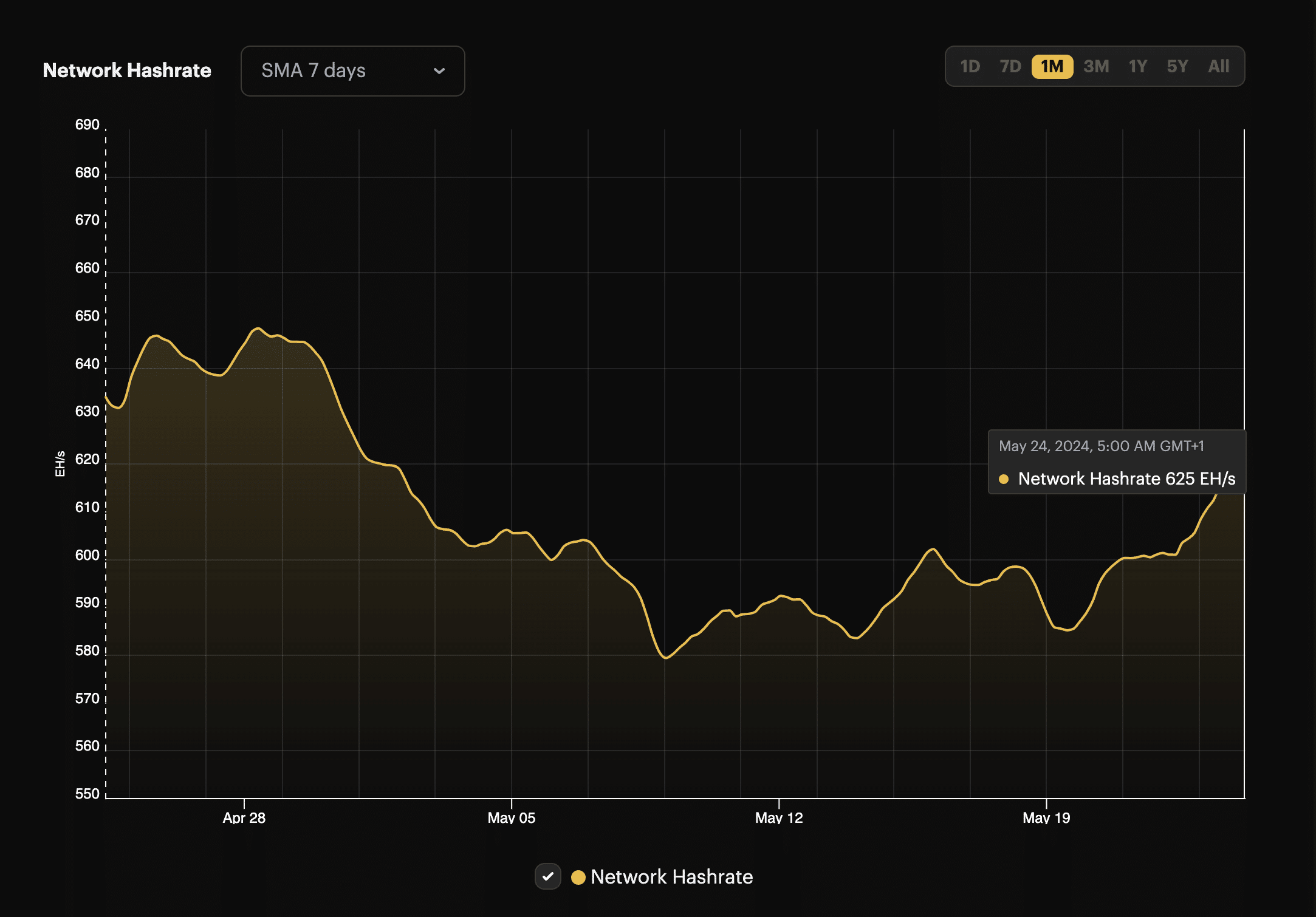

The timing of those shifts is essential as they align with broader market actions, together with Bitcoin’s worth consolidation and elevated community exercise marked by a rising hash charge, which lately surpassed 600 EH/s.

This improve in hash charge follows a major adjustment in mining issue, reflecting rising optimism and exercise within the cryptocurrency market, probably fueled by the current anticipation of the approvals of spot Ethereum ETFs in the USA.

Latest liquidations and future market predictions

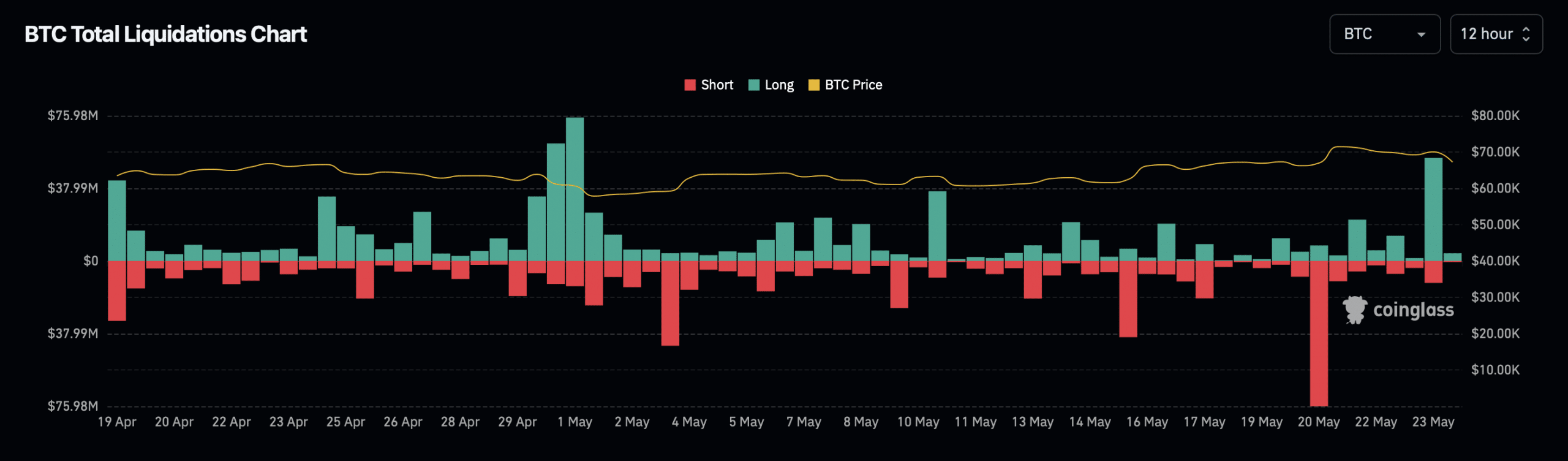

The current downturn in Bitcoin’s worth has not solely impacted traders’ portfolios but additionally led to substantial market liquidations.

Within the final 24 hours, Bitcoin lengthy merchants confronted roughly $57.84 million in liquidations, whereas brief merchants additionally skilled vital losses with round $13.75 million.

These occasions contributed to a complete of $390.80 million in crypto liquidations, affecting over 107,700 merchants globally.

Regardless of the present market challenges, AMBCrypto current report means that Bitcoin may quickly enter an ‘escape velocity’ section, doubtlessly pushing its worth previous $73,000.

This section is predicted to mark a major bullish development, probably pushed by enhanced investor curiosity and broader monetary market developments.