- Bitcoin’s open curiosity hits file $20 billion, simply 8% beneath its ATH, signaling potential worth volatility.

- Whales are accumulating Bitcoin, with web outflows from exchanges surging over the previous 7 days.

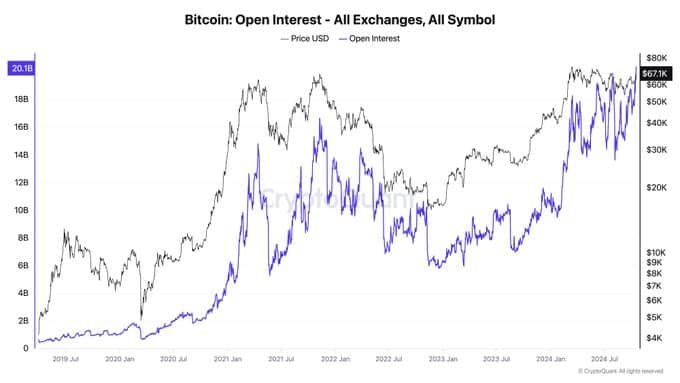

Bitcoin [BTC] open curiosity throughout all exchanges has reached a record-breaking $20 billion, as famous by Ki Younger Ju, CEO of CryptoQuant.

In the meantime, this surge in open curiosity comes as Bitcoin hovers simply 8% beneath its earlier all-time excessive (ATH), signaling anticipation of a significant worth motion. The rising participation in futures markets is a key indicator of rising curiosity in Bitcoin, significantly amongst institutional traders.

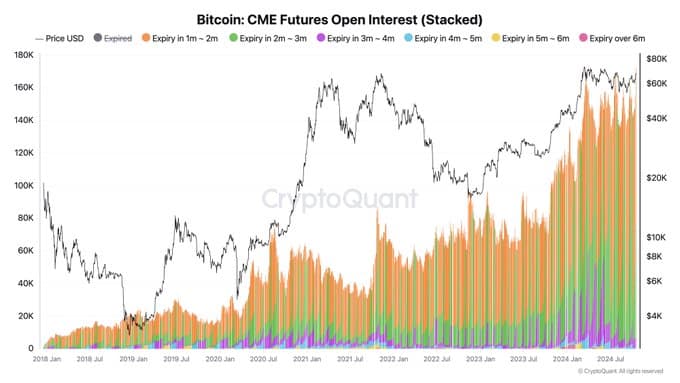

On the identical time, CME Bitcoin Futures open curiosity has additionally hit an all-time excessive. This simultaneous improve in each the value and futures positions means that merchants are getting ready for a interval of heightened market exercise.

Supply: X

Bitcoin open curiosity surges in 2024

The connection between Bitcoin’s worth and open curiosity has been traditionally robust, particularly throughout bull runs. Within the earlier rally from mid-2020 to late 2021, open curiosity and worth moved upward collectively, pushed by elevated hypothesis and leveraged buying and selling.

Open curiosity peaked alongside Bitcoin’s ATH in late 2021, reflecting merchants’ confidence within the rising market.

Nevertheless, throughout the bear market of 2022, each open curiosity and worth dropped considerably, with merchants exiting or decreasing positions.

As Bitcoin recovered from its lows, open curiosity started to climb once more, ultimately reaching new highs in 2024. Regardless of Bitcoin nonetheless being barely beneath its ATH, the rising open curiosity means that market members predict a significant worth motion within the close to time period.

Whale accumulation and community exercise

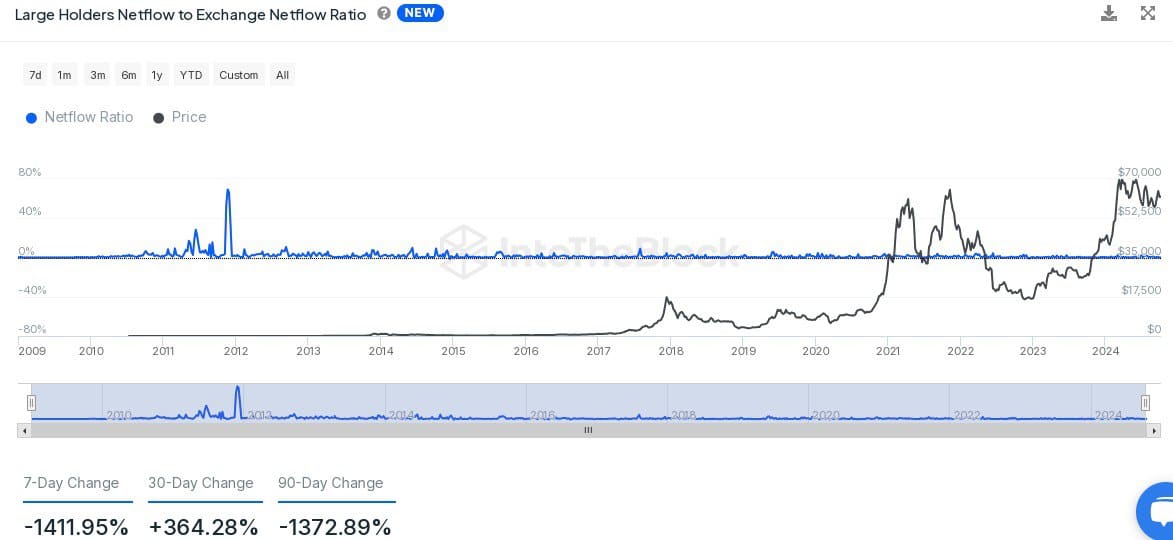

Information from IntoTheBlock reveals that enormous Bitcoin holders have been constantly shifting their holdings off exchanges, which is commonly an indication of accumulation.

Over the previous 7 days, there was a -1411.95% change in netflows to exchanges, indicating that whales are probably getting ready to carry their Bitcoin for the long run.

Supply: IntoTheBlock

On-chain metrics additionally mirror the rising curiosity. New addresses have elevated by 9.59%, and lively addresses are up by 8.20% over the previous week.

This improve in community exercise, coupled with Bitcoin’s rising worth, means that person engagement is rising, contributing to the optimistic sentiment surrounding the market.

Supply: IntoTheBlock

Whale transactions and short-term worth outlook

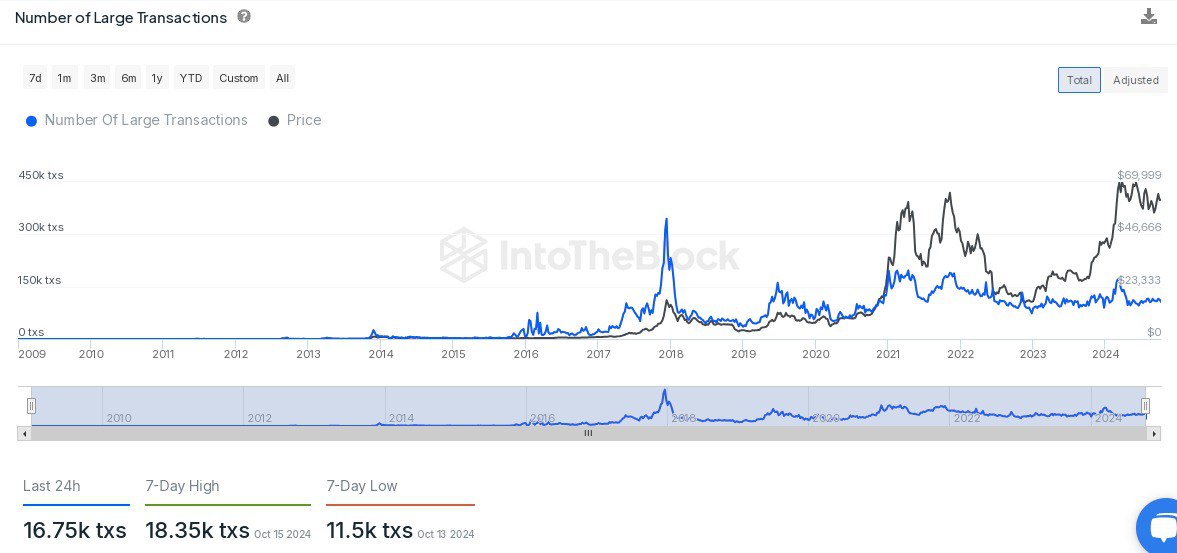

Whale exercise has additionally been notable prior to now 24 hours, with 16.75K massive transactions recorded. Whereas barely beneath the 7-day excessive of 18.35K transactions, the present quantity remains to be effectively above the latest low of 11.5K transactions.

Supply: IntoTheBlock

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This regular stream of huge transactions signifies that whales are actively buying and selling, which might contribute to potential worth actions within the coming days.

As BTC approaches its ATH, the mix of rising futures open curiosity, whale accumulation, and elevated community exercise factors to the potential for a major worth transfer.