- BTC recovered barely over the past 24 hours, gaining by 1.20%

- Bitcoin dangers mass sells-off if it stays under brief time period holders’ realized worth at $63,000

Over the previous week, Bitcoin [BTC] has seen a pointy decline on the charts, dipping by 5. 61%.

The final 24 hours have been totally different although, with the identical adhering to the cryptocurrency’s usually bullish pattern over the previous few weeks. In truth, on the time of writing, BTC was buying and selling at $62,099 following a 1.2% hike.

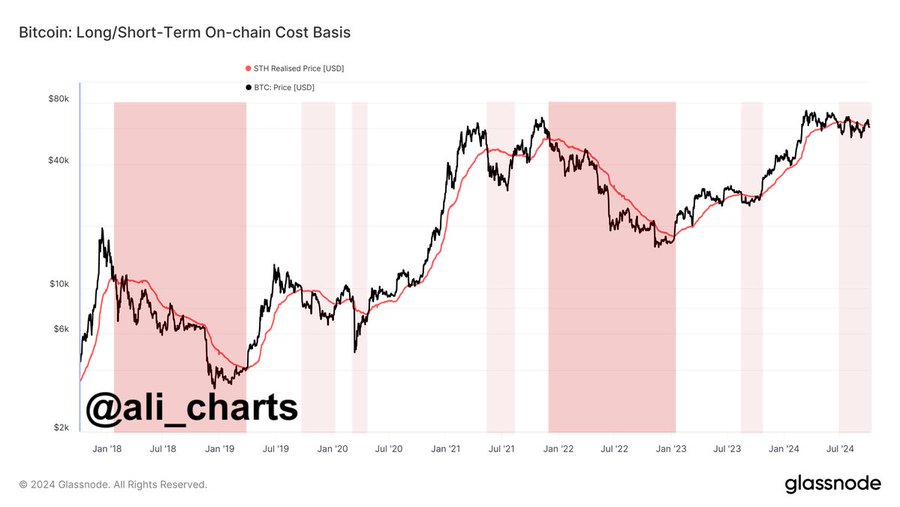

Regardless of this uptick, nonetheless, key stakeholders within the crypto market are nervous. Particularly over short-term holders’ realized worth. A type of voicing their considerations is the favored crypto analyst Ali Martinez. In truth, he predicted a possible sell-off by short-term holders if BTC doesn’t reclaim its $63,000 ranges.

What does market sentiment say?

In his evaluation, Martinez posited that if Bitcoin continues to commerce under short-term holders’ realized worth, the market will see larger promoting stress.

In keeping with this evaluation, BTC has traded under this stage since 22 June 2024. Thus, if the value stays under this stage, these holders who’ve held BTC for lower than 155 days will promote to keep away from additional losses which can end in a cascading sell-off.

Due to this fact, the market should keep this stage round $63,000 to find out the following consequence.

In context, so long as BTC stays under its realized worth for short-term holders, the probability of extra promoting stress builds. If extra short-term holders panic and promote, it may drive the costs decrease, doubtlessly triggering huge liquidations from leveraged positions, thus exacerbating the downtrend.

Merely put, Bitcoin has to reclaim $63,000. This can incentivize short-term holders to carry on to their BTC, anticipating additional upside.

What do the charts say?

Notably, the evaluation supplied by Martinez additionally shared a worrying market consequence. Nevertheless, it’s important to find out what different market fundamentals recommend.

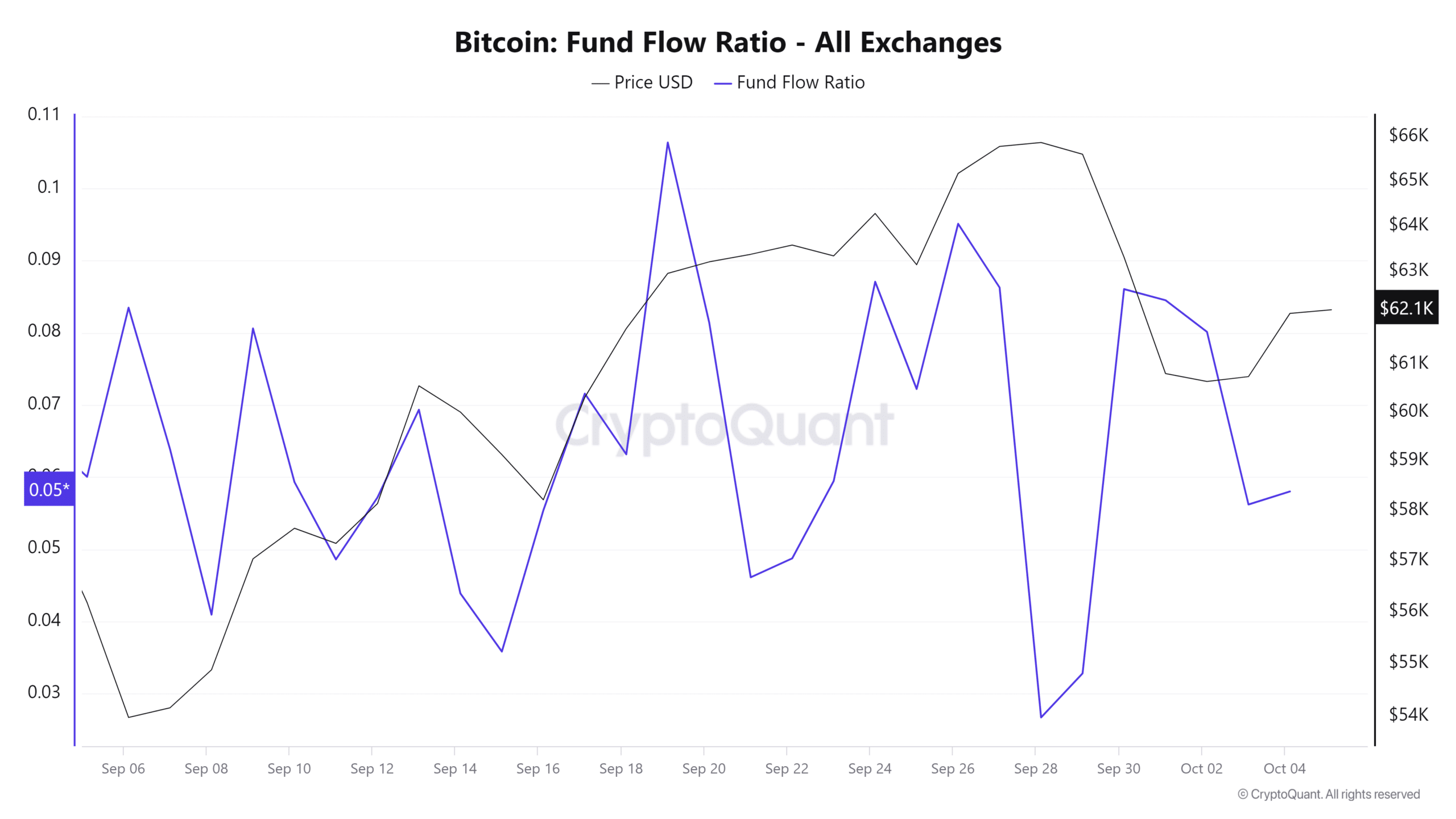

The primary indicator to think about is Bitcoin’s Fund Movement ratio, with the identical declining since 30 September. The fund stream ratio dipped from 0.08 to 0.05, signaling that fewer BTC is being transferred into exchanges.

Because of this buyers are transferring their property into non-public wallets, moderately than promoting. This usually alluded to a extra bullish sentiment as holders usually are not liquidating their positions within the brief time period.

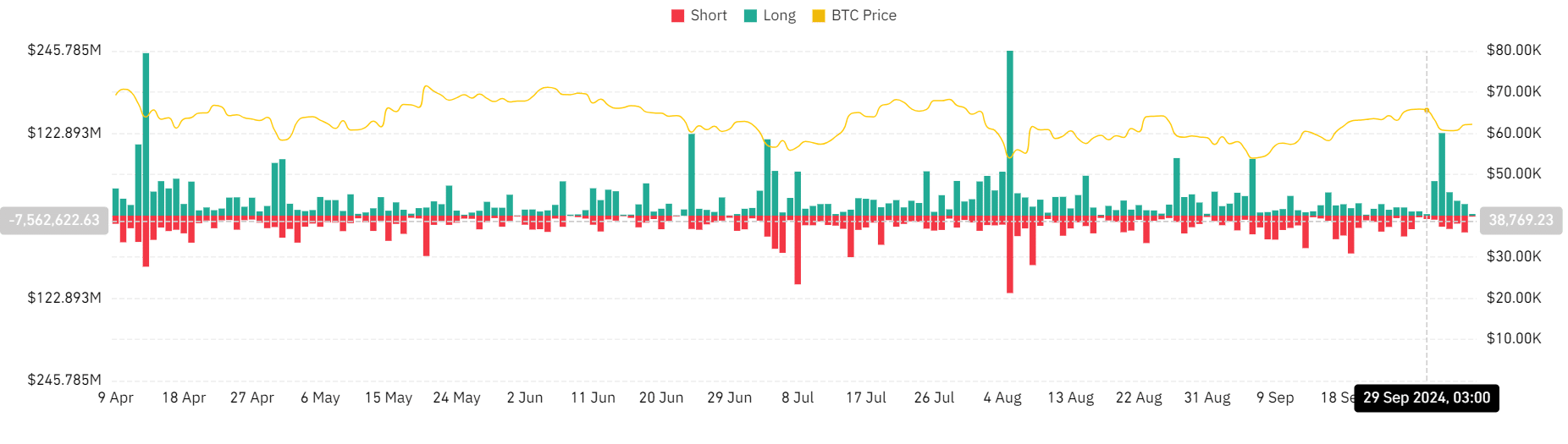

Moreover, since October began, liquidations for lengthy positions declined from $123 million to $2.47 million at press time.

Such a discount implies that many buyers are anticipating the value to rise. Thus, they’re paying a premium to carry, even throughout market downturns.

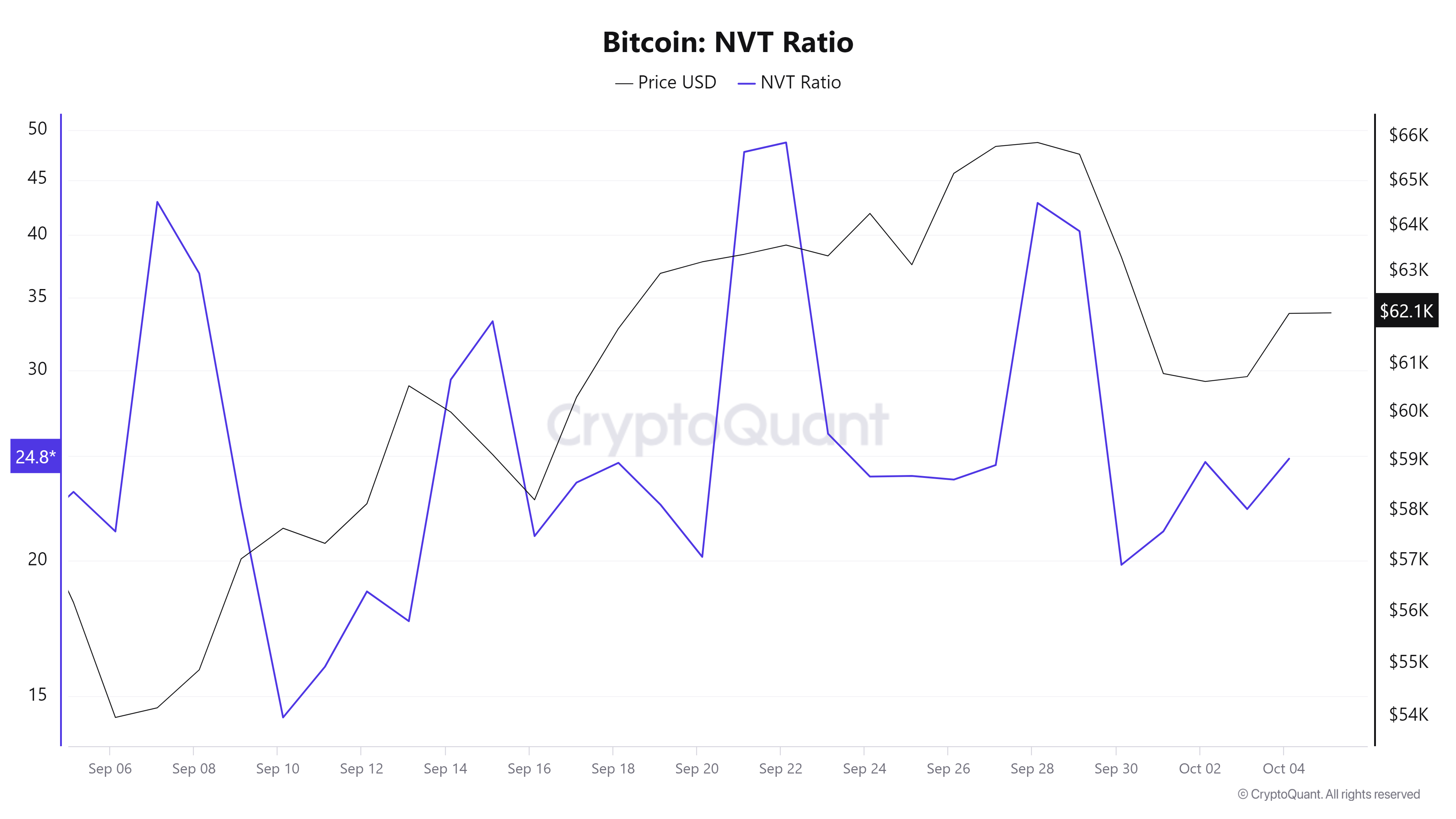

Equally, Bitcoin’s NVT ratio declined from 42.8 to 24.8 over the previous week. Merely put, BTC could also be presently undervalued, relative to its community exercise. What this implies is that the market has not but caught up with the rising exercise.

In conclusion, the prevailing market circumstances may set BTC for additional beneficial properties on worth charts.