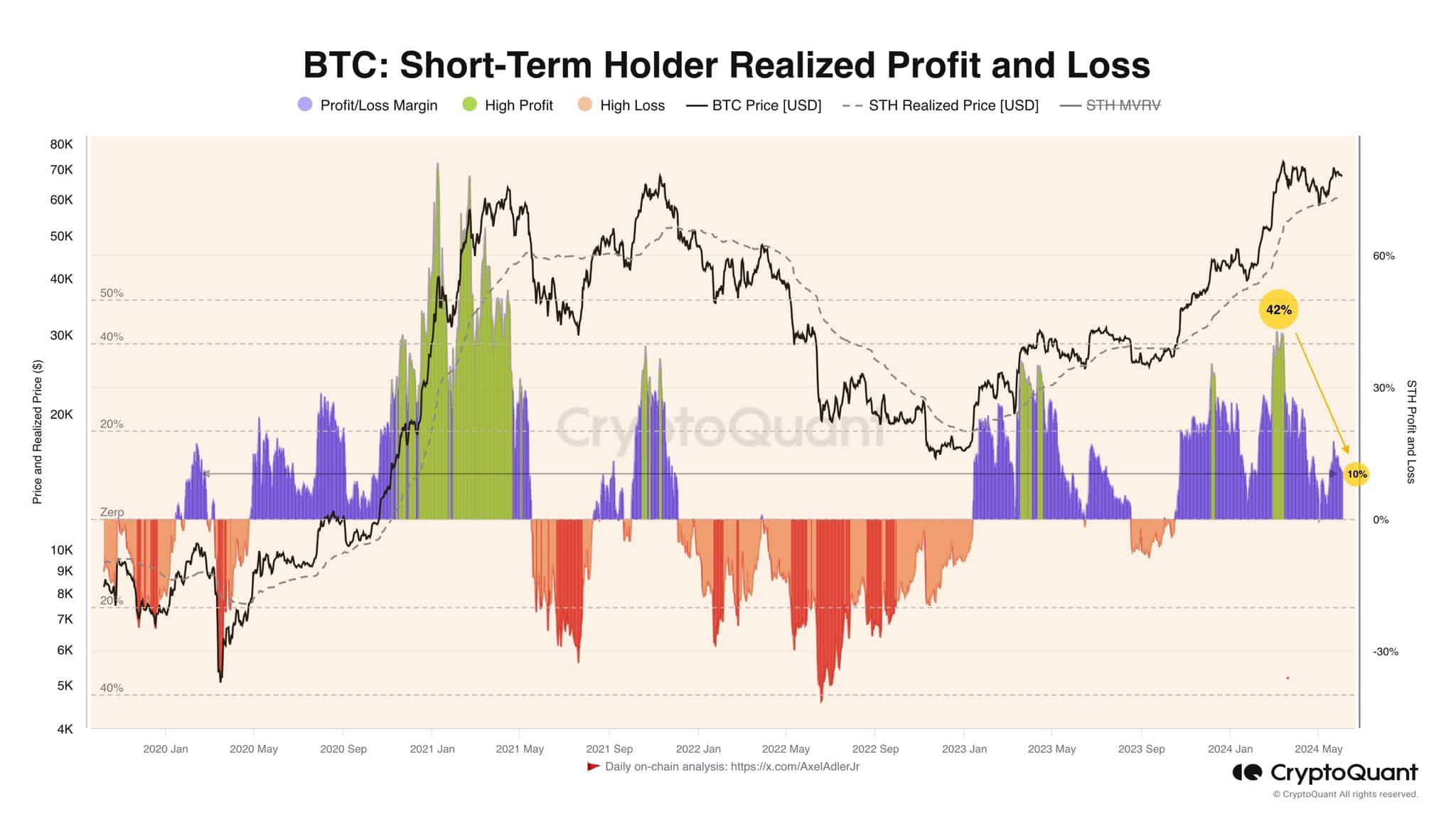

- Bitcoin’s short-term holder metric confirmed the latest consolidation has eroded their earnings.

- An inflow of latest buyers may arrive, which could result in a value breakout.

Bitcoin [BTC] short-term holder (STH) earnings have been down 32%, crypto analyst Axel Adler noticed. On the thirteenth of March, the revenue of STHs was 42%.

At press time, although the value of Bitcoin shouldn’t be a lot decrease, the revenue is at 10%.

Supply: Axel Adler on X

It is a constructive improvement. The consolidation of the previous two months has completed its job and shaken out the impatient market members. The high-profit ranges have additionally been reset, giving Bitcoin bulls renewed vitality to drive costs greater.

AMBCrypto took a better take a look at on-chain metrics to know the conduct of short-term and long-term holders, and what insights that would have for the long run value tendencies.

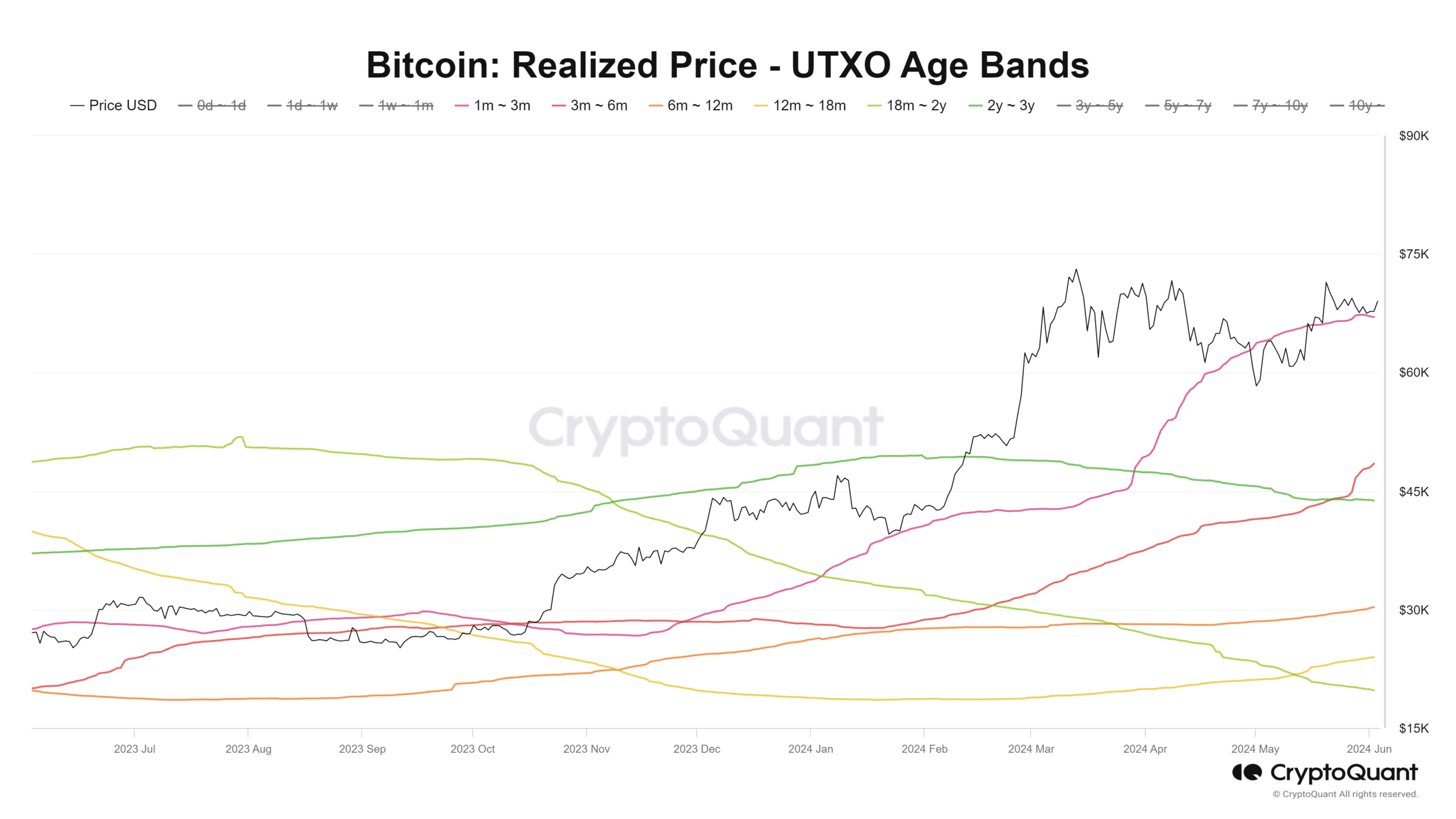

Utilizing the realized value age bands to know holders’ sentiment

Supply: CryptoQuant

The UTXO realized value age distribution metric confirmed that holders whose Bitcoin is aged 1 month to 18 months noticed elevated exercise since March. The diploma of this improve various, with the shorter-term holders being extra energetic within the markets.

Then again, the 18-month to 3-year-old Bitcoin noticed a decline in exercise. This was an indication of decreased coin motion from these holders, which additional outlined robust bullish expectations from the long-term buyers.

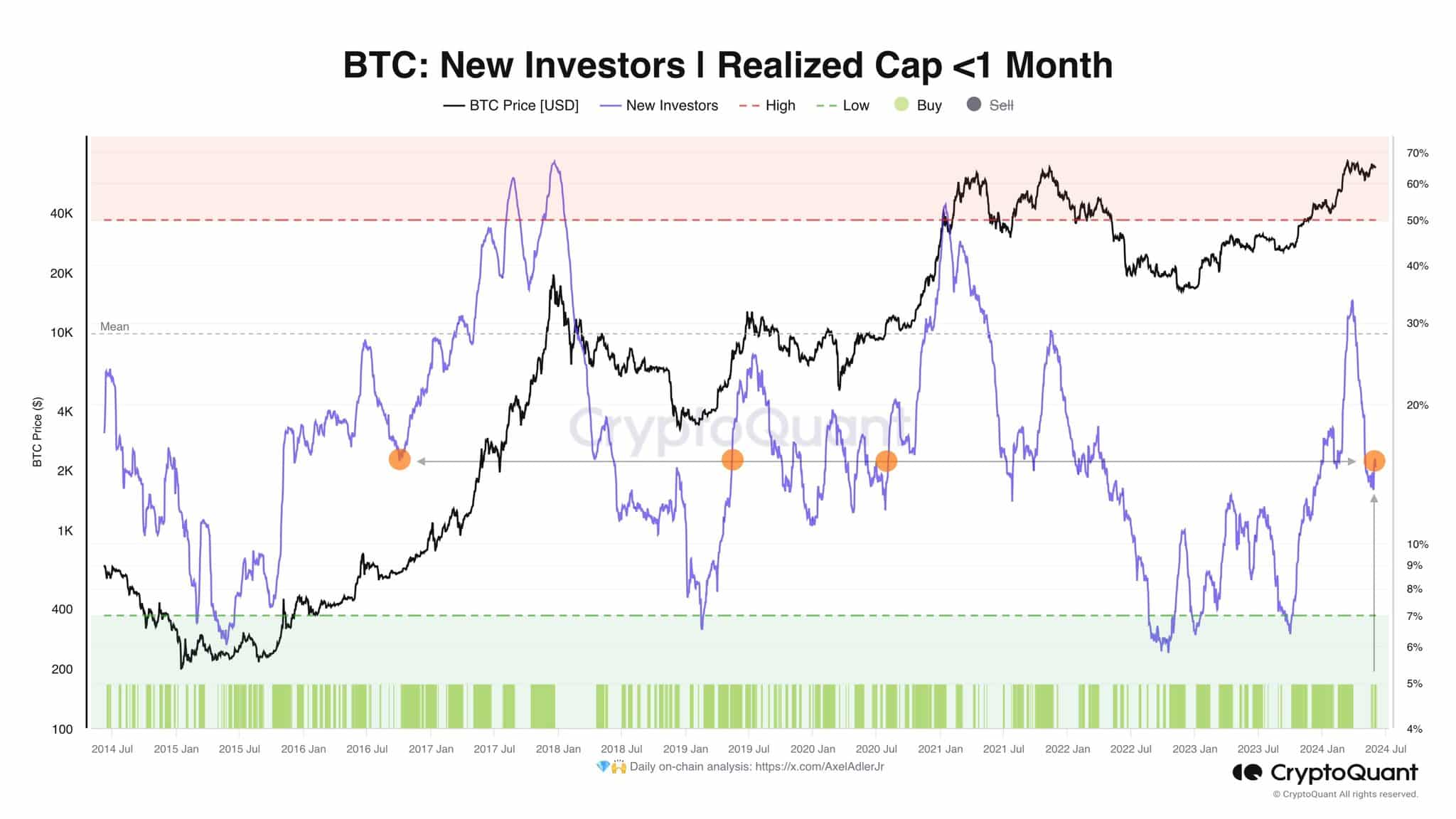

New buyers could possibly be poised to enter the market quickly

Traditionally, the primary two months after the halving have seen BTC consolidate. The decreased exercise among the many older cohorts displays this expectation as they didn’t see a dramatic shift in exercise previously two months.

Supply: Axel Adler on X

One other publish from Axel Adler highlighted this. The realized market capitalization from buyers holding BTC for lower than a month had fallen dramatically in latest weeks however was starting to climb greater once more.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

If this uptrend continues, it may mark a brand new section of value enlargement for Bitcoin. Buyers and merchants may preserve a detailed eye on this metric.

With STH earnings down, we are going to seemingly see a transfer northward, however the demand was not but in place to drive this value transfer.