- BTC noticed a large sell-off amid Israel-Iran tensions.

- BTC confirmed sturdy sensitivity to U.S. equities, making it inclined to geopolitical tensions.

After defying unfavourable seasonality expectations in September with respectable beneficial properties, Bitcoin [BTC] and crypto markets are off to a tough begin in ‘Uptober.’

BTC, the world’s largest crypto asset, declined almost 4% on the first of October, bringing its weekly losses to about 10%.

It dropped from the height of $65K to a low of $60.1K amid Israel-Iran escalations.

The BTC plunge triggered a wild crypto market sell-off, turning the entire sector pink up to now 48 hours.

Israel-Iran tensions

Israel-Iran tensions have been happening for years, though by proxies like Hezbollah and Yemen-based Houthis.

However the adversaries have since opted for a direct face-off, which hit fever pitch on the first of October as Iran reportedly launched a barrage of missiles at Israel. This was retaliation to Israel’s floor offensive in Lebanon.

Traders shortly adopted risk-off mode, maybe fearing that the escalations might morph right into a devastating regional battle.

The U.S. equities, led by tech shares, triggered a large sell-off. The tech-heavy Nasdaq Composite declined 1.5%, whereas the S&P 500 Index shed 0.93%.

BTC adopted swimsuit with an almost 4% plunge, dragging it to range-low ranges close to $60K.

Ethereum [ETH] noticed probably the most sell-off amongst main crypto property at press time. It was down 6% on the every day charts, adopted by Solana’s [SOL] 5.8% drop.

On the first of October, the U.S. spot BTC ETFs additionally recorded $242.5 million in every day outflows, the best since early September.

This additional underscored crypto buyers’ risk-off strategy as most switched to gold.

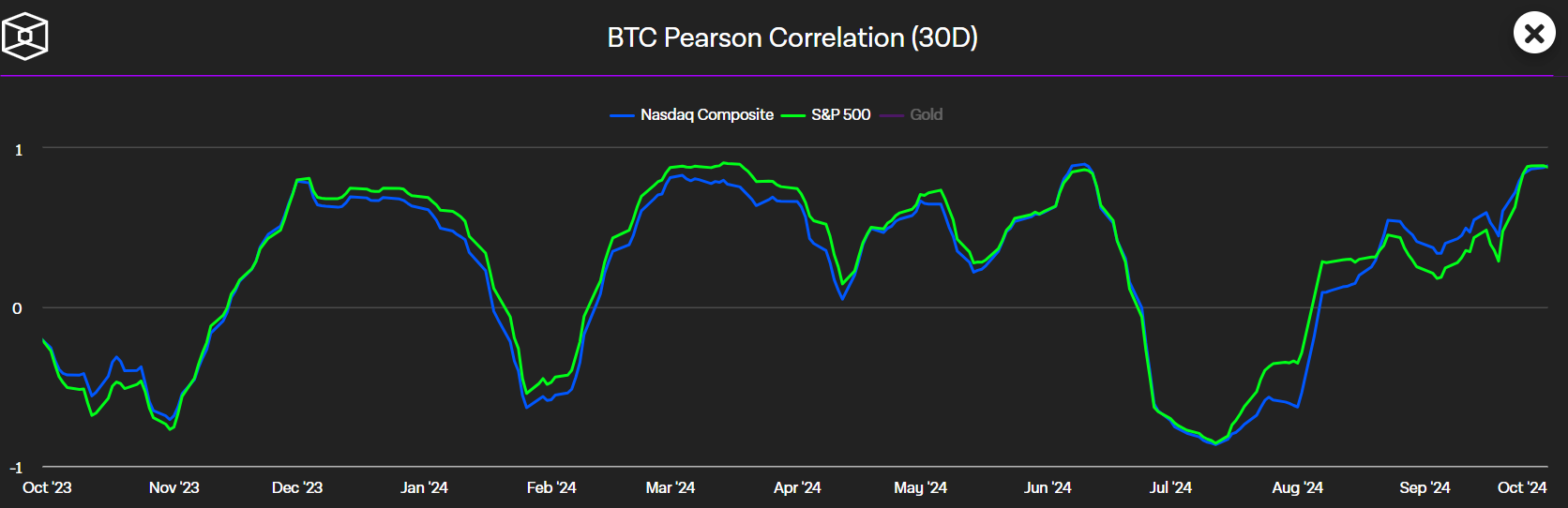

The sell-off wasn’t stunning given BTC’s risk-on standing and up to date sturdy constructive correlation with U.S. shares.

Per BTC Pearson Correlation, BTC has proven growing sensitivity to US shares since July.

That stated, Quinn Thompson, founding father of macro-focused crypto hedge fund Lekker Capital, claimed that the escalation was a fancy play that would affect US elections. Nonetheless, he believed the tensions would taper off within the brief time period.

“But if I had to bet on it, I would guess that today’s situation blows over in the near term with lots of saber rattling and barking similar to recent months.”

QCP Capital echoed an analogous short-term potential influence of the tensions. It stated,

“Middle East geopolitics will steal the limelight for now, but the shallow sell-off suggests that the market remains well bid for risk assets.”

If Thompson’s projection performs out, BTC and the general market might rebound quickly.

Within the meantime, $58K was a key degree to trace if the sell-off compounded and BTC broke under $60K.