- BTC’s STH MVRV appeared to be at an inflection level that might gasoline or dump BTC

- Choices merchants elevated hedging exercise forward of Trump’s inauguration

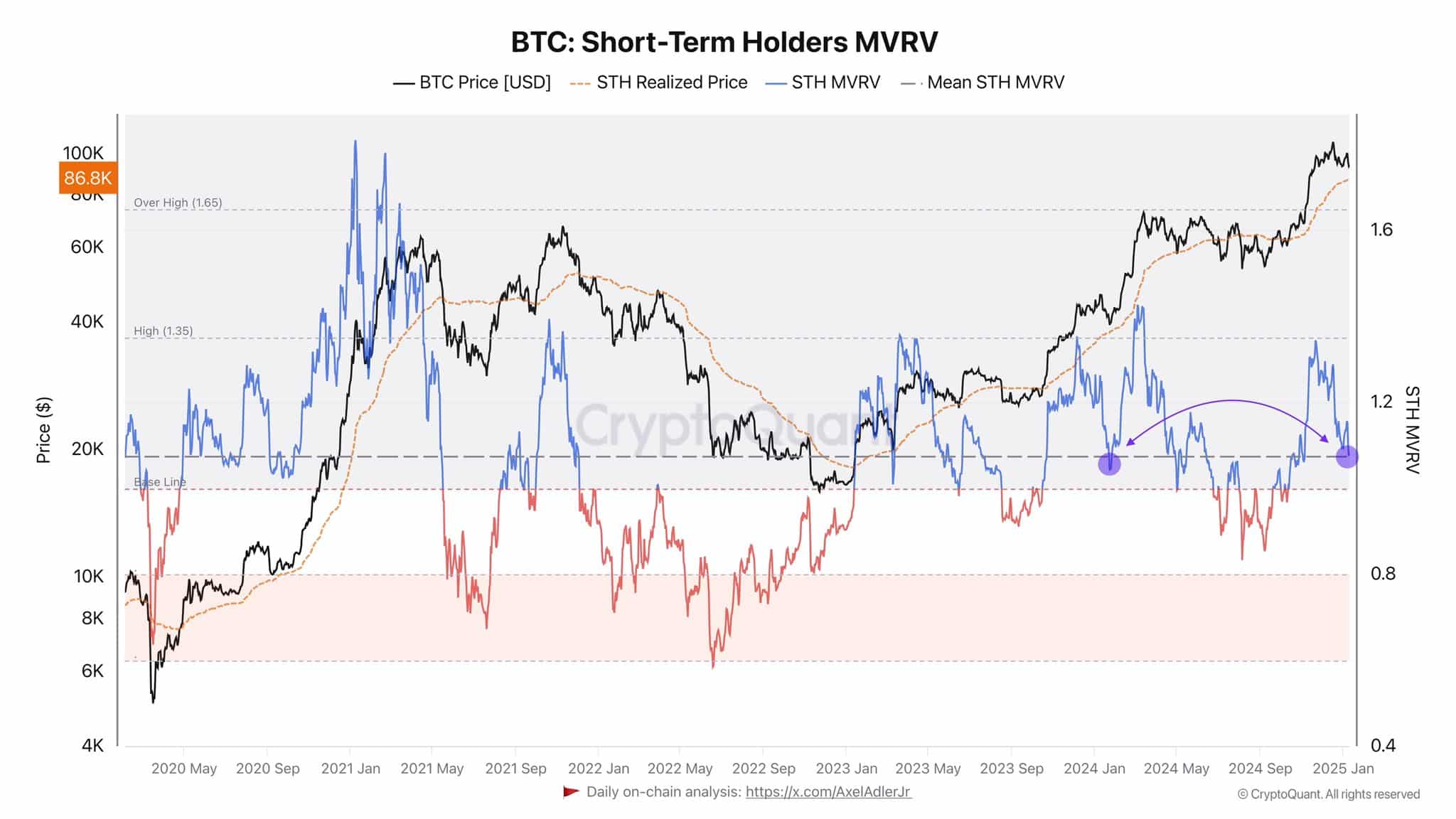

Bitcoin [BTC] is at a crossroads forward of Donald Trump’s presidential inauguration on 20 January. That’s not all although, as a key valuation indicator, STH (short-term holders) MVRV, has retreated to a pivotal level too.

Is one other ‘Trump pump’ doubtless?

At press time, the STH’s realized worth was valued at $86k. Factoring the STH MVRV degree, this may very well be a bullish set off for BTC, based on CryptoQuant analyst Axel Adler. Adler famous,

“Currently, the STH Realized Price stands at $86.8K. If demand persists until Trump’s inauguration, the STH RP could rise to $90K. Should the president fulfill even some of the promises made to voters in the early days of his term, this could serve as a strong bullish trigger.”

The chart hooked up revealed that the STH MVRV bounced on the imply degree in January 2024. Afterwards, BTC noticed an 88% pump to $72k. This additionally coincided with the approval of the U.S Spot BTC ETFs, suggesting {that a} repeat may very well be doubtless if Trump makes any bullish bulletins for the sector.

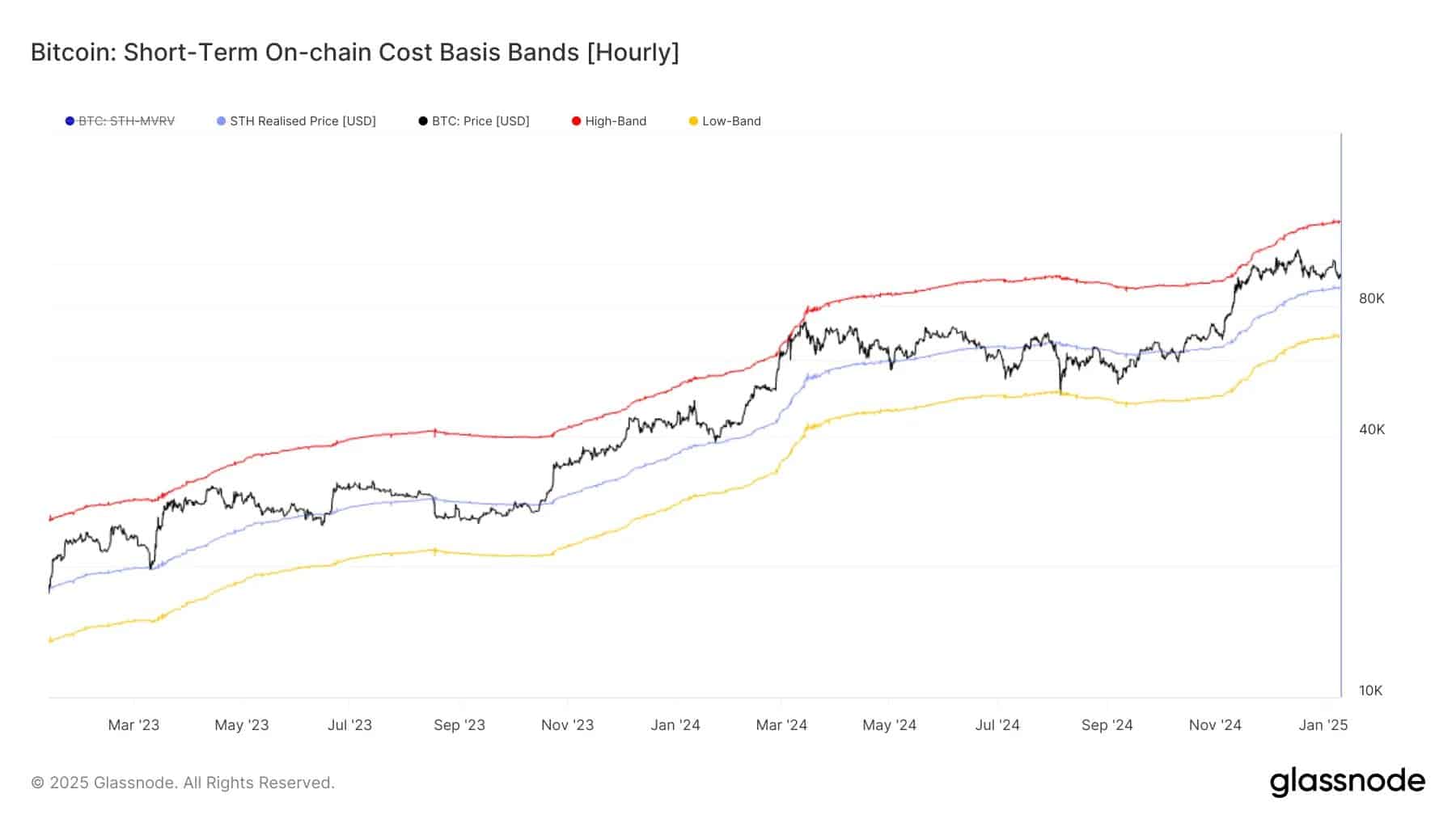

Quite the opposite, a drop beneath the imply degree for STH MVRV has traditionally indicated a protracted downtrend or worth consolidation for BTC. This might occur if BTC’s worth drops beneath the STH value foundation, which was at $88k on the time of writing, based on Glassnode.

The analytics agency said,

“$BTC price is now around 7% above the STH cost-basis of $88,135. If the price stabilizes below this level, it can signal waning sentiment among new investors – which is often a turning point in market trends.”

Briefly, if BTC defends $88k earlier than or after Trump’s inauguration, a powerful rebound may very well be imminent. Nevertheless, a drop beneath $88k might set off a panic sell-off by the STH cohort, which might drag the cryptocurrency even decrease.

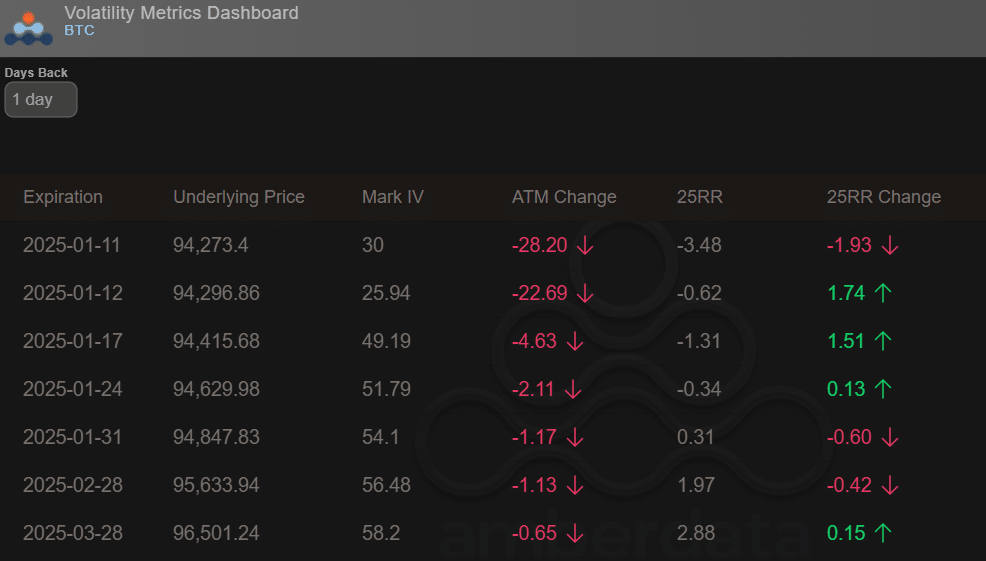

On the Choices market, merchants have been pricing destructive to barely bullish outlooks earlier than and after the inauguration. This was illustrated by the 24-hour change within the 25RR (25-Delta Danger Reversal).

The indicator was destructive for seventeenth and twenty fourth January Choice expiries, underscoring rising hedging exercise or a premium for places choices (bearish bets to cowl draw back dangers).

For the 31 January expiry, the 25RR was barely optimistic at 0.31, indicating a slight premium for calls (bullish bets). Merely put, Choices merchants expect wild swings and potential drops earlier than the occasion and a few stabilization afterwards.