- Bitcoin’s value appreciated by 9.06% over the previous week

- Bitcoin’s whale exercise hiked over the previous week, driving its most-recent rally

Over the previous week, Bitcoin [BTC] has maintained its month-long bullish momentum on the worth charts. At press time, it was buying and selling at $68.3k on the again of 10% month-to-month beneficial properties and 9% weekly beneficial properties.

Regardless of the aforementioned beneficial properties, nonetheless, it’s value declaring that the crypto remains to be 7.27% under its ATH recorded earlier this yr.

That’s not all although since as BTC recorded vital beneficial properties, whales had been the driving power behind it.

Are Bitcoin whales driving the surge?

In keeping with Santiment, the variety of Bitcoin whales noticed an exponential surge when BTC dropped to $59k on the worth charts.

From 10 to 13 October, 268 extra wallets started holding between 100-1k BTC. This evaluation advised that whales performed a component within the prevailing rally that Bitcoin is part of. What this implies is that with out capital inflows from whales, the weekly rally we’ve seen would likely not have occurred.

Thus, in the course of the dip, whales turned to accumulation, indicating their confidence within the crypto’s future worth.

Normally, when whales improve their holdings, it indicators a possible bullish development. Due to this fact, the continuing value motion was partly pushed by a surge in whale actions.

What does Bitcoin’s chart say?

Whales play an important position in any crypto’s value actions.

As such, a hike in whale accumulation is an indication of constructive market sentiment, with skilled traders anticipating the crypto’s worth to understand additional.

Due to this fact, these prevailing market sentiments may set BTC for extra beneficial properties on the charts.

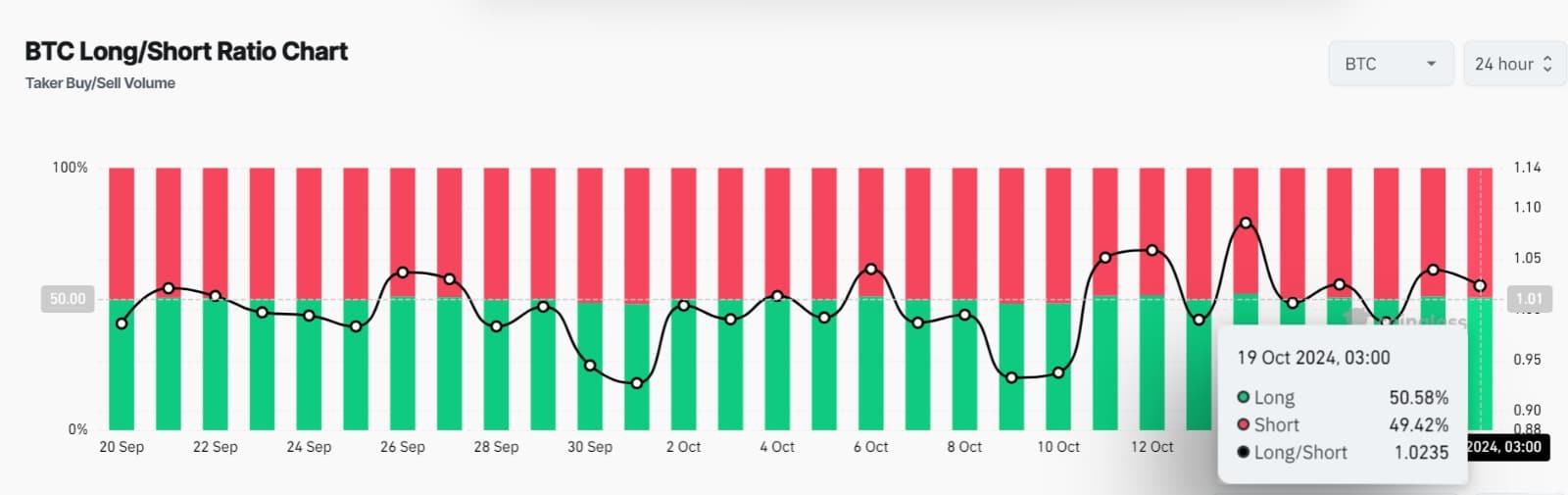

For instance, Bitcoin’s Lengthy/Quick Ratio has remained above 1 over the previous 24 hours. At press time, this ratio had a studying of 1.023.

This implied that long-position holders have been dominating the market.

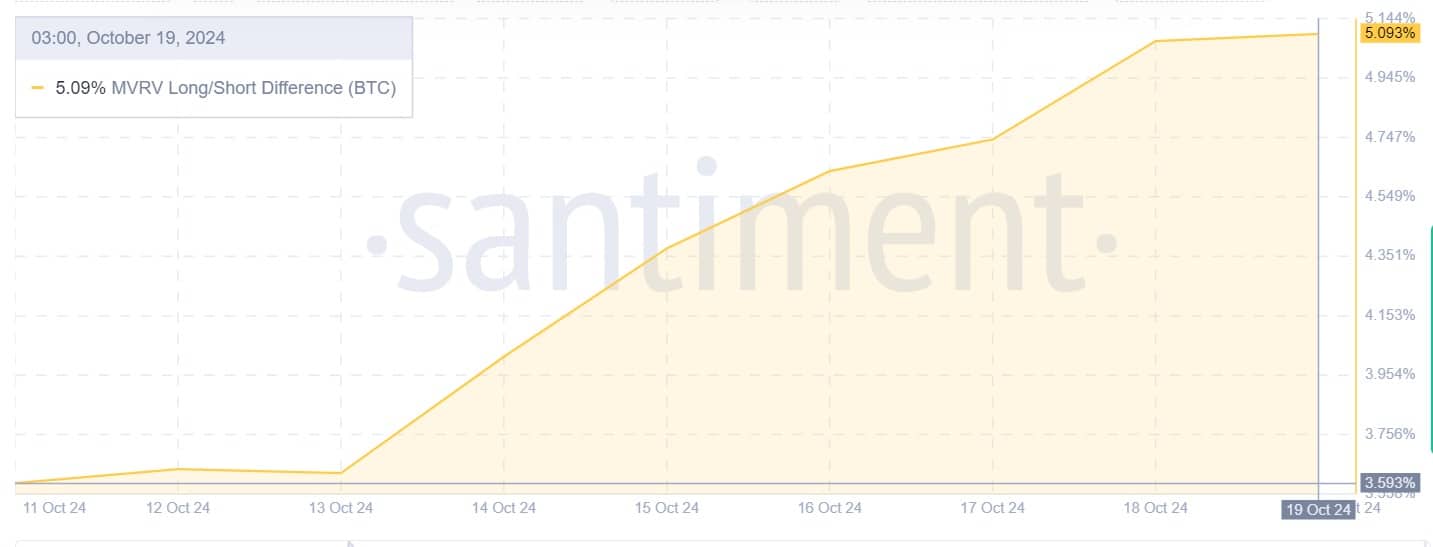

Moreover, Bitcoin’s MVRV Lengthy/Quick distinction surged over the previous week from a low of three.59% to 5093%. This may be seen as an indication that long-term traders are in revenue.

Because the MVRV for long-term holders outpaced short-term holders, it underlined confidence out there’s longer-term prospects.

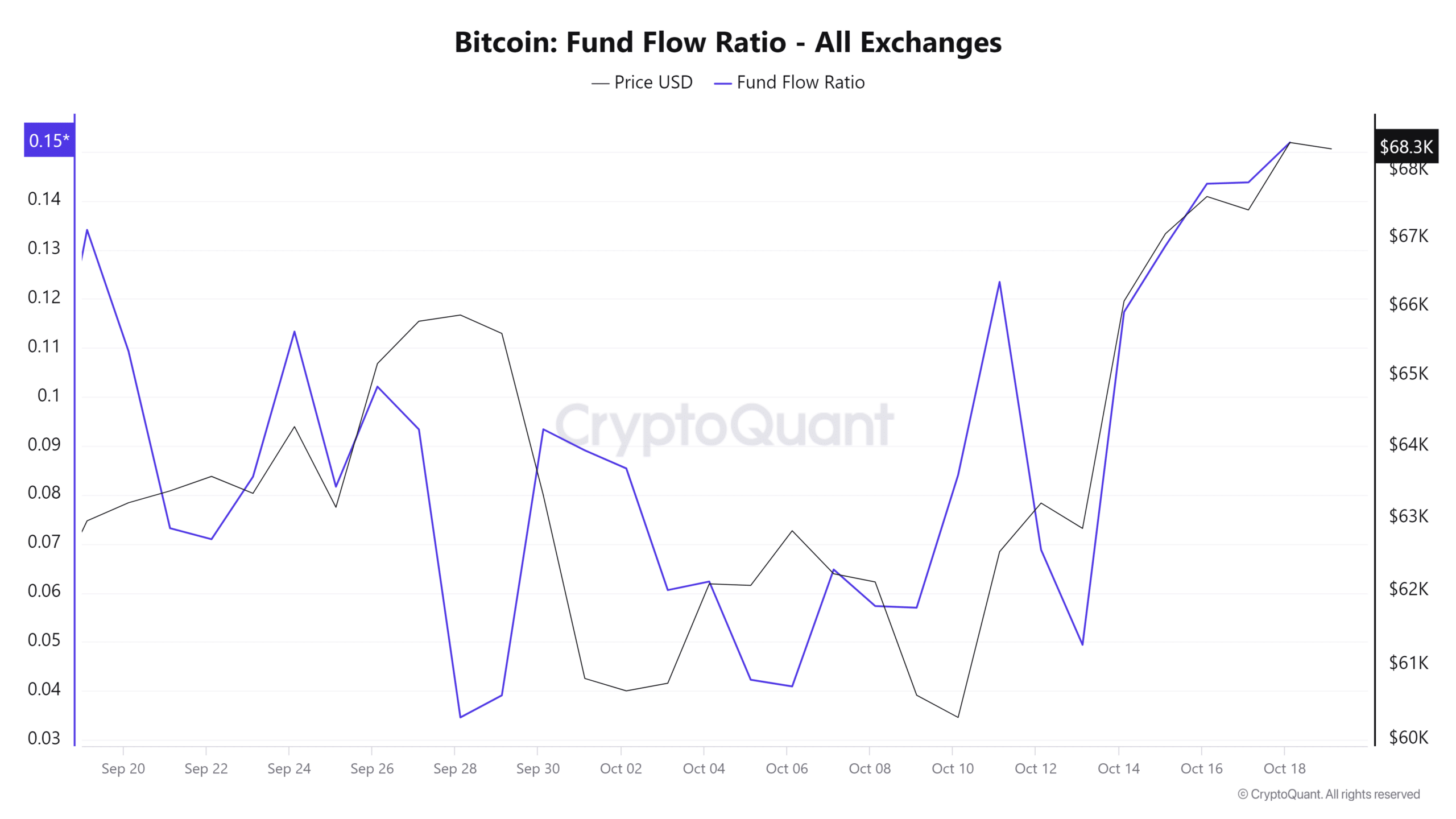

Lastly, Bitcoin’s Fund Circulation Ratio hit a month-to-month excessive of 0.15. Merely put, this advised that BTC is now having fun with the next shopping for stress than promoting stress.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Due to this fact, traders are accumulating BTC and expressing their confidence out there.

Proper now, in mild of traders’ favourability and market sentiment, BTC is in a very good place. If the development holds, the crypto will reclaim $70k within the quick time period.