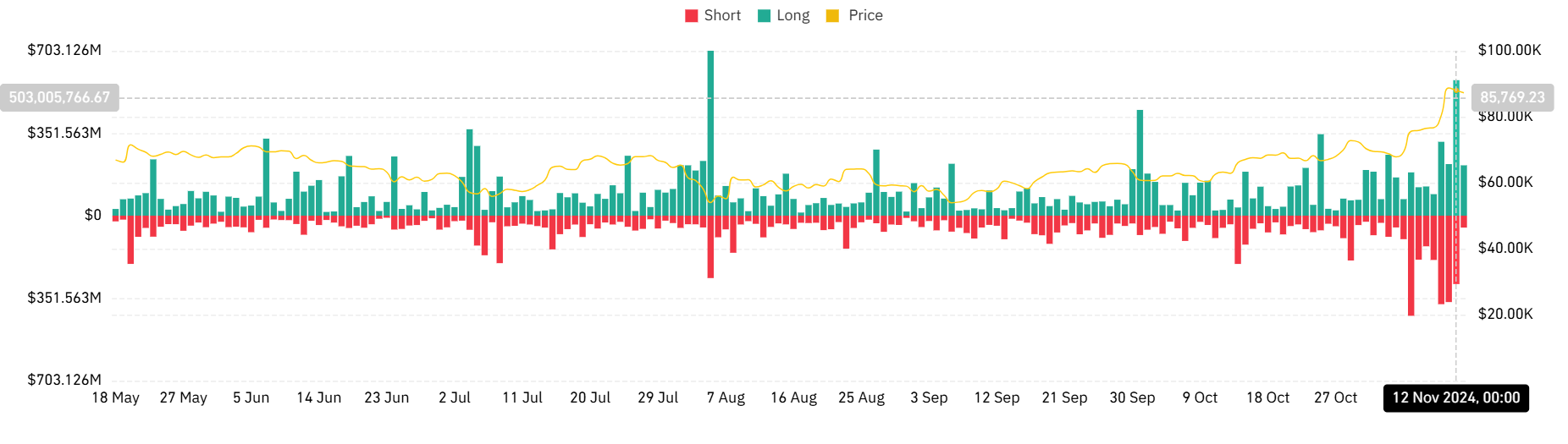

- Lengthy and quick positions noticed a spike in liquidation quantity within the final buying and selling session.

- Bitcoin contributed over $500 million to the liquidation.

The cryptocurrency market has not too long ago witnessed vital liquidation exercise, with Bitcoin [BTC] on the forefront of those actions.

As merchants navigate unstable value swings, the liquidation of lengthy and quick positions provides essential insights into the market’s present state. The newest knowledge reveals the leverage and danger within the crypto ecosystem.

Longs, shorts hit notable ranges

In response to the liquidation chart on Coinglass, over $503 million in liquidations have been recorded not too long ago, highlighting the affect of Bitcoin’s speedy value actions.

Additionally, AMBCrypto’s evaluation of the full liquidation confirmed that it surged to just about $870 million within the final buying and selling session.

This pattern illustrated the precarious stability of leverage out there, the place merchants betting on continued upward momentum have been caught off guard by sudden value corrections.

Conversely, the rise briefly liquidations prompt that Bitcoin’s latest rally pressured bears to cowl positions as belongings broke previous key resistance ranges.

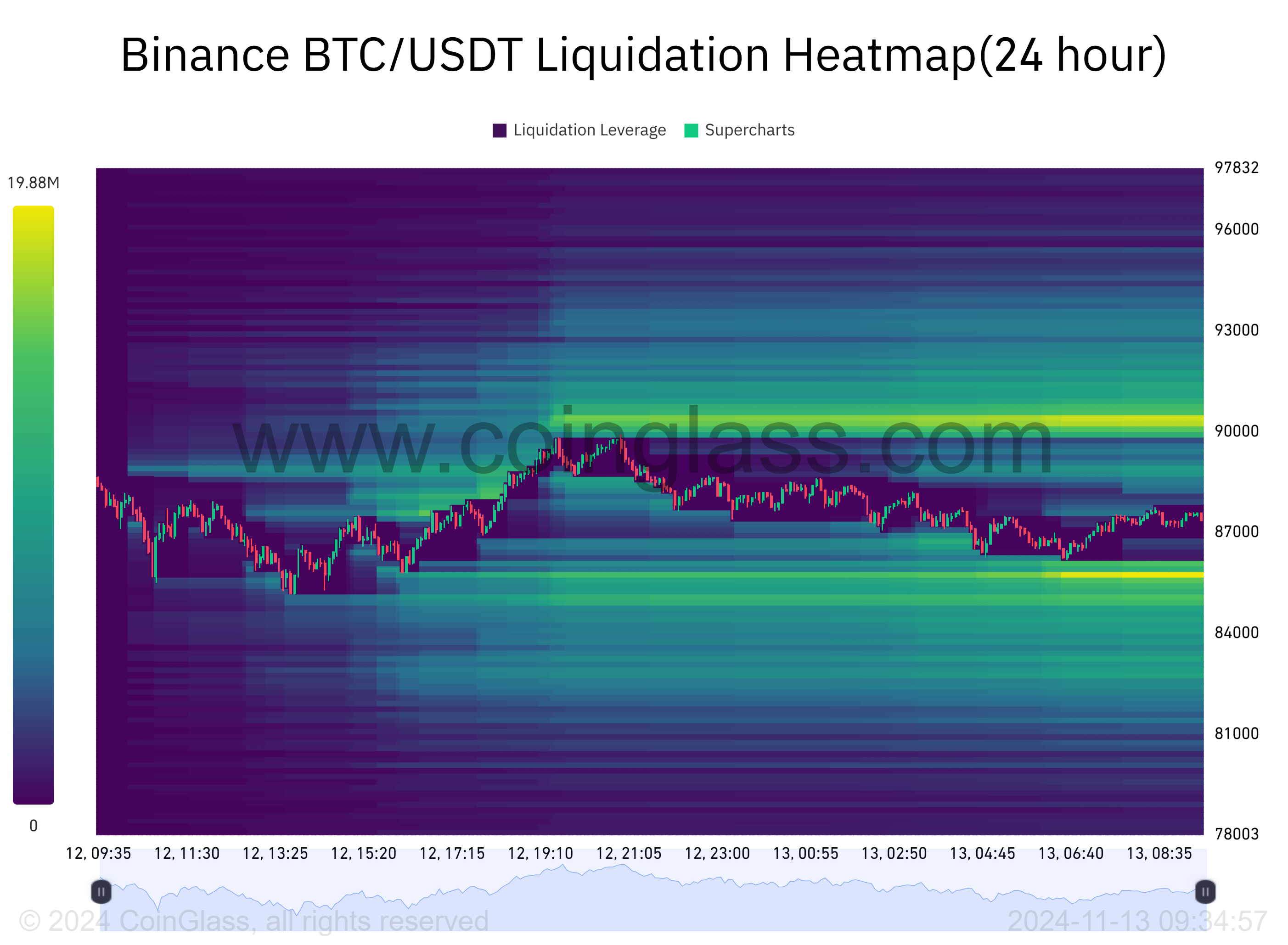

Excessive leverage concentrations

The Binance BTC/USDT Liquidation Heatmap supplied extra context, showcasing areas of concentrated liquidation exercise.

The heatmap highlighted liquidation clusters between $84,000 and $88,000, with darker zones representing increased leverage and extra vital liquidations.

This focus round Bitcoin’s psychological resistance ranges underscored the depth of speculative buying and selling out there.

The yellow line on the chart indicated Bitcoin’s value nearing $85,769, correlating with the lengthy and quick liquidations surge.

Notably, long-position liquidation dominated the market as Bitcoin’s value retraced from latest highs, triggering stop-loss orders and margin calls.

Curiously, the liquidation heatmap reveals that leverage merchants have positioned vital bets close to present value ranges, creating each alternatives and dangers.

Whereas these zones can act as liquidity swimming pools to propel value motion, in addition they sign potential market fragility if liquidations cascade additional.

Market implications

The spike in crypto liquidations, notably on main exchanges like Binance, mirrored the broader market’s heightened volatility.

With Bitcoin persevering with to commerce close to all-time highs, liquidation knowledge highlighted each the passion and vulnerability of market contributors.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Because the market strikes, merchants will carefully watch key value ranges and liquidation knowledge to gauge the following directional transfer.

Whereas liquidations can exacerbate short-term value swings, in addition they present alternatives for market stabilization and new developments to emerge.