Replace – Since publication, BTC has fallen under $60k on the value charts.

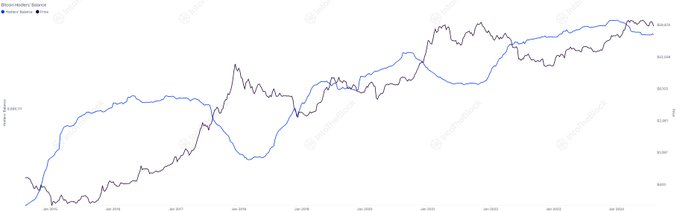

- Bitcoin HODLers managed 12.87M BTC at press time, shaping market cycles and signaling potential developments.

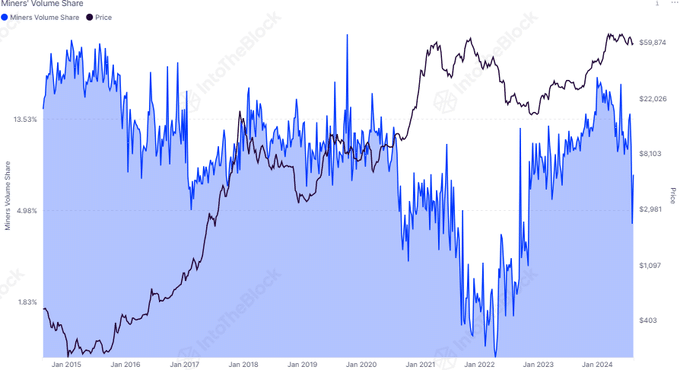

- Miners’ affect on Bitcoin value weakened as their quantity share dropped to 7.4%, decreasing market volatility.

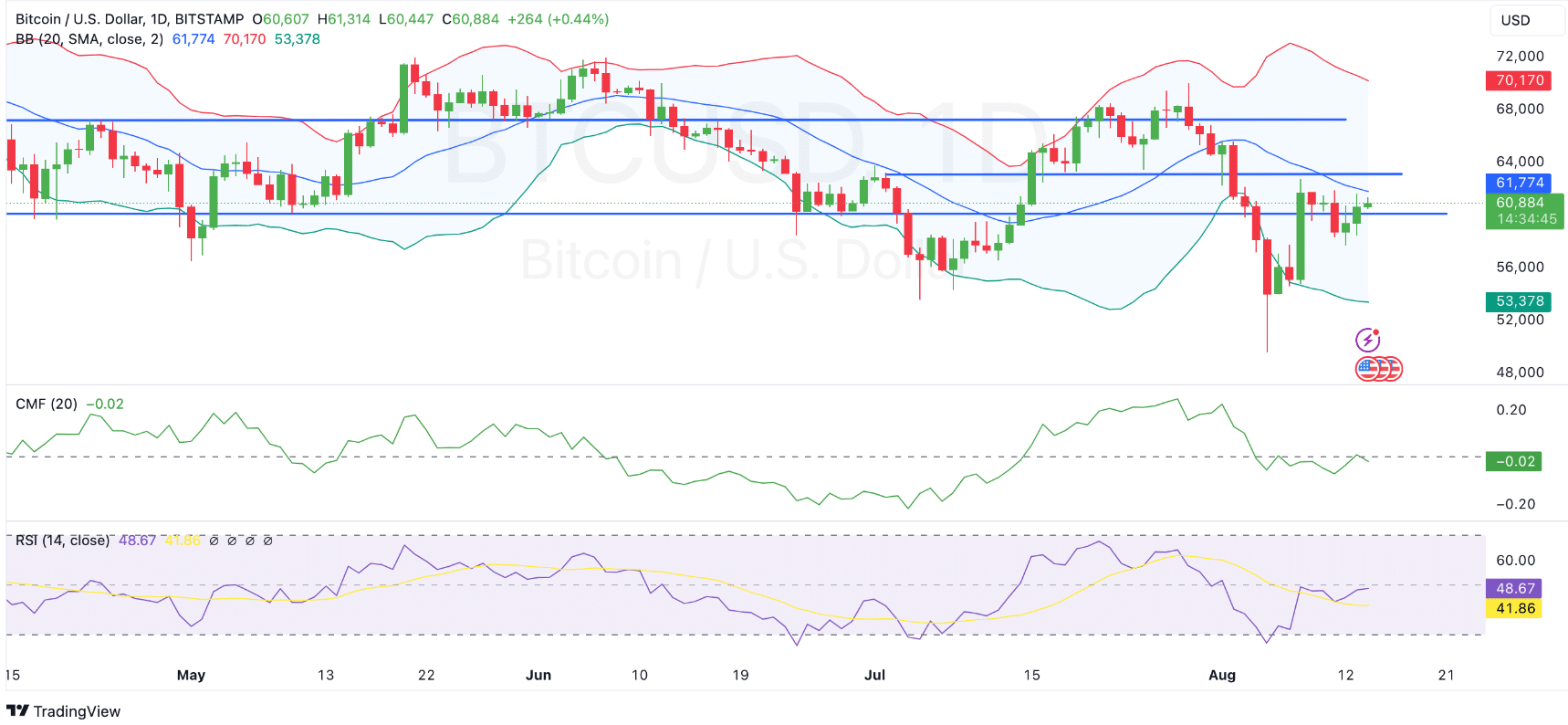

Bitcoin [BTC] not too long ago surged previous $61,000 throughout early Asian buying and selling hours on Wednesday, recovering from a big value drop earlier within the month.

Because the main asset within the crypto market, Bitcoin’s efficiency is commonly seen as a barometer for broader market developments.

In response to IntoTheBlock knowledge, Bitcoin HODLers – long-term buyers who maintain onto their property regardless of market fluctuations – managed 12.87 million BTC at press time.

This group is understood for accumulating Bitcoin throughout bear markets and strategically promoting throughout bull markets.

The substantial quantity of Bitcoin beneath their management signaled their continued affect in shaping market developments.

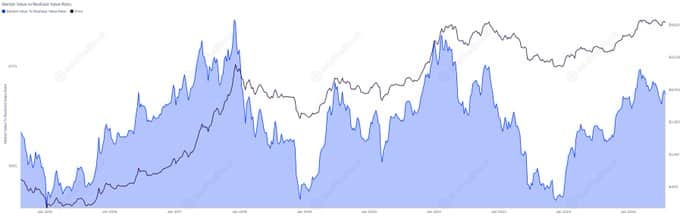

In the meantime, the present Market Worth to Realized Worth (MVRV) ratio was 1.86, indicating that Bitcoin’s market worth was 86% larger than its realized worth.

Whereas this steered that Bitcoin could be barely overvalued, it doesn’t level to an excessive overvaluation.

Historic knowledge confirmed that comparable MVRV ranges have coincided with market peaks in 2017 and 2021, whereas decrease MVRV ratios have been noticed throughout market bottoms in 2018 and 2022.

Miners’ diminishing market affect

In August 2024, Bitcoin miners’ quantity share declined to 7.4%, marking a lower in comparison with earlier within the 12 months. This discount in miners’ share signifies that their affect on market costs has diminished.

Miners historically promote parts of their mined Bitcoin to cowl operational prices, and a decrease promoting quantity can contribute to market stability.

This pattern of decreased promoting strain from miners steered a possible easing of supply-side constraints on Bitcoin’s value.

With miners promoting much less, the market might expertise much less volatility, offering a extra steady atmosphere for merchants and buyers.

Market sentiment and community exercise

Furthermore, 81% of Bitcoin addresses have been in revenue at press time, reflecting robust market sentiment. Nevertheless, this share is topic to alter, illustrating the cyclical nature of the market.

The Bollinger Bands, a technical indicator used to measure market volatility, are narrowing, suggesting a part of decreased volatility and potential value consolidation.

The Chaikin Cash Movement (CMF), which measures shopping for and promoting strain, is barely detrimental at -0.02.

This indicated that promoting strain marginally outweighed shopping for strain, pointing to a cautious market sentiment.

At press time, the Relative Energy Index (RSI) was at 48.66, just under the impartial stage of fifty, signaling neither overbought nor oversold circumstances.

The RSI’s current developments trace at a possible restoration if optimistic momentum builds.

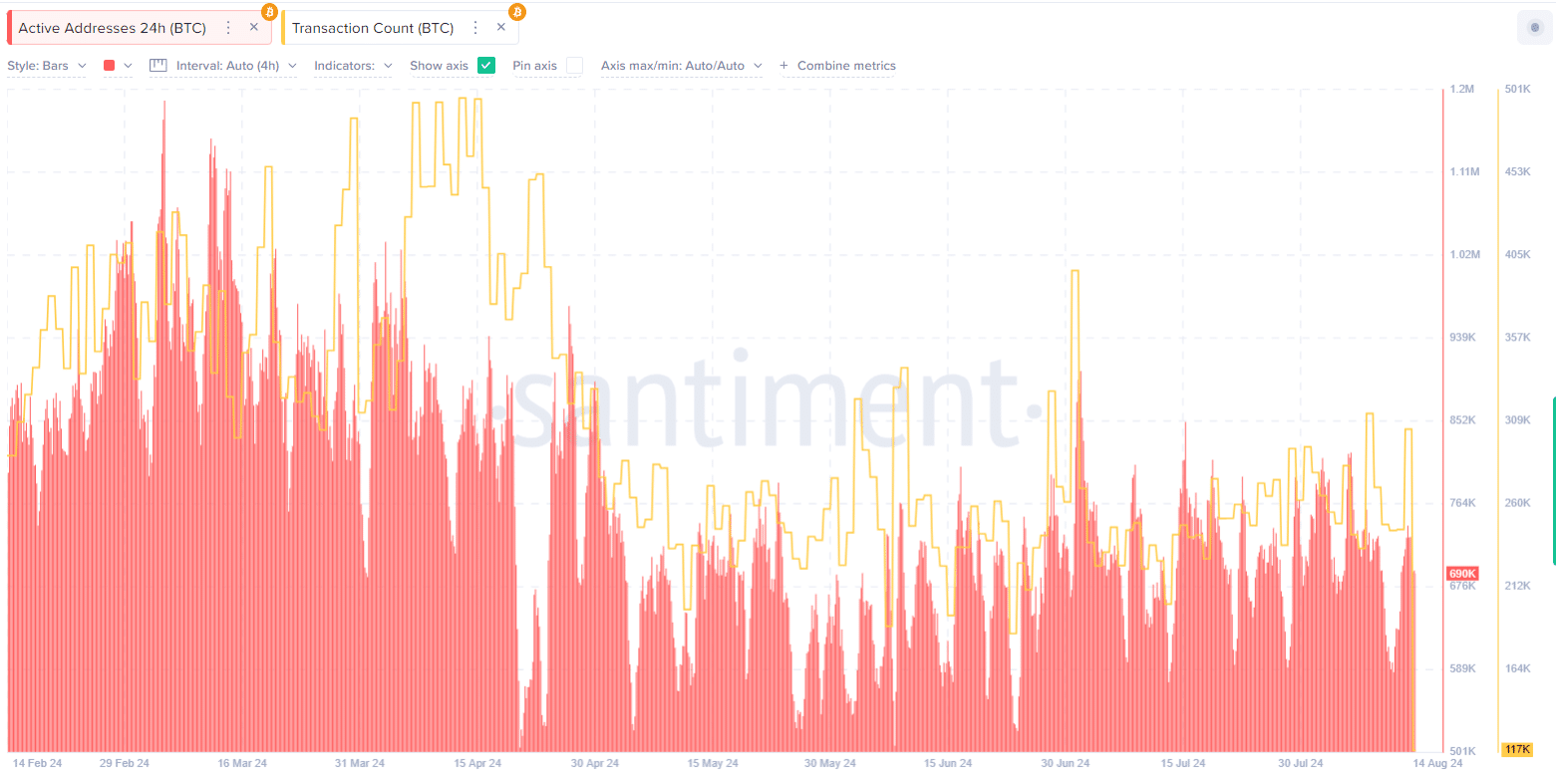

Bitcoin’s community exercise remained regular as properly, although it was barely decreased from peak ranges earlier within the 12 months.

The variety of lively addresses was 690.41K, reflecting constant person engagement, whereas the transaction rely was 117.89K.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Regardless of the lower from earlier highs, the transaction rely seems to be stabilizing, indicating ongoing, albeit decreased, exercise on the community.

This steady exercise stage is essential for sustaining the community’s general well being and performance.