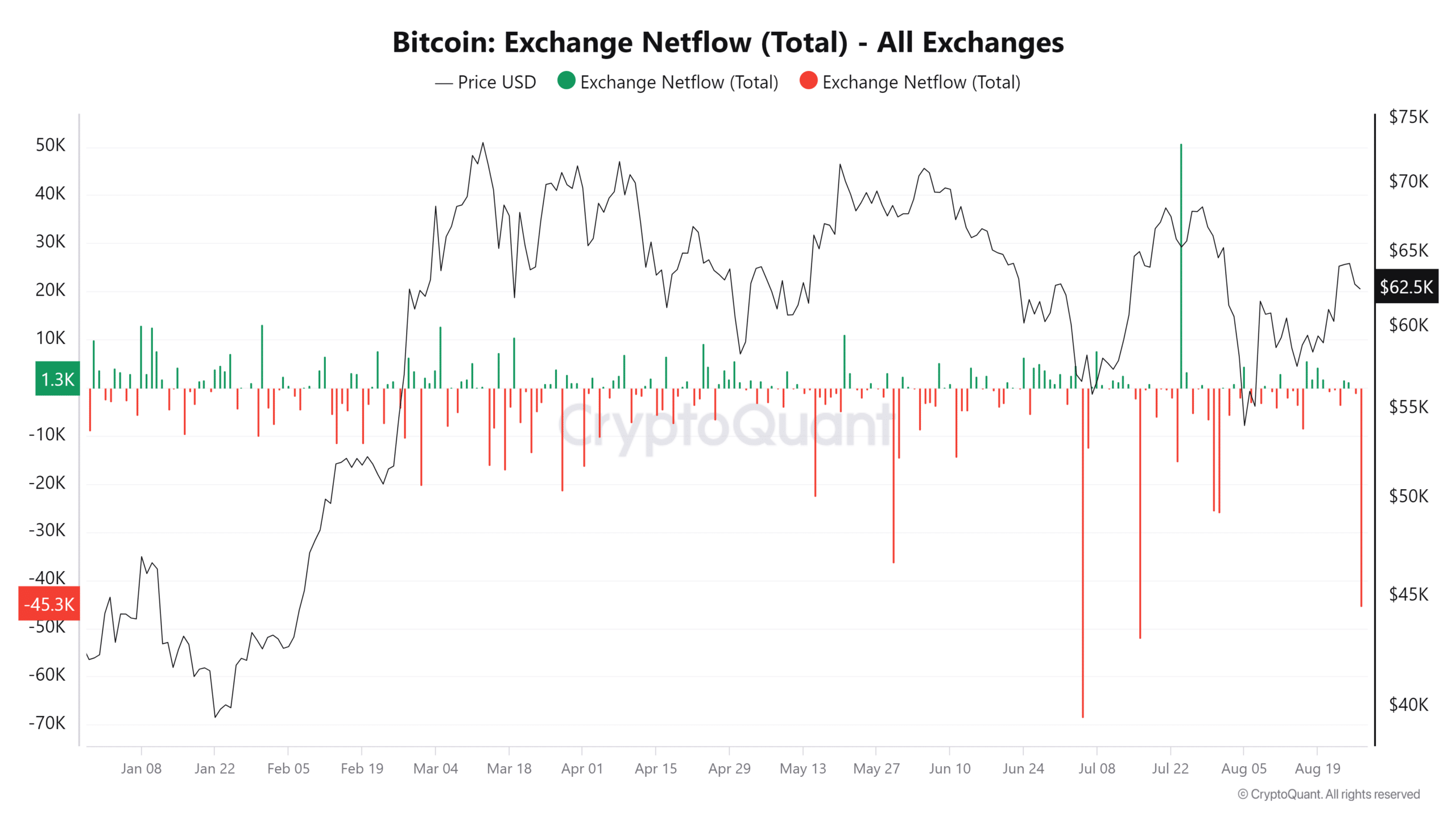

- BTC noticed an outflow of over 45,000.

- BTC has declined within the final 24 hours however remained round $62,000.

The current volatility in Bitcoin’s [BTC] worth has led to elevated exercise amongst merchants and holders.

Whereas Bitcoin has managed to take care of its place across the $60,000 degree, the fluctuations in the previous few days have induced some holders to rethink their positions, resulting in sell-offs.

Bitcoin sees sell-offs from short-term holders

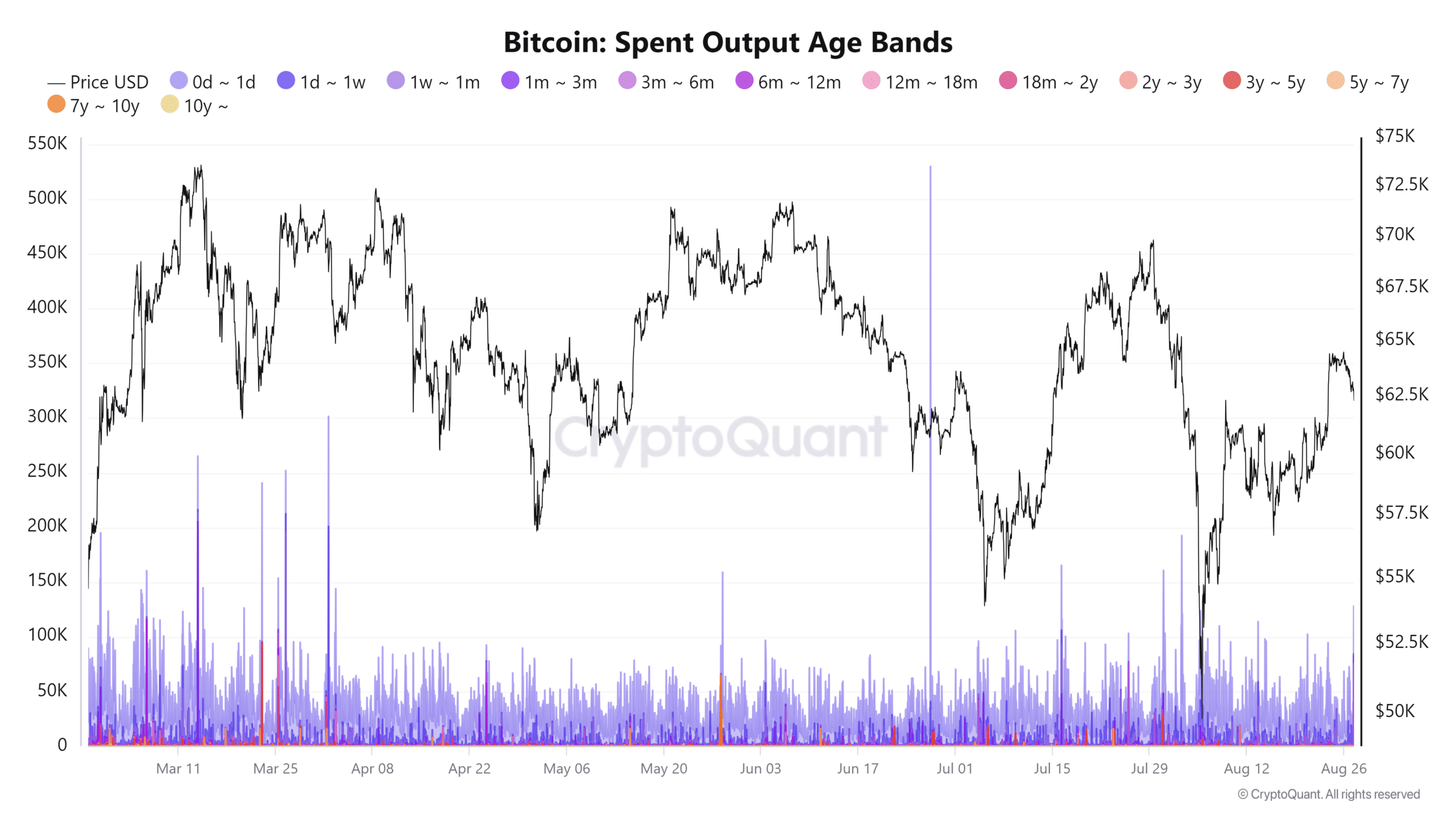

Current information from CryptoQuant indicated that some beforehand dormant Bitcoin networks have began to point out renewed exercise.

Particularly, evaluation of the 1w-1m spent output age bands revealed that short-term Bitcoin holders have transferred a big quantity—33,155 BTC.

This uptick in short-term holders’ exercise may sign rapid market promoting stress.

The present market volatility and uncertainty doubtless drive the choice to switch and promote these holdings.

Traders could search to lock in earnings after Bitcoin’s current worth actions or mitigate potential losses in the event that they anticipate additional declines.

Moreover, some could also be rebalancing their portfolios in response to the altering market dynamics.

This elevated exercise amongst short-term holders may add downward stress on Bitcoin’s worth, significantly if these transfers result in vital promoting on exchanges.

Bitcoin information its largest outflow of the month

Regardless of the current sell-off exercise from short-term holders, Bitcoin recorded its largest outflow on the twenty sixth of August, indicating a big shift in market habits.

In line with the evaluation of CryptoQuant’s change netflow, it was strongly detrimental, round -45,432 BTC. The final time Bitcoin skilled a detrimental outflow of this magnitude was in June, almost two months in the past.

A detrimental change netflow signifies that extra BTC was withdrawn from exchanges than was deposited.

This development is mostly thought of bullish, suggesting that holders are shifting their Bitcoin off exchanges. When traders withdraw their property from exchanges, it usually displays confidence.

Additionally, this motion contrasts with the promoting stress seen from some short-term holders.

This suggests that whereas some market contributors are locking in earnings or mitigating dangers, a bigger group of traders is selecting to carry their BTC off exchanges.

BTC’s volatility stretches

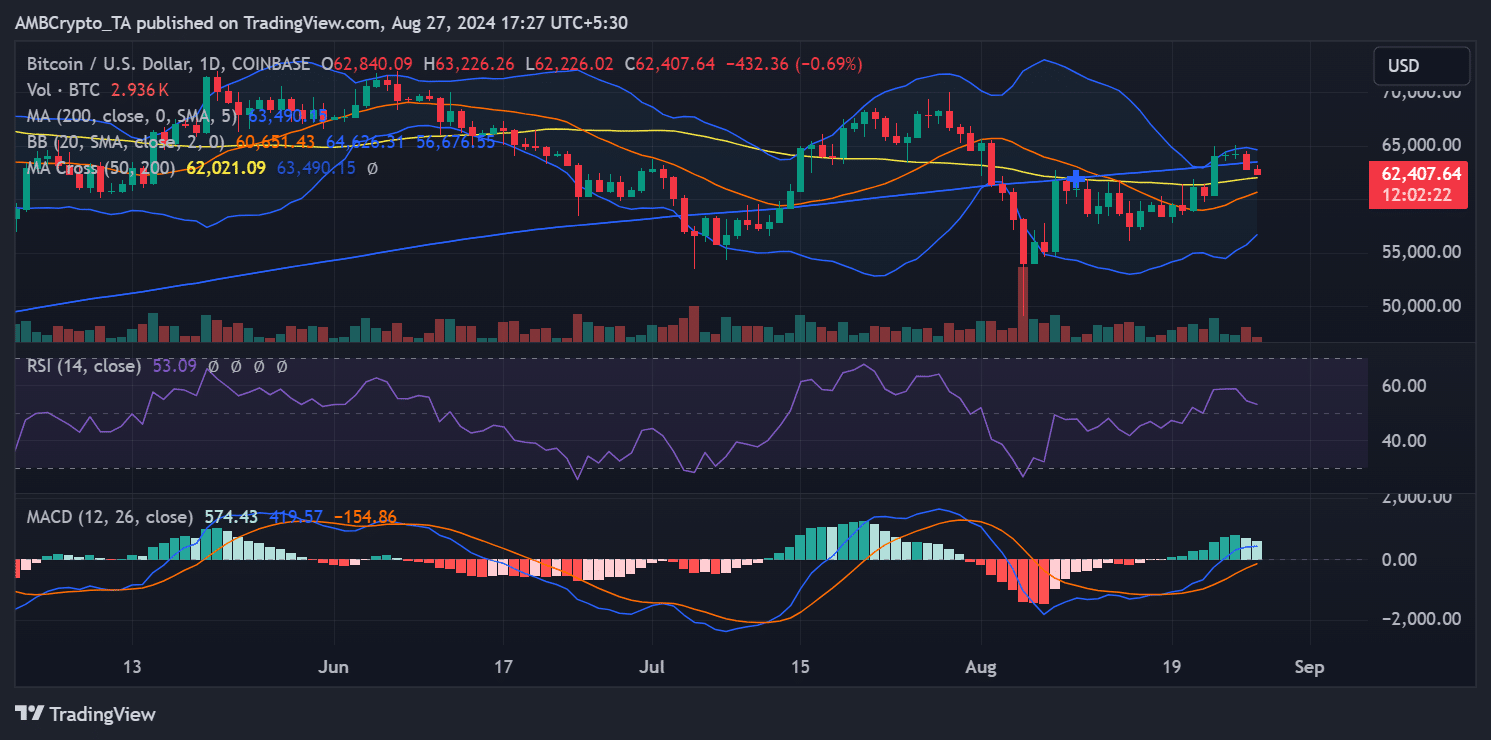

AMBCrypto’s evaluation of Bitcoin’s each day development highlights the continuing volatility that Bitcoin has been experiencing.

The examine of its Bollinger Bands—a technical indicator that measures worth volatility—exhibits that the bands have stretched in current days, reflecting the elevated worth fluctuations.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Within the final buying and selling session, Bitcoin misplaced over 2% of its worth and has continued to say no by nearly 1% within the present session.

As of this writing, Bitcoin was buying and selling at roughly $62,401. The widening of the Bollinger Bands indicated that the market has skilled increased volatility, with worth actions turning into extra pronounced.