- Curiosity in Bitcoin ETFs grew considerably as inflows surged.

- Value motion remained impartial, holders stayed worthwhile.

Bitcoin [BTC] ETF volumes grew materially over the previous month, indicating rising curiosity in BTC from the standard monetary sector.

Will Bitcoin rise?

Bitcoin ETFs surged in June, marking a record-breaking begin to the month.

This robust efficiency was evident throughout a number of key metrics, together with fund flows, asset below administration (AUM), buying and selling volumes, and particular person fund AUM reaching new highs.

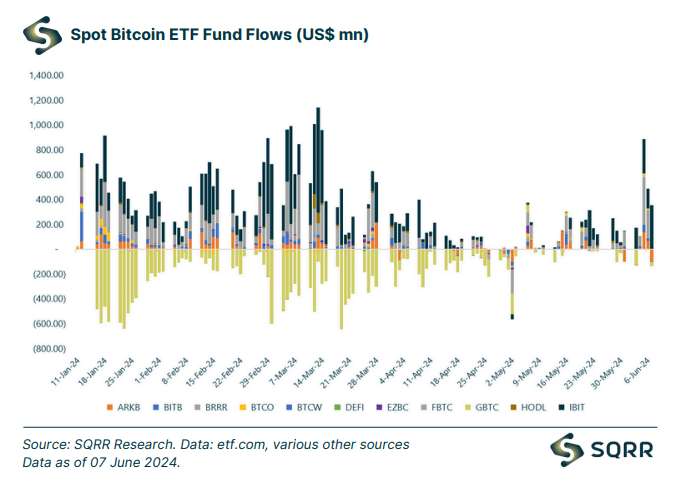

Fueled by investor enthusiasm, all Bitcoin ETFs witnessed a internet influx of roughly $1.75 billion in the course of the week.

IBIT and FBTC have been the most important drivers, collectively bringing in a staggering $1.63 billion in internet inflows. Notably, GBTC was the one fund to expertise internet outflows for the week, at -$0.12 billion.

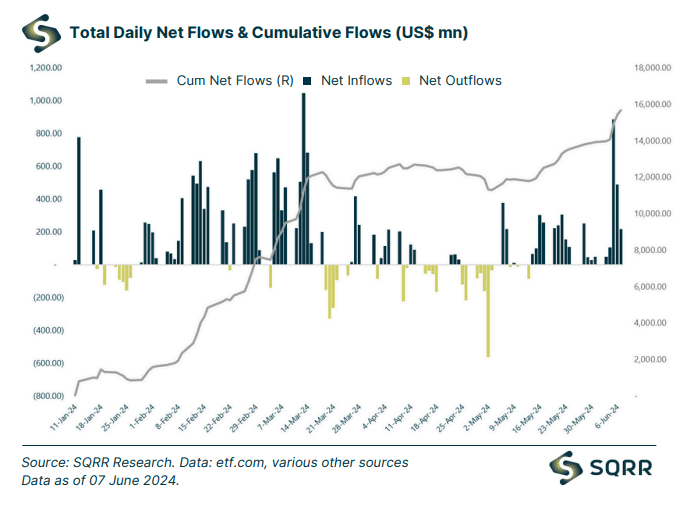

It’s vital to do not forget that this comes amidst a record-breaking 18 consecutive days of total internet inflows for all funds, reaching a complete of $15.66 billion.

The overall belongings below administration (AUM) for Bitcoin ETFs additionally surpassed a big milestone, reaching $62.33 billion by the week’s finish, a transparent indication of rising investor confidence on this asset class.

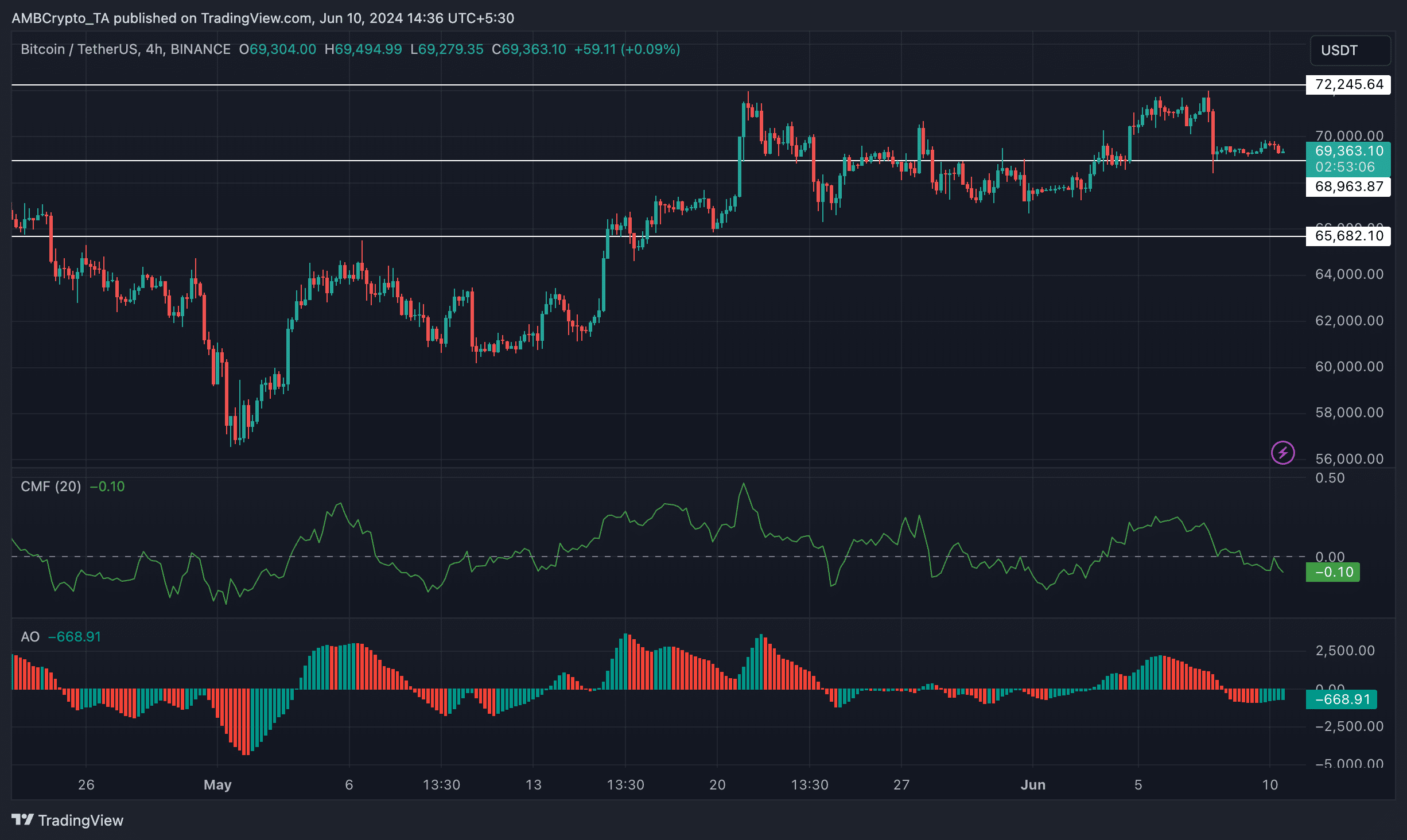

Regardless of the surge in worth, BTC hasn’t been in a position to push previous the $70,000 mark over the previous couple of days. On the time of writing BTC was buying and selling at $69,388.69 within the final 24 hours, it had seen a minimal surge of 0.06%.

Because the twenty first of Might, after testing the $72,245.64 mark, Bitcoin had been shifting sideways. Although the value motion of BTC was largely impartial, the CMF (Chaikin Cash Circulate) for the king coin declined.

This meant that the cash flowing into BTC had lowered.

Furthermore, the Superior Oscillator(AO) had turned unfavourable. This indicator measures momentum by evaluating latest worth actions to historic knowledge.

A decline suggests the latest BTC worth will increase is likely to be dropping energy, probably indicating a shift in direction of a bearish sentiment with extra sellers or much less shopping for stress.

What ought to holders do?

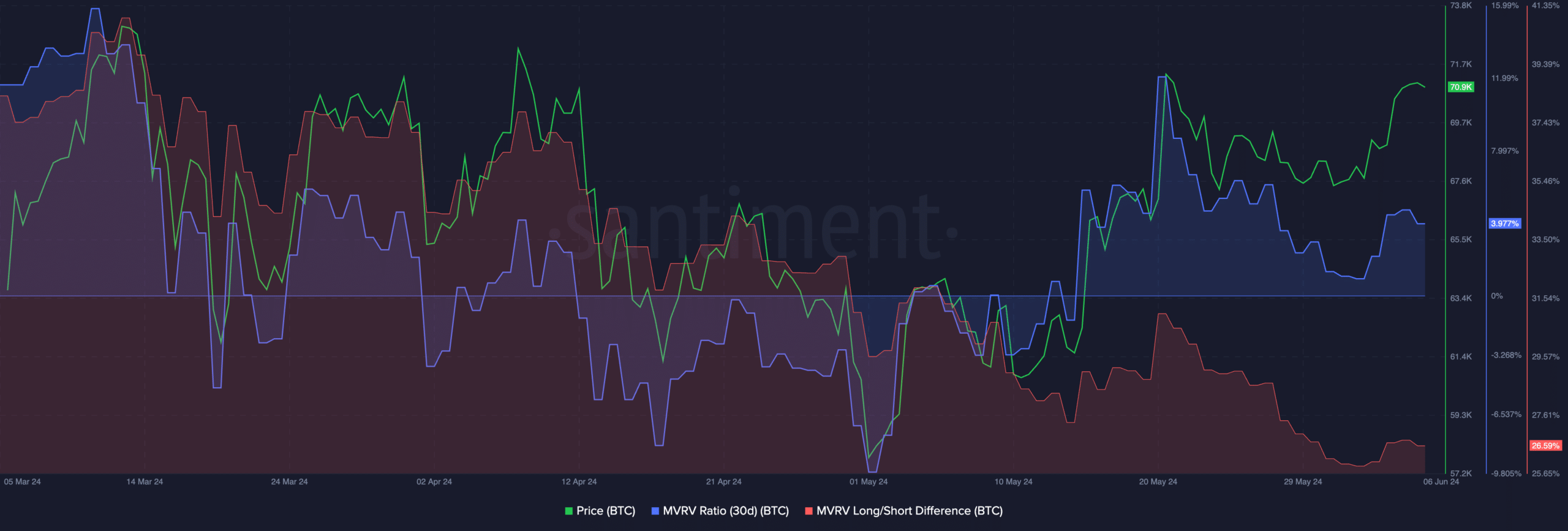

Most BTC holders remained worthwhile on the time of writing. This was indicated by the MVRV ratio for BTC remained excessive.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The Lengthy/Quick distinction for BTC had declined considerably as nicely, indicating that the variety of short-term holders accumulating BTC had declined.

The temperament of those short-term holders and their willingness to promote or maintain their holdings will play an enormous position in figuring out BTC’s worth.