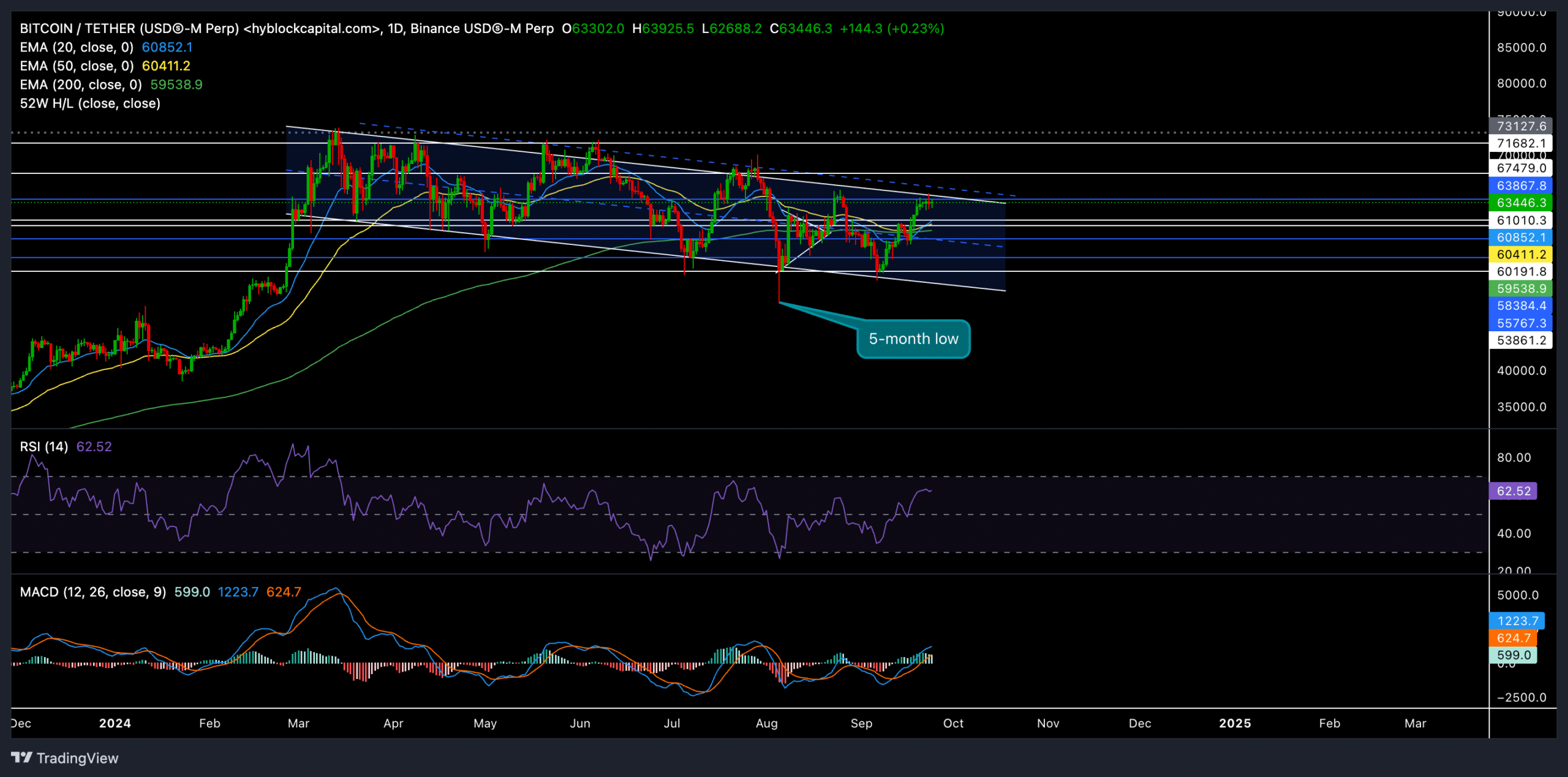

- Bitcoin continued its descending channel trajectory on the every day chart.

- The current features helped the coin set off a golden cross on its EMAs.

Bitcoin [BTC] oscillated inside a well-established down-channel for over seven months. After bouncing off the $53.8K assist degree earlier this month, BTC has rallied almost 18%, pushing towards the channel’s higher boundary.

The essential query is whether or not the bulls can push past this resistance to provoke a breakout or succumb to a different downward.

At press time, BTC traded at round $63,446. The current worth motion confirmed a tug-of-war between patrons and sellers, with Bitcoin hovering across the fringe of the sample.

Rebounding from key assist

It’s value mentioning that the 20-day EMA lately crossed above the 200-day EMA, confirming a ‘golden cross’ on the every day chart. The empirical tendencies of the king coin present how a continued upside on the chart often follows such a crossover.

A breakout above this degree may set the stage for a sustained rally towards the $67,000 – $70,000 vary.

Nevertheless, the worth was but to interrupt the higher boundary of the down channel. If patrons can not push by, it might set off a short-term pullback. A rejection from right here may result in a pullback towards $60,000 and even $55,838.

The RSI stood at round 62.52 on the time of writing. It hovered above the impartial 50 mark to depict a powerful bullish edge however was but to the touch the overbought mark. This confirmed there’s nonetheless room for upside if the bulls maintain their momentum.

It’s essential to notice that RSI marked larger highs alongside flatter highs on worth motion. This highlights the possibilities of a possible bearish divergence with worth.

Then again, the MACD (Shifting Common Convergence Divergence) indicator reaffirmed the bullish momentum, with the MACD line remaining above the sign line.

Derivatives information revealed THIS

BTC’s quantity dropped by 19.93% to $47.39B, reflecting a comparatively weak every day motion. Equally, open curiosity decreased by 0.58% to recommend that merchants hesitated to decide to new positions at present ranges.

The lengthy/quick ratio for the final 24 hours was barely bearish at 0.9869. This indicated a balanced sentiment with a slight edge for brief positions.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Nevertheless, prime merchants on Binance confirmed extra confidence within the bulls with an extended/quick ratio of 1.0172.

The golden cross between the 20-day and 200-day EMAs hinted at bullish potential however merchants ought to look ahead to affirmation with an in depth above the higher boundary of the down channel.