- BTC had hit lengthy liquidity at $67K and will reverse latest losses post-FOMC.

- Trading corporations underscored merchants’ short-term bullish prospects regardless of the latest dip.

Bitcoin [BTC] prolonged losses to the $67K area amidst traders’ worries concerning the Fed resolution.

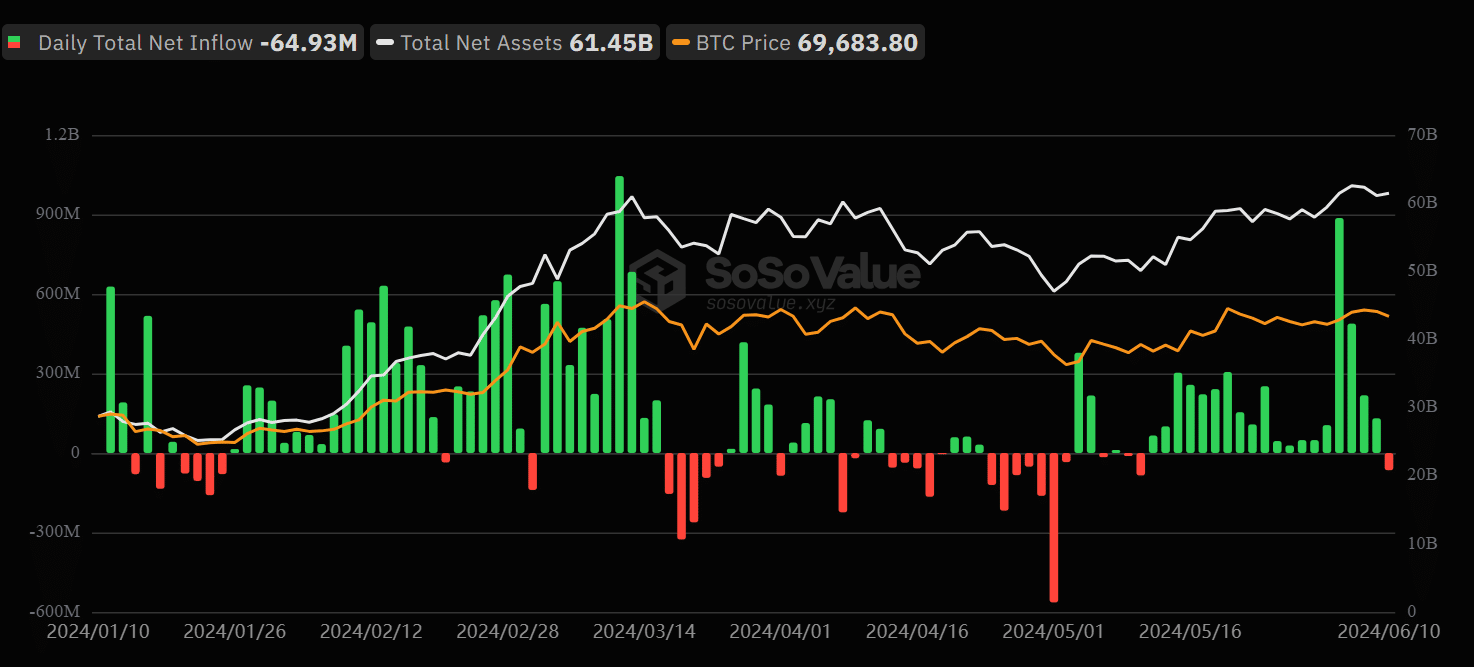

The short-term bearish sentiment was mirrored within the BTC ETFs, too, because the merchandise broke a month-long streak of inflows.

On the tenth of June, spot BTC ETFs recorded a day by day web outflow of $64.9 million per SoSo Worth information.

The bearish sentiment adopted a stronger US Jobs report on the seventh of June, and additional volatility was anticipated on the FOMC (Federal Open Market Committee) assembly scheduled for the twelfth of June.

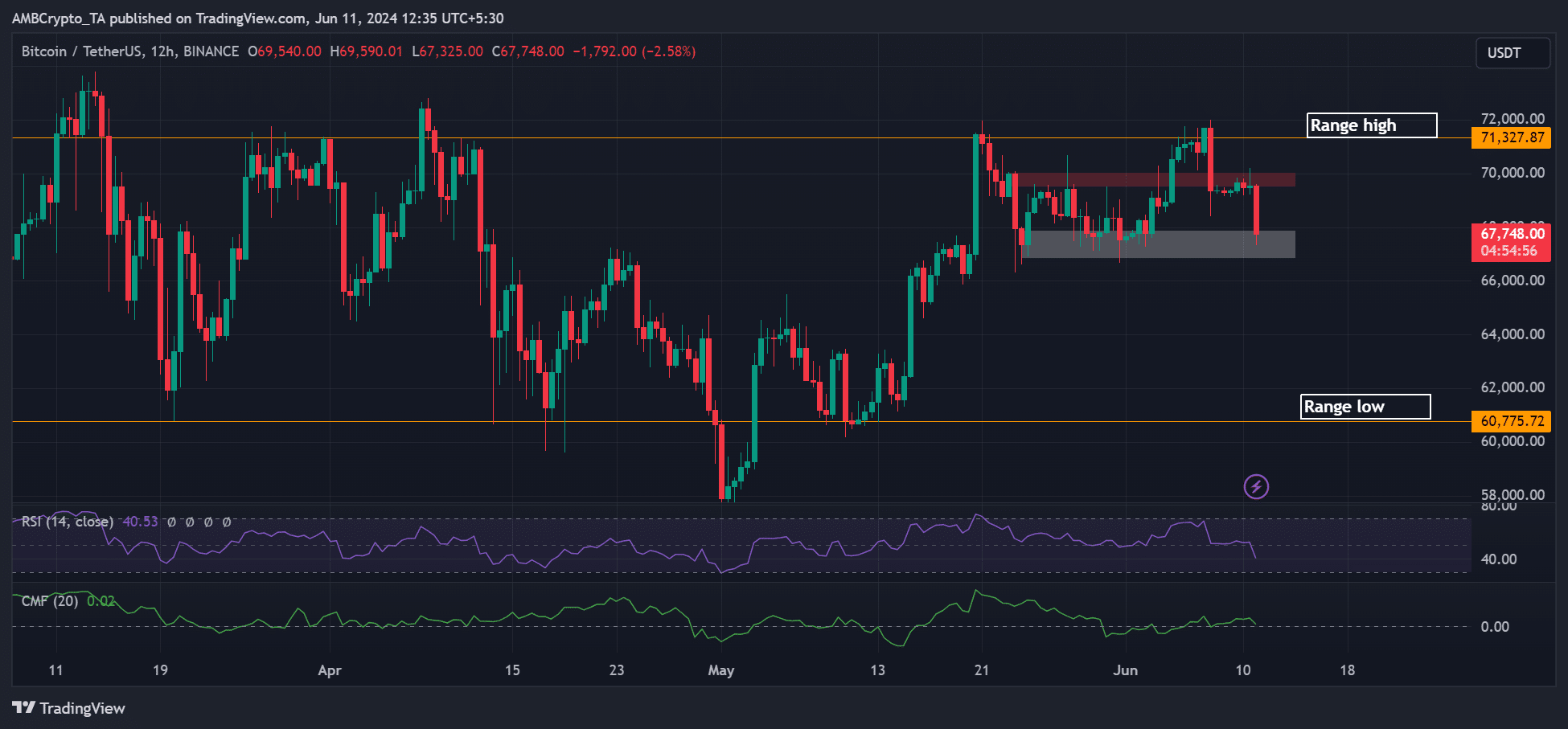

Already, BTC’s dip has hit a weekly low and retested a earlier short-term demand of $66.8K—$67.92K. Curiously, Hyblock Capital information marked the extent as a key lengthy liquidity space.

Will the short-term help above $67K maintain post-FOMC, or will sellers overwhelm it?

Bitcoin predictions: Will $67K maintain?

The HTF (larger timeframe) chart confirmed a document weakening in shopping for stress, as demonstrated by the southbound RSI (Relative Energy Index).

Nonetheless, the capital inflows into the king coin had been nonetheless barely above common as of press time, as proven by the CMF (Chaikin Cash Movement).

Notably, the $67K have prevented additional BTC plunge from mid-Might, however a hawkish Fed resolution may swiftly tip sellers to interrupt beneath the help.

Nonetheless, U.S. Senators, led by Elizabeth Warren, just lately urged the Fed to contemplate reducing the rates of interest. Ought to the Fed heed their name, the $67K may maintain.

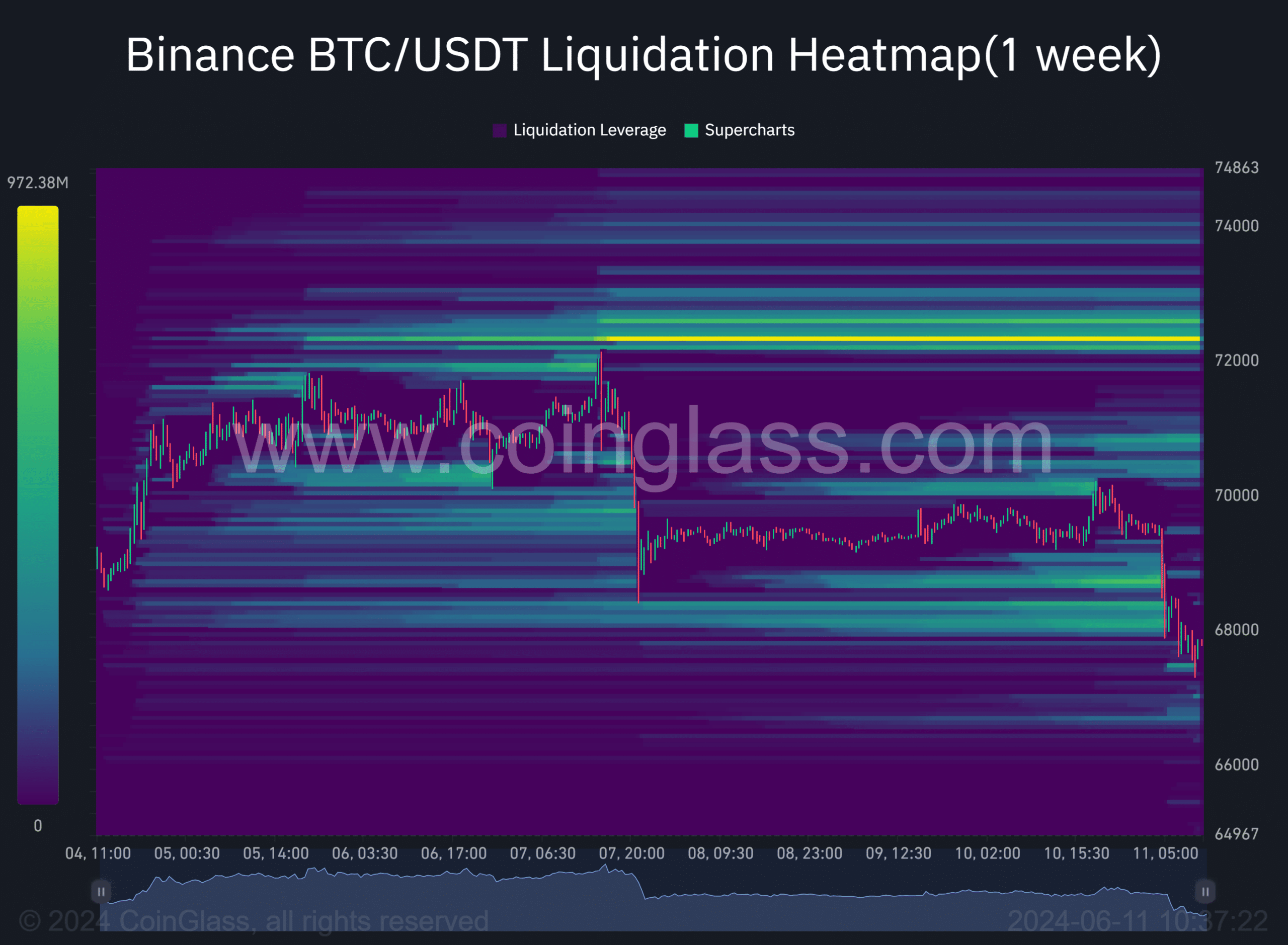

That stated, the latest drop has cleared the lengthy liquidity at $68K. Nonetheless, the subsequent key liquidity was overhead, at $70K and $72K, as proven by Coinglass information.

This meant that BTC may reverse the latest losses if it eyes the overhead liquidity.

The bullish state of affairs was additionally projected by crypto buying and selling agency QCP Capital, who stated,

“As we anticipate what the Fed has to say in this week’s FOMC meeting, the desk saw more near-dated bullish flows this session, with Call skew increasing over Puts.”

This meant that the agency’s buying and selling desk recorded extra bullish bets (Name choices) than bearish bets (Put choices) on the derivatives market.

The main crypto choices agency, Deribit, additionally strengthened QCP’s short-term bullish stance and famous,

“Technical analysis indicates potential for a Bitcoin rally, with traders eyeing a bullish trend and considering Call Butterfly Spread strategies.”

Nonetheless, a hawkish Fed will dent the bullish thesis and will decrease BTC to $64K or vary lows.