On this article, I will introduce Monte Carlo simulations, clarify their relevance in buying and selling, and describe a particular choices buying and selling technique I’ve developed utilizing these simulations. I will additionally share backtested outcomes for instance the technique’s effectiveness.

1. What Are Monte Carlo Simulations?

Monte Carlo simulations are a computational method used to mannequin the chance of various outcomes in a professionalcess that can’t simply be predicted because of the presence of random variables. Named after the famed on line casino, these simulations are particularly helpful in finance as a result of they permit for the evaluation of uncertainty and threat.

The method entails operating 1000’s and even tens of millions of simulations primarily based on historic worth actions, the place every simulation initiatives a potential future end result. The ensuing distribution offers merchants with possibilities of worth ranges over a given time horizon.

2. How Are Monte Carlo Simulations Utilized in Trading?

In buying and selling, Monte Carlo simulations assist to anticipate how a monetary instrument, similar to an ETF like SPY or QQQ, may behave over a future interval. The method appears again over a number of years of historic worth information and runs quite a few simulations to mission future worth distributions. The outputs usually present a chance distribution of future costs, highlighting key metrics similar to confidence intervals.Right here is an instance for SPY:

These simulations are invaluable for choices merchants as a result of they provide insights into the chance {that a} inventory or ETF will stay inside above/beneath worth bounds over a particular time-frame. This data helps to craft structured choices methods, like Credit score Put Spreads, which revenue when an asset stays above a worth threshold.

3. Instance for a Credit score Put Unfold

Right here for instance is the results of 10,000 simulations carried out on SPY for a prediction of the motion in 15 days by asking the algorithm to calculate what share of information is above the $565 threshold. For instance if we contemplate that this worth is a assist or that this worth can be the break even of a Credit score Put Unfold technique that we might have applied.

We see that there’s a chance of 77% that the ticker is above this threshold worth.

Recall that Monte Carlo simulations observe the previous habits of the ticker over a few years, day after day, deduce a statistical distribution and carry out random pictures oriented like this statistical distribution so as to seize the pseudo-random nature of the market. It is going to be essential to see how these predictions have come true up to now.

4. The Technique: Utilizing Monte Carlo Simulations for Choices Trading

Utilizing the break evens of an Iron Condor as threshold values isn’t attention-grabbing as a result of the simulations confirmed that credit acquired on the Name half weren’t adequate.

So let’s concentrate on the Put half by way of Credit score Put Spreads. For a given ETF (we’ll pass over shares due to the earnings), there are a lot of expiration dates and lots of strikes, every with their very own worth. Which ETF to decide on, which strikes to purchase and promote and which expiration dates?

For this, this system I wrote scans crucial ETFs, [‘SPY’,’GLD’,’QQQ’,’IWM’,’EEM’], all their expiration dates between two numbers of days [min_days = 30 max_days = 120] and all strikes beneath the OTM strike that may type a Credit score Put Unfold. A degree is thus given by, for instance, [SPY, 2024-11-15, put bought=$577, put sold=$582].

For every level, the code then performs 10,000 Monte Carlo simulations, wanting again 20 years and calculating the chance that the SPY shut will probably be greater than the break even in 29 days (=variety of days remaining between now and the expiration date). Then, this system shows all of the factors within the type of a graph with, on the abscissa, the perceived credit score and on the ordinate, the Monte Carlo chance. Credit score > $0.50 and achieve/loss ratio above 40% are solely chosen.

The graph is split into 4 quadrants, the certainly one of most curiosity to us being the northeast quadrant (most credit score and most chance). This system then detects the 2 factors which, on this quadrant, have the best chance or the best credit score.

Right here is an instance of show:

4. Backtesting Outcomes

To validate this technique, we carried out backtests utilizing historic information for the previous 15 years. The concept was to simulate what would have occurred if this technique had been utilized up to now with the break even akin to the chance computed within the chosen level.

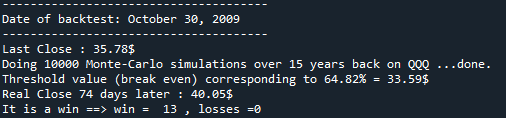

To make use of the instance right here above with the utmost credit score,the backtest would reply this query: for the ticker QQQ on the expiration date of 2024-12-31 (akin to 74 days from now, the date of writing this text), the Monte Carlo simulations inform me that the Shut of QQQ has a chance of 64.82% of being greater than the technique’s break even. If I had utilized this technique 15 years up to now from now, day after day with the Break Even at the moment akin to this quantile, would the actual worth of QQQ have certainly been greater than this Break Even? And in that case, what number of instances has it labored between 15 years in the past and now, day after day?

To be extra particular, through the backtest the algorithm shows the outcomes of the step-by-step backtests very clearly:

Instance of a screenshot through the backtest:

and the plot of the histogram to show the consistency of the edge worth:

This systematic method, with exact threat administration, offers merchants with a strong device to make knowledgeable choices about structuring choices trades. It is price noting that the efficiency of every technique can fluctuate relying on market circumstances, so constant backtesting is essential to holding the technique worthwhile in evolving markets.

The ultimate results of the backtest, for that technique, is:

Which means that backtests give higher outcomes (83.64% win fee) than the possibilities introduced by Monte Carlo simulations (64.82%) and the commerce may very well be opened.

Conclusion

Monte Carlo simulations supply a scientific and data-driven option to mission future worth ranges within the typically unpredictable world of buying and selling. By making use of these simulations, we are able to develop methods that intention to seize worth by precisely predicting worth actions inside particular time horizons. The backtests present that utilizing this methodology, particularly for long-term choices methods like Iron Condors, can considerably enhance the probability of success.

This method enhances different choices methods and offers a sturdy framework for structuring trades with a excessive chance of revenue, whereas rigorously managing threat.