Market Overview: FTSE 100 Futures

FTSE 100 futures went sideways to up final week excessive up in a long-term buying and selling vary. We have been in breakout mode for a very long time after which received a powerful bull breakout so we must always get one other leg up at the least. Bears need to fade the highs of the buying and selling vary however shouldn’t have a superb sign but. We’re at all times in lengthy.

FTSE 100 Futures

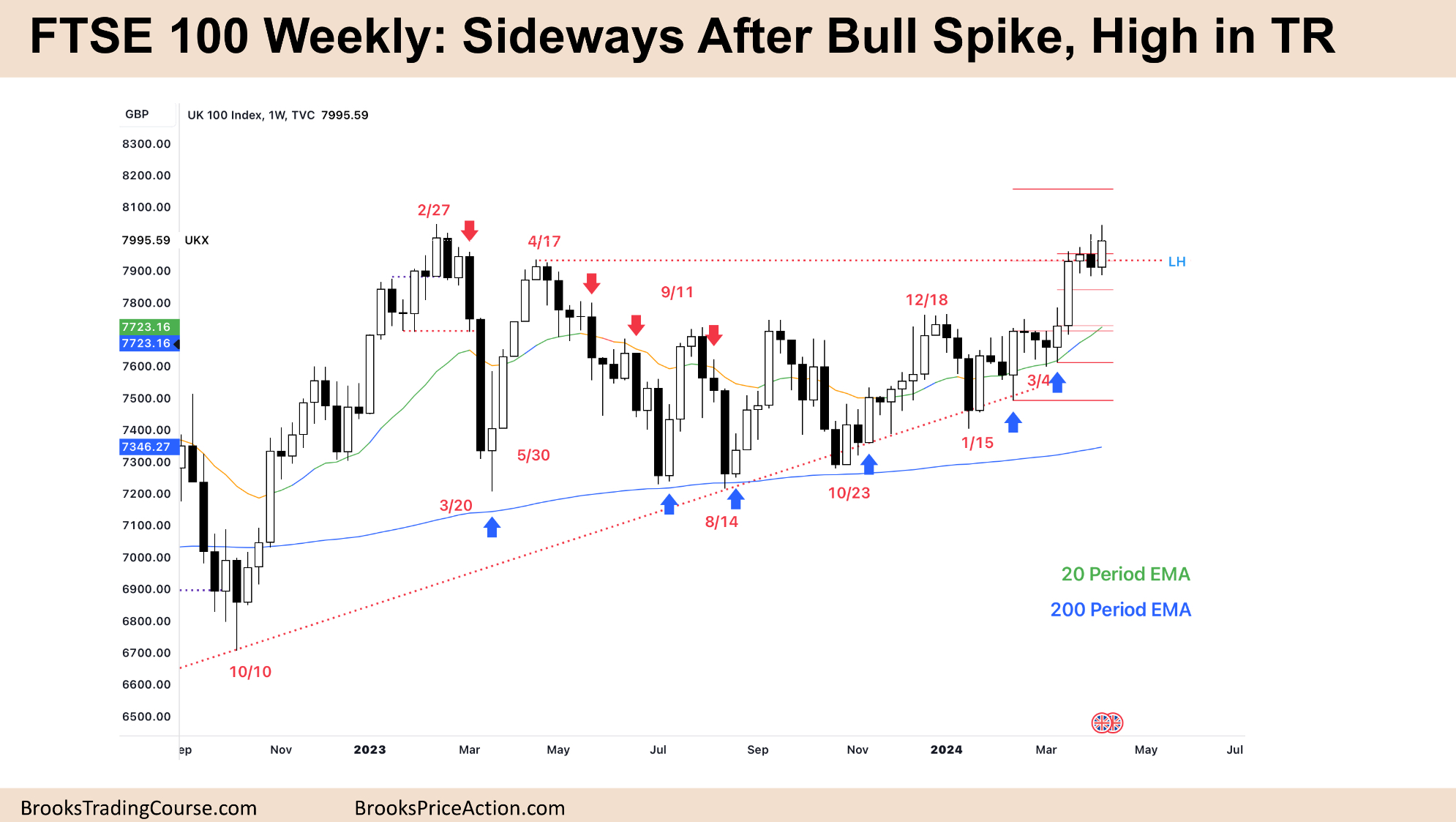

The Weekly FTSE chart

- The FTSE 100 futures chart final week was a bull bar with a tail above final weeks bar, however with an in depth under final week’s excessive.

- Most merchants will see it as a buying and selling vary.

- It was almost an outdoor bar so will most likely commerce like one as effectively.

- Bulls see a spike up from the MA and anticipated the primary reversal to be minor. It was.

- Final week was an outdoor bar, a buying and selling vary on the LTF. Trading ranges act like continuation patterns in sturdy traits.

- Most merchants count on the spike to show right into a spike and channel and it seems like we’re within the channel section.

- Within the channel section, bulls purchase and scale in decrease. Usually shopping for weak bear bars like final week.

- Because the channel continues, bulls will probably purchase midpoints and under bars till they assume it’s time for a correction primarily based on worth motion.

- The bears noticed a spike / climax as much as the highest of a buying and selling vary. They have been in search of a 2nd entry brief right here. They received one bar within the prior week nevertheless it didn’t set off the promote under it.

- There are measured transfer targets so until subsequent week can do one thing to make bulls hand over we’ll most likely go larger.

- At all times in lengthy so merchants needs to be lengthy or flat.

- Anticipate sideways to up subsequent week.

- Its frequent for worth to hit assist or resistance and go sideways. It’s a logical place for orders to be sitting. However as soon as the commerce is reside and bars are printing, every dealer is managing expectations.

- The bears have little threat and massive reward – so low likelihood. They’ll probably hand over or scale in to extend likelihood.

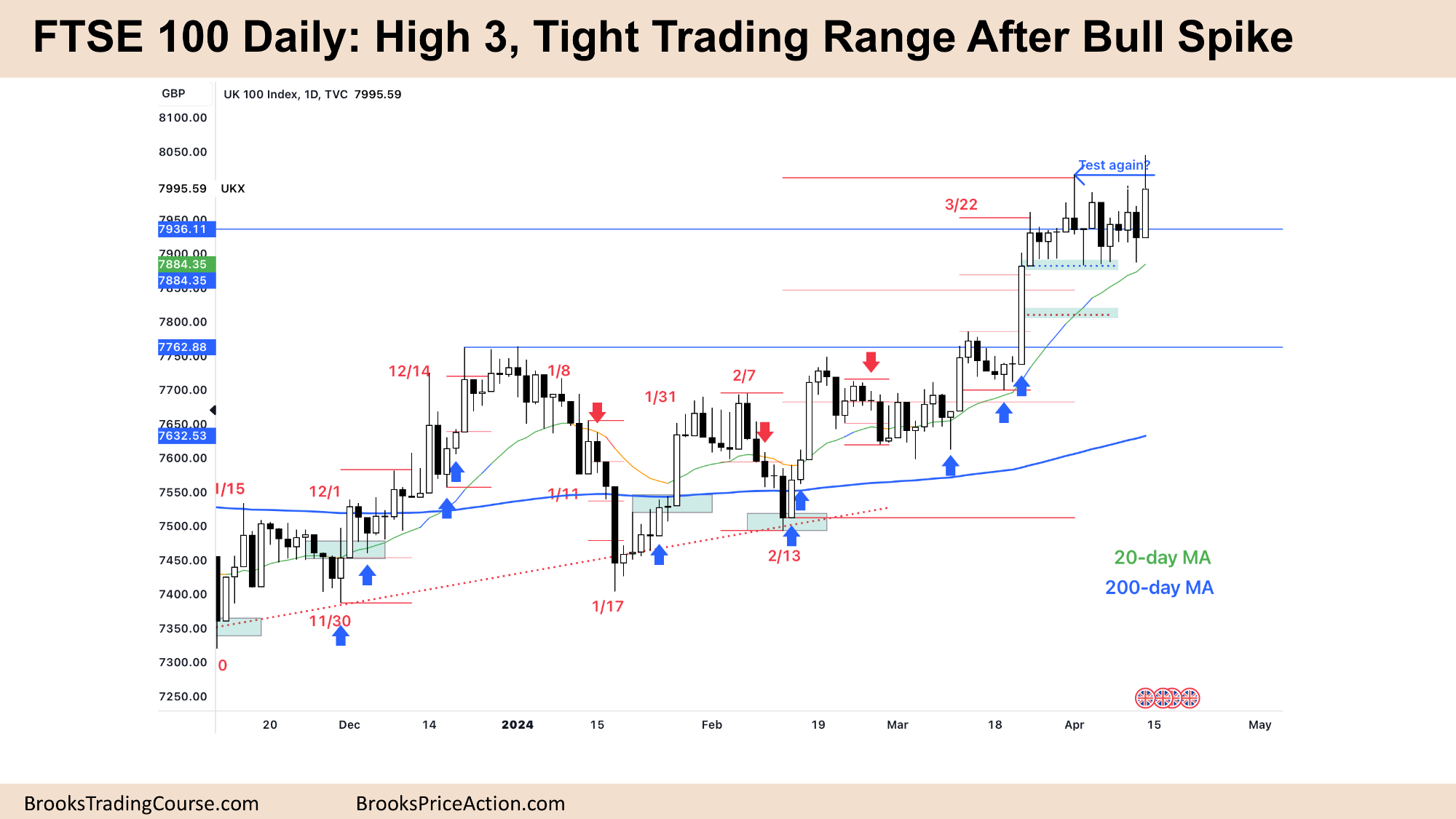

The Each day FTSE chart

- The FTSE 100 futures final week was a giant bull bar with a tail on high testing the prior excessive.

- We mentioned final week in a bull spike and channel, merchants enter through the lows of the channel and take earnings on the excessive which we did all week.

- The bulls see a spike and channel however a good buying and selling vary right here. They don’t need it to go on for too many bars or their likelihood begins going again to 50/50.

- Good shut but additionally not that good. Under Wednesday’s excessive was a shock.

- If you happen to squeeze your eyes you’ll be able to see a wedge backside or at the least 3 failed makes an attempt to reverse.

- However this sign bar might be a purchase the midpoint or wait on Monday to see if we hole up.

- It’s also possible to BTC if you’re keen to carry extra dimension so as to add on decrease or larger.

- Bears see a good buying and selling vary and made cash promoting above bars. However is that this the most effective commerce you’ll find on this atmosphere?

- Take a look at shaved tops and bottoms of bars.

- Friday didn’t go under the shut of Thursday. That tells you that extra merchants have been ready for a superb purchase space and took it.

- If merchants are shopping for dangerous bears bars, then you definitely most likely need to be a bull!

- We’re close to the all-time highs and so your threat/reward is superb however likelihood may be very low if you’re shorting proper now.

- At all times in lengthy so merchants needs to be lengthy or flat.

- Anticipate sideways to up subsequent week.

Market evaluation reviews archive

You possibly can entry all weekend reviews on the Market Evaluation web page.