Market Overview: FTSE 100 Futures

FTSE 100 futures went sideways to down final week after a bull BO. The bulls hit their swing goal, took their 2:1, and ran! Massive breakout hole beneath, so a greater place to get lengthy is down there – if it units up. Bears who had been fading the breakout obtained a aid bar. Anticipate a second leg sideways to down and Excessive 2 subsequent week.

FTSE 100 Futures

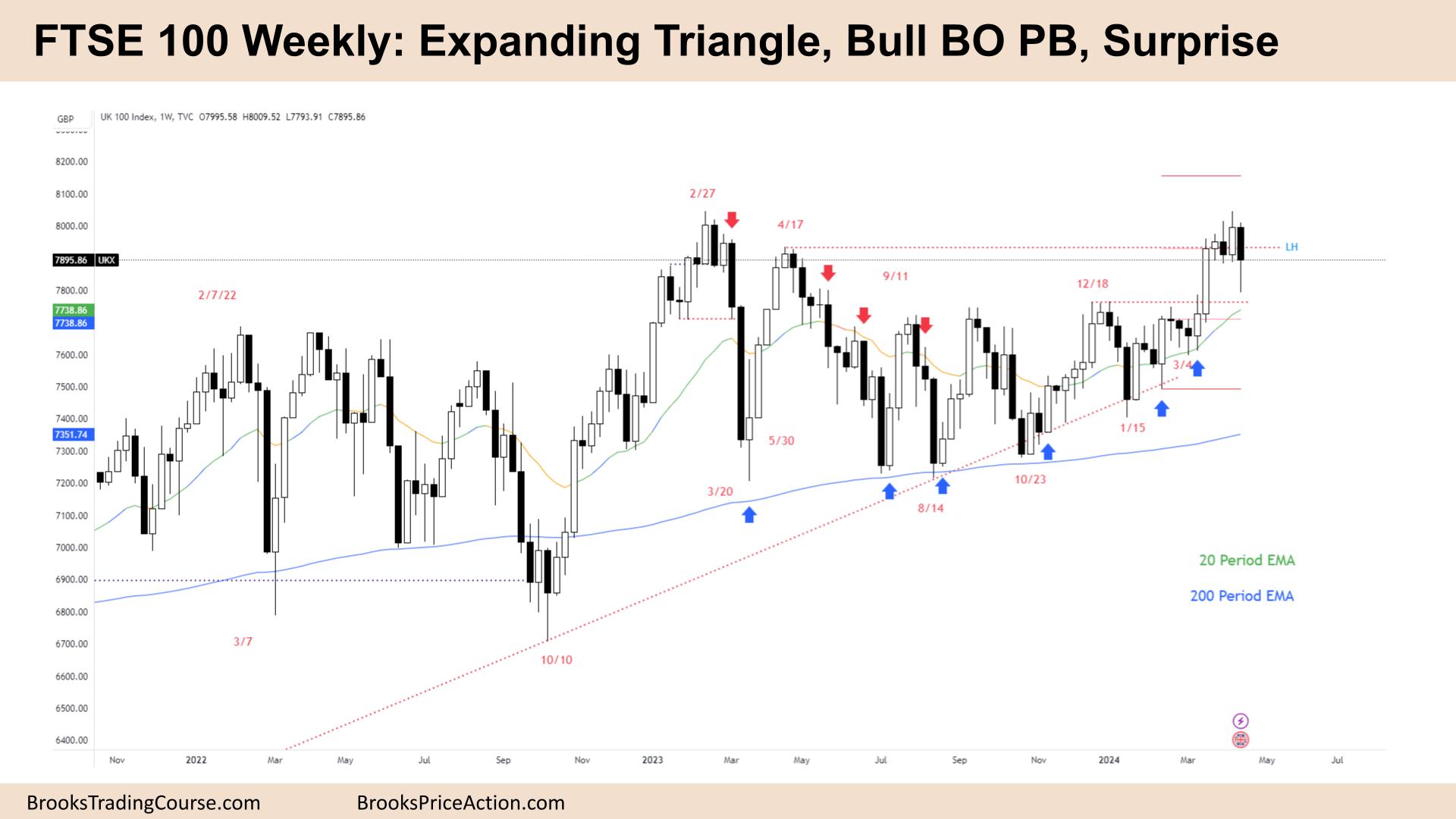

The Weekly FTSE chart

- The FTSE 100 futures went decrease final week in an increasing triangle, a bear shock bar after a bull BO and a pullback.

- The bulls see BOM, a bull breakout and a pullback to the transferring common.

- We mentioned final week there have been doubtless consumers on the midpoint of that bull breakout bar, and there was.

- There was a quasi-ledge from December, however we didn’t go all the best way to the touch it.

- The bulls now have a breakout hole, which, if it stays open, is more likely to result in a robust second leg up.

- The bears see sideways excessive in a buying and selling vary and a bear shock bar. The bar is large enough right down to disappoint bulls who purchased late.

- However it’s an enormous bar with a big tail beneath, so there’s not an amazing promote sign beneath. We are going to doubtless check above it subsequent week.

- Do the bulls get out? In a channel, a very good technique is to scale in and take some off at new highs. The April excessive was a very good purpose to take some off.

- Final week was a very good place to enter once more for a check of the highs. So, I believe most bulls can be completely satisfied to scale in right here, and in the event that they don’t attain the highest of this TTR, then they’ll exit.

- The tail may need been scale-in bears, now shocked with the massive bull breakout exit after they obtained an opportunity to break-even.

- The difficulty with fading a bull breakout like that is that every bar makes a brand new excessive. So that’s bull channelling behaviour. They need a bear bar to promote above, however the less complicated commerce is to attend to attempt to get lengthy.

- Bulls can await a 2 legged pullback to the MA, though restrict bulls will most likely purchase beneath final week and the MA.

- At all times in lengthy so higher to be lengthy or flat.

- Anticipate sideways to up subsequent week.

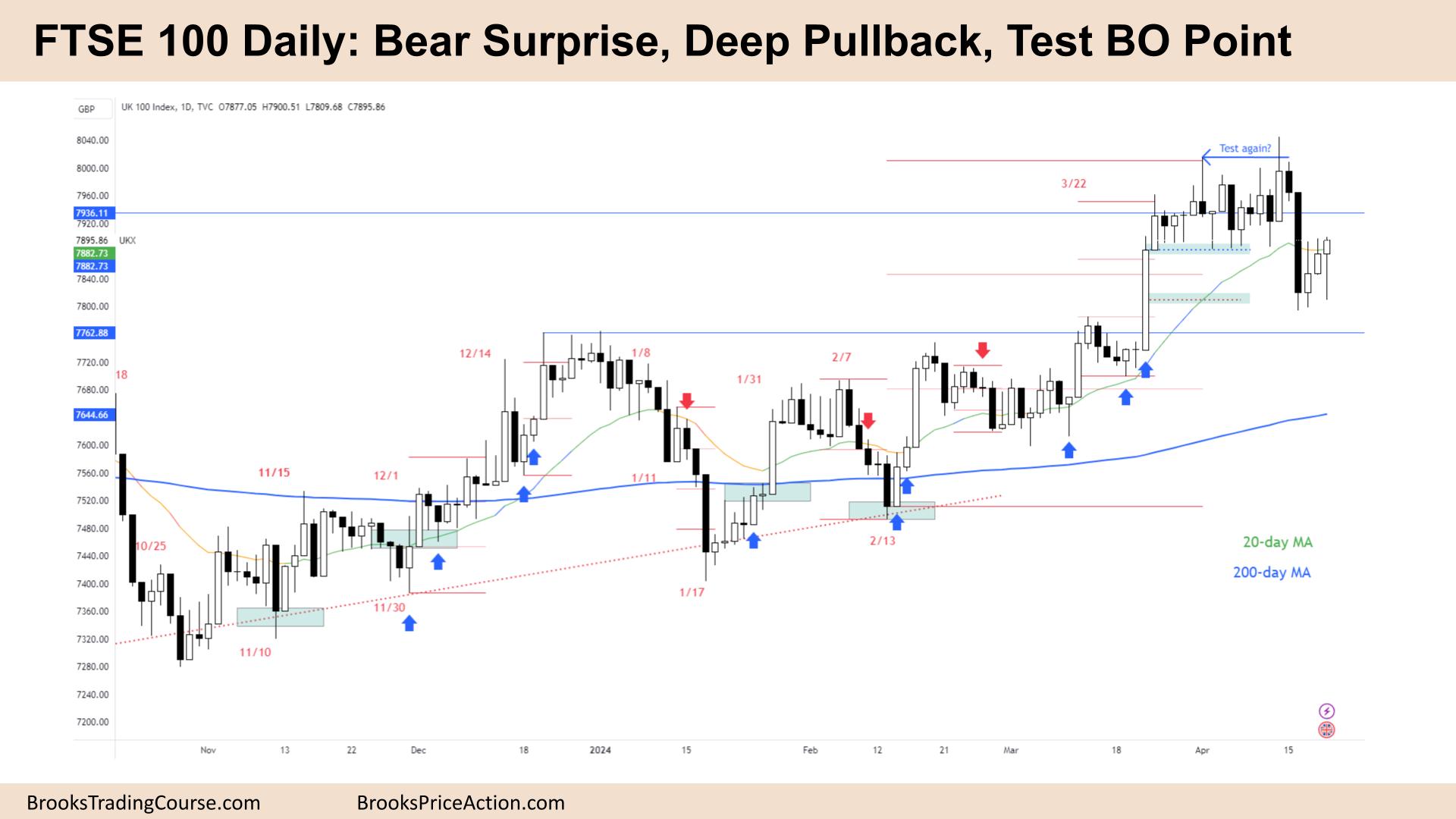

The Each day FTSE chart

- The FTSE 100 futures completed the week with 3 bull bars after an enormous bear shock bar after the bull BO.

- We mentioned final week that the bulls hit their goal however would doubtless come again and provides them one other probability to exit. They did final week, and it offered off shortly.

- The bulls obtained a swing goal of two:1, so the pullback was anticipated. We’re in a bull channel and would possibly want to check the breakout level beneath.

- The bears see a robust counter-trend leg and can most likely get another push down earlier than the Bulls purchase once more.

- The primary bear bar is beneath the MA in 20 bars, so an MA hole bar is a purchase set-up for a scalp.

- However I don’t assume it’s a sturdy purchase right here but. We didn’t shut above Thursday.

- Should you purchased the pullback purchase on the midpoint of the massive bull bar final week, I might exit right here and wait. Excessive probability of one other leg down.

- No sign to brief but.

- Bears need a decrease excessive to promote and a very good sign. Its doubtless they get that or straight down to search out consumers.

- Friday is an out of doors up bar, but it surely set free any bears who had been brief on the shut of the bear shock. A fortunate exit, I think!

- Above, there’s a tight buying and selling vary, so it would act like a magnet. Might you purchase for a scalp up? I believe the RR is weak in your aspect of the commerce.

- The one brief I can see is promoting the place the MA’s bulls obtained caught. However you would possibly must day commerce that one on the 5 min chart! See if anybody agrees with you.

- Trading vary or weak bull channel, so higher to attend for a second entry lengthy low.

- Anticipate sideways to up subsequent week.

Market evaluation studies archive

You may entry all weekend studies on the Market Evaluation web page.