- Bitcoin recorded a slight pullback, dropping by 0.66% within the final 24 hours

- Cryptocurrency’s long run holders have been significantly bullish for the yr forward

For practically 2 weeks, Bitcoin [BTC] has traded on an uptrend, with the cryptocurrency climbing to a brand new excessive of $109k 4 days in the past too.

Since hitting this stage, BTC has seen some minor pullbacks on the charts. The truth is, on the time of writing, the cryptocurrency was buying and selling at $104,337 after declining considerably on the each day timeframe. And but, the uptrend was as intact because it was just a few days in the past.

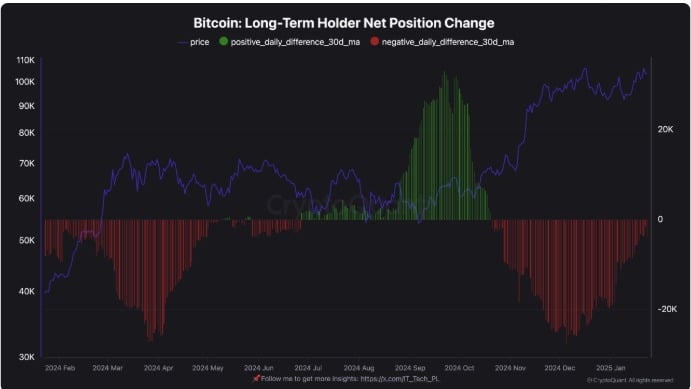

The consistency in BTC’s momentum may be attributed to holders’ habits, particularly long-term holders.

Bitcoin long-term holders lead the market

Based on CryptoQuant, Bitcoin is now dealing with a fierce battle between diamond arms and speculative FOMO.

Owing to the identical, long-term holders’ provide dominance has remained excessive, signaling sturdy long-term conviction. This cohort continues to build up BTC when the value drops and take earnings strategically when the value surges. This well-controlled market habits helps a bullish long-term outlook by limiting market promoting strain.

Quite the opposite, short-term holders have seen a hike in exercise throughout worth rallies, indicating speculative curiosity and FOMO-driven entries.

Nonetheless, vital distribution each time the value drops is an indication of weaker arms exiting the market, thus contributing to short-term volatility.

With LTHs having a big share of the provision, plainly Bitcoin’s market has now matured.

Due to this fact, the falling affect of STHs on provide can reinforce market stability. Though their speculative habits may nonetheless drive short-term worth swings.

This mixture positions Bitcoin for a bullish outlook all through 2025. Strategic profit-taking by LTH may spur wholesome pullbacks, providing alternatives for brand spanking new accumulation.

What does this imply for Bitcoin’s charts?

Whereas the evaluation supplied above presents us a promising outlook, it’s important to counter-check different market indicators to find out what they imply and trace at.

For starters, Bitcoin’s fund move ratio has risen over the previous week from 0.05 to 0.11.

Such an uptick implies that extra capital could also be flowing into BTC, than leaving. Such a market method may be interpreted as an indication of accumulation habits.

Moreover, Bitcoin’s SOPR declined from 1.05 to 1.01.

This appeared to indicate that with BTC buying and selling sideways, holders have been reluctant to promote, leading to provide shortage. This, in flip, ends in worth appreciation. Merely put, the market could also be absorbing potential promoting strain and not using a sturdy downturn on the charts.

This shortage may be confirmed by the rising stock-to-flow ratio. The truth is, the SFR spiked from 124 to 599.03. Such a spike implies that extra traders are conserving their property off exchanges, both in personal wallets or chilly storage.

In conclusion, with long-term holders strategically positioning themselves, the market is mature sufficient for a possible upside.

Due to this fact, this optimistic notion from LTHs is taking part in a essential position in absorbing the promoting strain. If the market holds these situations, Bitcoin will reclaim $107k and try and hit $110k. Nonetheless, a sustained correction will imply a drop to $102,770.