- Exchanges see much less BTC and ETH.

- Holders continued to extend regardless of the decline on exchanges.

Bitcoin [BTC] and Ethereum [ETH] are the 2 largest property primarily based on their market capitalizations. However current information signifies that one among them is changing into scarcer.

Bitcoin and Ethereum on exchanges decline

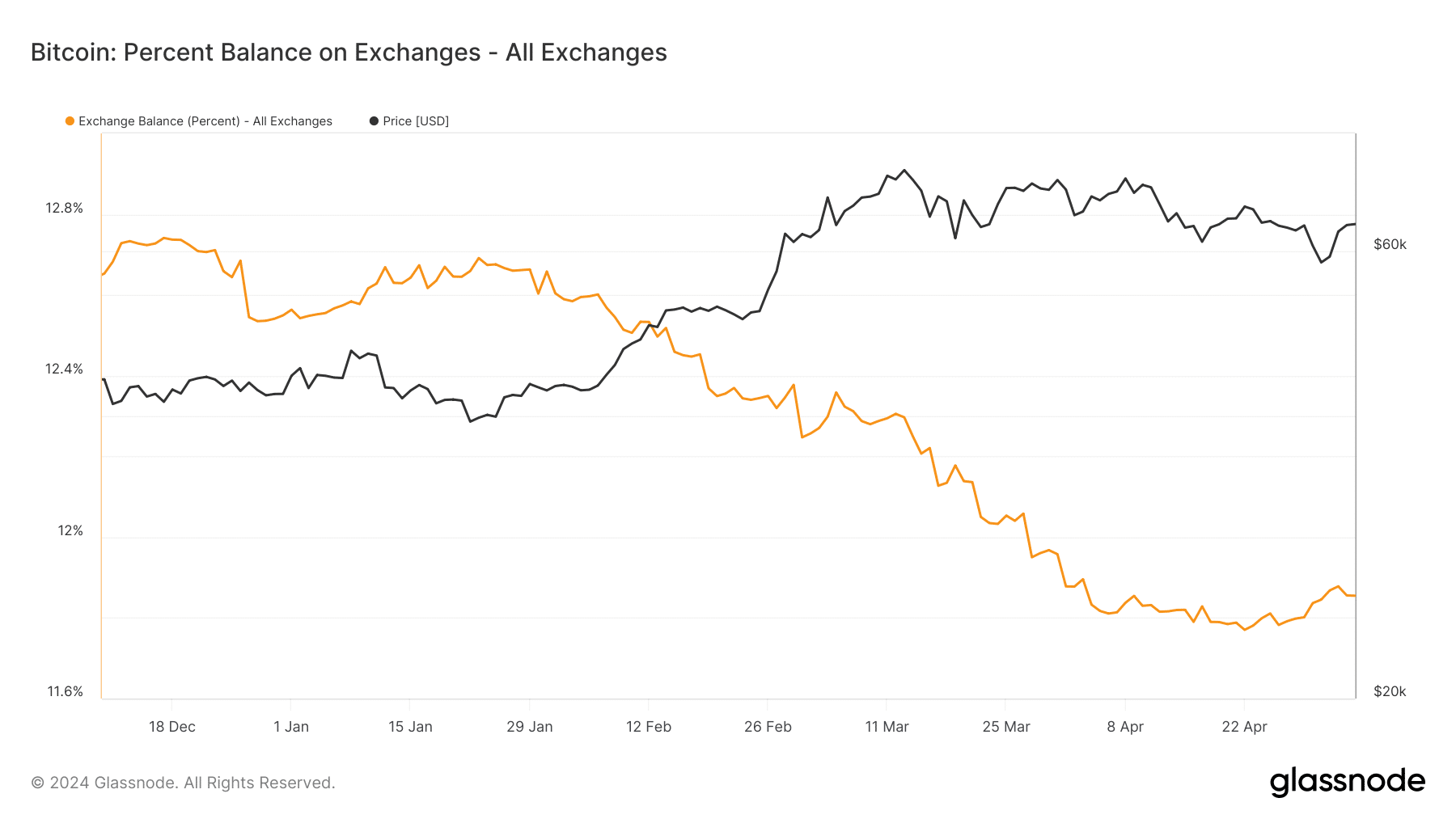

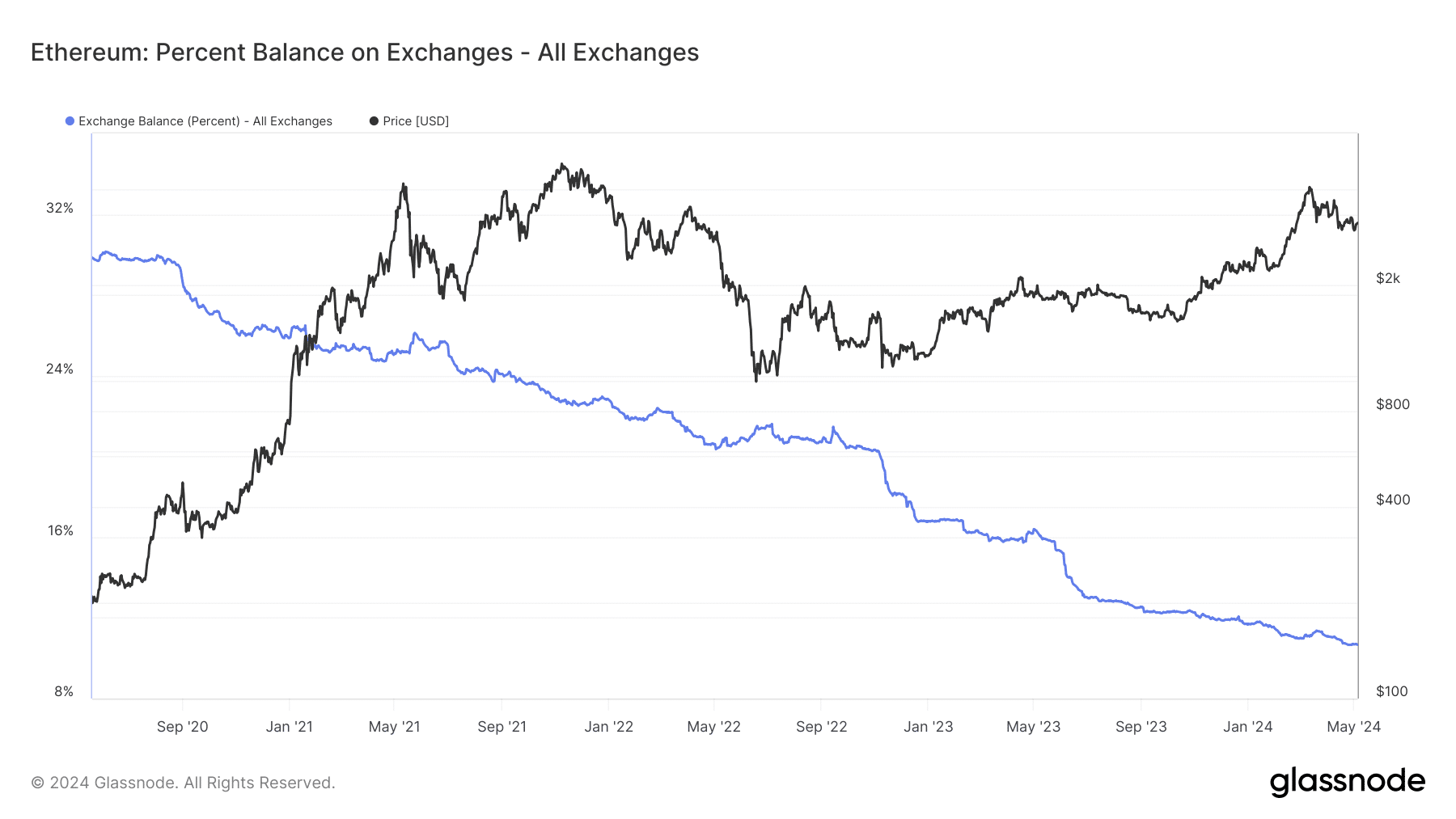

AMBCrypto’s evaluation of the Bitcoin and Ethereum Steadiness on Trade metric indicated a decline within the availability of those property on exchanges.

Curiously, Ethereum’s steadiness on exchanges has skilled a extra pronounced lower in comparison with Bitcoin.

In keeping with information from Glassnode spanning from March 2023 to the current, the ETH steadiness on exchanges has plummeted by almost 6%.

Beginning at 16% in March 2023, it has declined to 10.66% as of the most recent figures.

Conversely, the BTC steadiness on exchanges has seen a milder decline of just about 2%, dropping from 13% in March 2023 to roughly 11.85% at press time.

The dwindling steadiness of Ethereum on exchanges steered growing shortage of the property accessible for buying and selling.

Sometimes, a decline in steadiness on exchanges implies that holders are withdrawing their property from buying and selling platforms.

Within the case of Ethereum, it might additionally point out that holders are withdrawing and staking their property for potential returns, additional decreasing the accessible provide for buying and selling.

Has it affected the variety of holders?

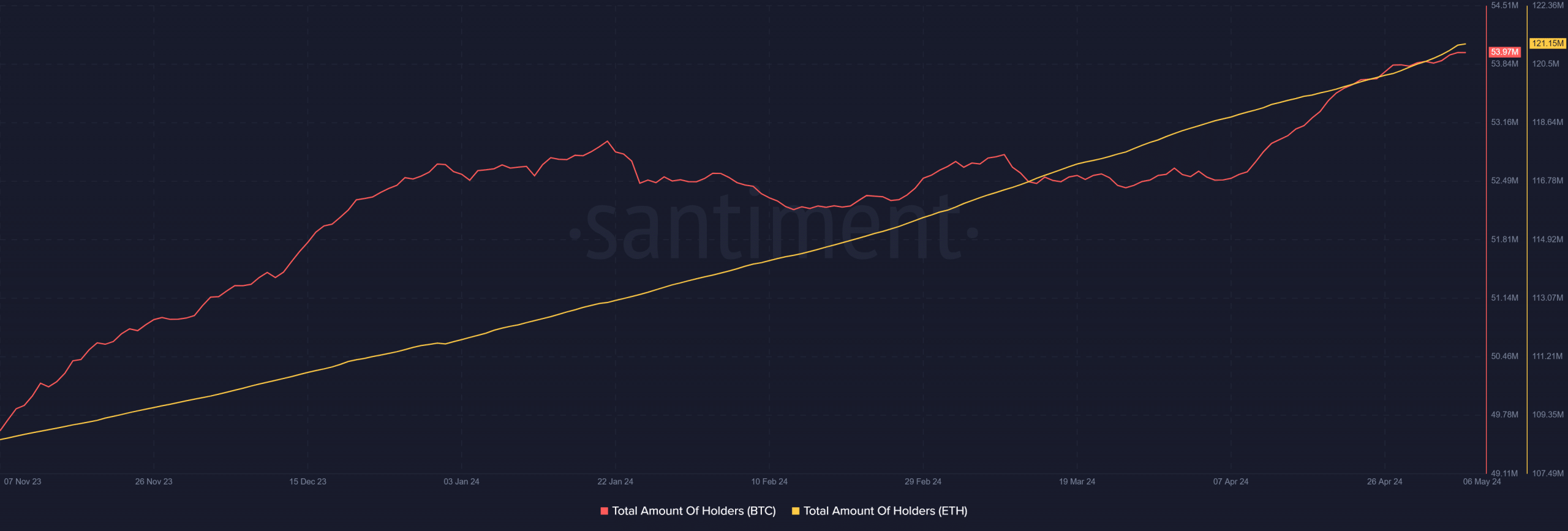

Bitcoin and Ethereum’s holders on Santiment revealed a constant progress pattern.

On the time of this evaluation, the variety of BTC holders had reached virtually 54 million, whereas Ethereum boasted over 121 million holders.

This information means that each property have steadily accrued holders over the previous few months, indicating sustained curiosity and adoption.

The rise within the variety of holders additionally aligns with the declining steadiness of those property on exchanges, as noticed in earlier analyses.

This pattern means that holders are actively withdrawing their property from exchanges, presumably for long-term holding or different funding methods.

Such conduct is usually interpreted as a constructive signal for the property, because it displays confidence of their long-term worth and utility.

Bitcoin and Ethereum in revenue rises

Evaluation of the Bitcoin and Ethereum provide in revenue indicated a current uptrend. As of this writing, the ETH provide in revenue was virtually 117 million, whereas BTC registered almost 18 million.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

This upward motion aligned with the current value rebound noticed in each BTC and ETH markets.

As of this writing, ETH was buying and selling at roughly $3,200 with a acquire of over 2%, whereas Bitcoin was priced at round $65,200, additionally experiencing a rise of just about 2%.