- Per VanEck, BTC’s excessive community hashrate was partly boosted by low cost energy in Texas.

- Nonetheless, BTC miner sell-off has intensified and will crush costs within the quick time period.

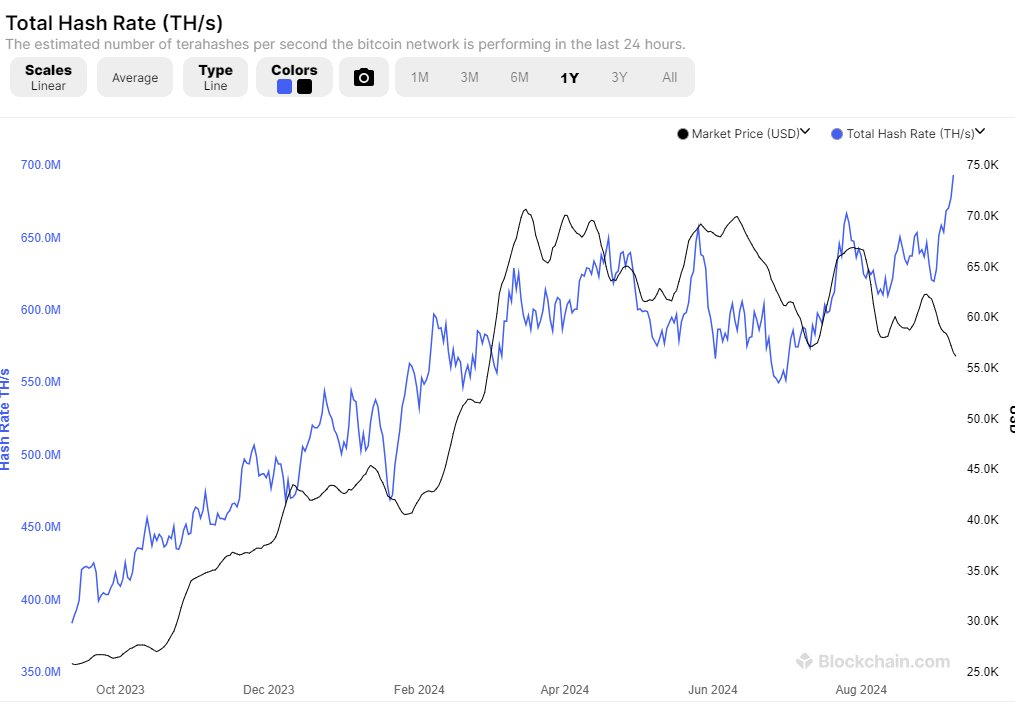

Bitcoin [BTC] community hashrate has seen exceptional restoration, rising from June lows of 550 TH/s to a file excessive in September.

The metric tracks the computational energy wanted to mine a single BTC and, by extension, the community safety.

The restoration prompt that miners deployed extra energy in the summertime after the huge miner capitulation that started the post-BTC halving occasion in April.

Though the metric positively correlates to the BTC worth, it has just lately printed a divergence.

BTC worth trails community hashrate

In line with Mathew Siggel, VanEck’s Head of Digital Belongings Analysis, the community hashrate surge was partly pushed by cheaper electrical energy in Texas throughout summer time. He stated,

“The recent increase in hash rate seems to be driven by higher rig utilization following seasonal Summer reductions in activity due to high electricity prices during the peak months. But Forward Power Prices in TX (~10% of Global Hash Rate) are Now Lowest in 4 Years.”

Siggel added that if mining prices stay low, the sell-off from miners may ease and scale back the stress on BTC costs.

Nonetheless, Glassnode established that regardless of enhancing miner conviction, BTC merchants remained unconvinced concerning the BTC worth within the quick time period.

In the meantime, the miner promote stress appears removed from over. Up to now three days, miners have offloaded 30K BTC, price about $1.7 billion, into the market.

As of the time of writing, the whole sell-off in September was 40K BTC, which means a lot of the dump (30k BTC) occurred earlier within the week when BTC tried worth restoration.

This ongoing miner sell-off may derail a powerful worth restoration for BTC.

On the time of writing, BTC was valued at $56.6K, down 4% from its month-to-month excessive of $59.8K.