- Ethereum is establishing itself as a novel asset, carving out its personal id.

- A number of elements are contributing to this improvement.

Two years in the past, the crypto market was rocked by the collapse of FTX, sparking widespread worry and triggering intense regulatory considerations. Quick-forward to at present, and the panorama has remodeled.

The market is again with a vengeance, and Ethereum [ETH] is main the best way. ETH just lately broke out of a four-month droop in underneath 5 buying and selling days, posting every day positive aspects near 10%.

In early bullish cycles, capital typically shifts from Bitcoin into altcoins as buyers chase new alternatives for revenue.

Nonetheless, with election uncertainty easing – an occasion that briefly pushed Bitcoin dominance over 60% – Ethereum is now rising as a definite asset class, not simply one other high-cap altcoin.

May this pave the best way for ETH to outperform Bitcoin [BTC], as buyers start to view it with contemporary conviction?

Ethereum is on a journey of self-discovery

Trump’s pro-crypto manifesto has clearly resonated with buyers, propelling Bitcoin near $80K.

Trading at $79,500 at press time, Bitcoin has posted a achieve of over 15%, and it’s nonetheless lower than every week because the election outcomes had been introduced.

Nonetheless, this speedy development in such a short while may spark warning amongst buyers, significantly the “weak hands” – those that are fast to exit when Bitcoin enters the chance zone.

This might create a major alternative for Ethereum, a possible shift that AMBCrypto suggests it could capitalize on, very like it did in the course of the mid-Could cycle.

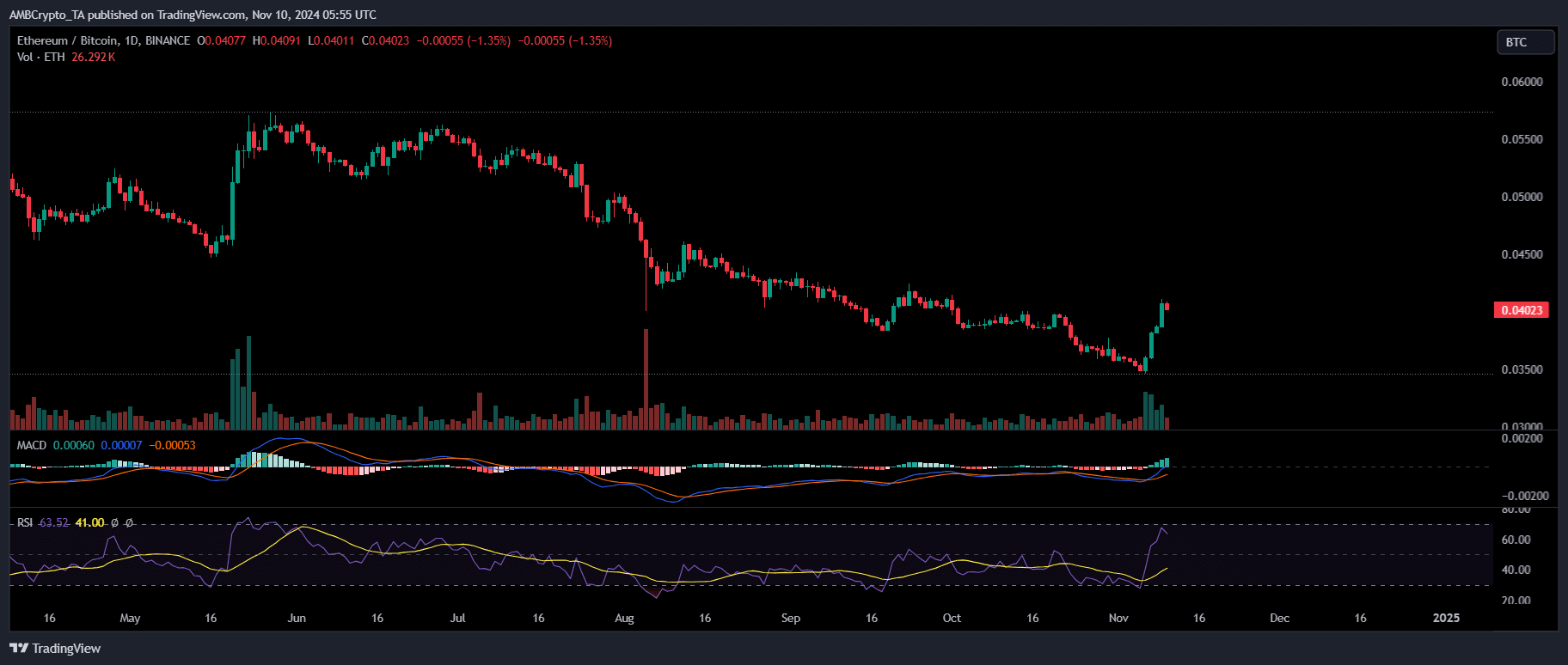

After six months of constant downtrend, Ethereum demonstrated vital dominance over Bitcoin. The final time this occurred, ETH posted an enormous every day candle, highlighting a 20% surge in a single day.

Equally, this time, a considerable circulate of capital from Bitcoin into Ethereum has performed a key position in serving to ETH break the $3K benchmark.

Nonetheless, there’s extra to this shift, which may sign Ethereum’s rising independence from Bitcoin, positioning the 2 as distinct asset sorts available in the market.

There’s enough proof to again this notion

To start with, Ethereum’s weekly achieve has doubled compared to Bitcoin, reaching a exceptional 30%. Driving this surge are double-digit capital inflows into ETH ETFs.

It is a game-changer, because it marks the primary time ETH ETFs have seen an enormous inflow of capital since their launch 4 months in the past. Initially, regardless of the launch, the influence on ETH’s worth was minimal.

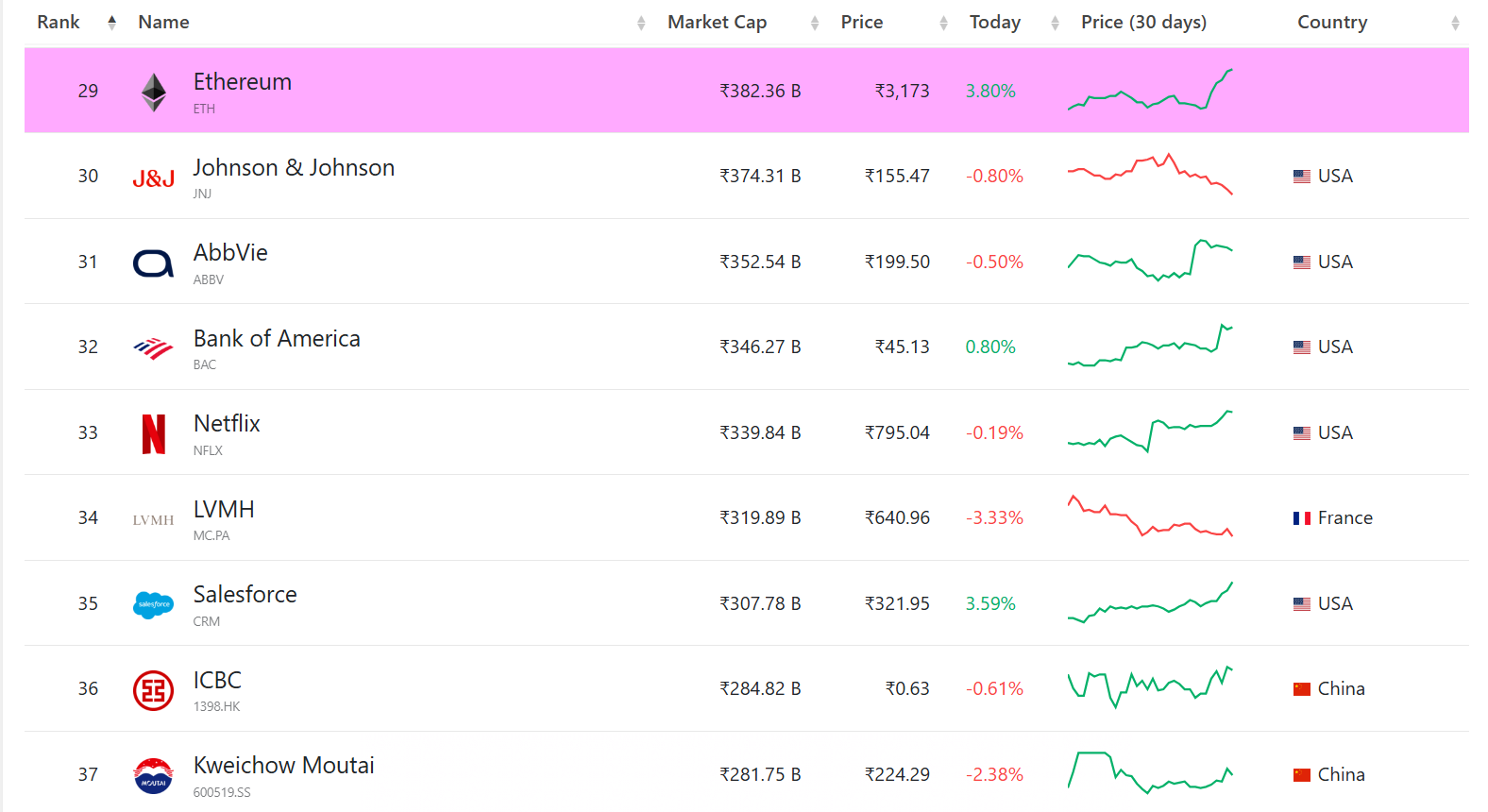

Nonetheless, this current surge alerts a shift, propelling Ethereum again into the highest 30 Most worthy belongings on the planet, with a market cap of $382.36 billion.

These developments recommend a rising group of establishments backing Ethereum’s long-term potential. This institutional help is essential in mitigating any near-term strain that would push ETH southwards.

Moreover, what was as soon as dubbed the “Ethereum killer,” Solana has lived as much as its identify. For the reason that previous cycle, Solana has attracted notable liquidity from Bitcoin, buying and selling above $200.

This brought on a stir available in the market, main analysts to marvel if a market shift is underway, with Ethereum probably dropping floor to its rival.

Whereas Ethereum nonetheless lags behind Solana on numerous fronts, its 7-day development in a number of key metrics has been impressively robust.

With weekly income up 250%, in comparison with Solana’s 67%, and every day transactions growing by 10%, far outpacing Solana’s 3%, Ethereum is exhibiting resilience.

Is your portfolio inexperienced? Try the ETH’s Revenue Calculator

Thus, this bull cycle has been a game-changer for Ethereum. Whereas it could face some sideways strain at key resistance ranges, this surge has undoubtedly boosted its long-term outlook.

Ethereum is now primed for a possible breakout, with an actual shot at surpassing the $3.5K mark within the close to future.