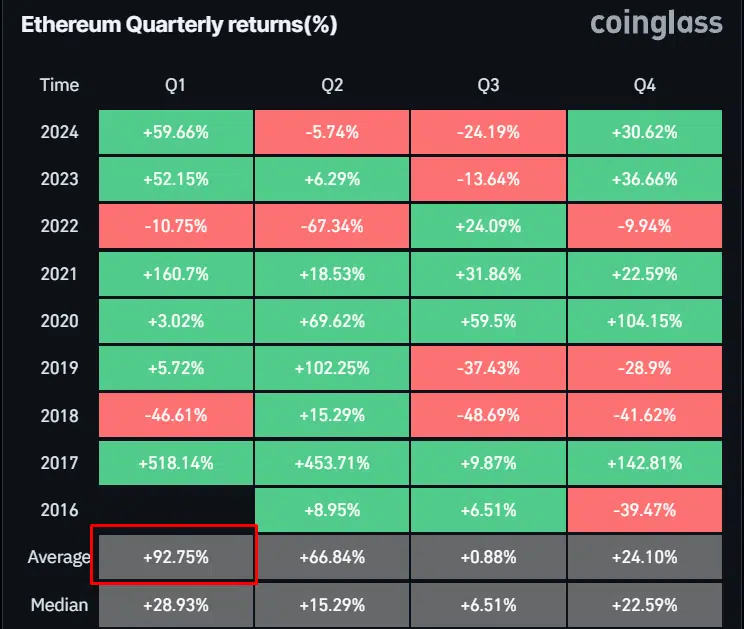

Ethereum’s Q1 2024 returns outperformed its historic quarterly common of +92.75%, marking a considerable restoration in comparison with Q1 2022’s -10.75%.

This development was pushed by heightened institutional curiosity and improvements in scaling options.

Regardless of Q2’s modest decline, the resilience of Ethereum’s DeFi ecosystem performed a vital function in offsetting bearish sentiment.

Wanting forward, the Q3 drop displays profit-taking habits however units a secure basis for This fall’s anticipated rebound, traditionally a robust quarter.

Comparative evaluation reveals that Ethereum’s 2024 efficiency mirrors prior volatility patterns, highlighting its cyclical but promising trajectory.

As Layer-2 networks combine deeper into mainstream finance and staking adoption will increase, Ethereum’s momentum might redefine market dynamics heading into 2025’s anticipated altseason.

Ethereum’s dominance in post-halving altseasons

Ethereum has traditionally thrived throughout Bitcoin-driven altseasons, as evident in its explosive rallies post-2017 and 2020 Bitcoin halvings.

ETH’s excessive beta to Bitcoin permits it to seize outsized beneficial properties when capital rotates into altcoins following BTC’s dominance peaks.

Coming into the 2025 cycle, Ethereum’s strategic positioning within the crypto and blockchain area units it aside.

With Bitcoin’s April halving occasion driving market-wide liquidity, ETH might outperform attributable to its increasing utility and deflationary tokenomics.

Ethereum’s worth resilience and upward trajectory since 2023 counsel sturdy investor confidence.

If earlier patterns maintain, ETH’s development potential aligns with its enhanced community fundamentals, making it a key participant within the subsequent altseason wave.