On-chain knowledge exhibits that the Ethereum change web flows have been extremely constructive not too long ago, an indication that promoting could also be going down out there.

Ethereum Trade Netflows Have Seen A Spike Not too long ago

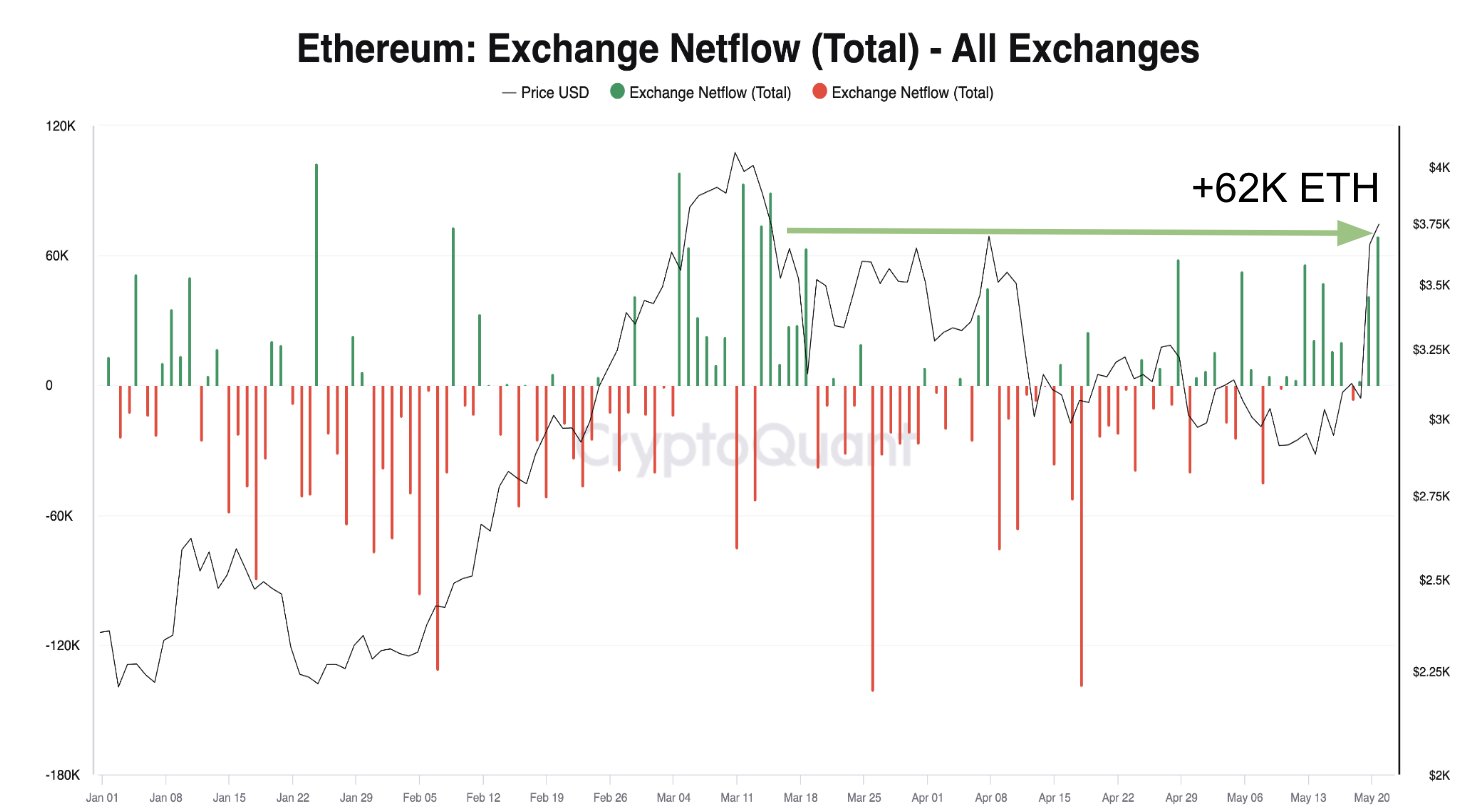

In a brand new publish on X, CryptoQuant head of analysis Julio Moreno mentioned the most recent pattern in Ethereum’s change netflow. The “exchange netflow” right here refers to an on-chain metric that retains monitor of the online quantity of ETH shifting into or out of the wallets of all centralized exchanges.

When this metric’s worth is constructive, it implies that these platforms are receiving a web variety of cash proper now. As one of many foremost causes holders may deposit cash to exchanges is for selling-related functions, this pattern can doubtlessly bearish penalties for the asset’s worth.

Then again, the indicator’s detrimental studying implies that exchange-associated wallets are observing web withdrawals presently. Buyers could also be shifting their cash away from the custody of those central entities for long-term holding, so such a pattern might show to be bullish for the cryptocurrency.

Now, here’s a chart that exhibits the pattern within the Ethereum change netflow over the previous couple of months:

The worth of the metric seems to have been fairly excessive in latest days | Supply: @jjcmoreno on X

The above graph exhibits that the Ethereum change netflow has registered some giant constructive spikes not too long ago. These web deposits have been of a scale solely noticed in March. In keeping with Moreno, these deposits have largely been headed in direction of Binance and Bybit.

As talked about earlier than, web change inflows can point out that promoting is going down out there, though this doesn’t essentially must be the case. Typically, giant deposits use one of many different providers these platforms present, like derivatives contracts.

Regardless of the case, although, volatility does are inclined to rise following giant deposits. The chart exhibits that the rally prime again in March noticed the indicator assume excessive values as traders participated in profit-taking.

Not too long ago, Ethereum has noticed a pointy surge, fueled by constructive information surrounding the spot exchange-traded funds (ETFs). Given this rally, it’s attainable that profit-taking might as soon as once more be the aim behind the constructive web flows.

Thus far, although, ETH has managed to stave off this potential selloff, as its worth has remained comparatively excessive. It’s unsure, nevertheless, how lengthy demand can proceed to soak up the attainable promoting strain if deposits proceed to circulate into these platforms within the coming days.

ETH Worth

Ethereum began a transfer up through the previous day as its worth breached the $3,950 mark. The rise solely lasted briefly, although, because the asset returned under the $3,800 stage.

Appears to be like like the worth of the asset has noticed a surge over the previous couple of days | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CryptoQuant.com, chart from TradingView.com