Ethereum (ETH) at the moment trades roughly 11% under its native highs of round $2,730. Buyers are optimistic a few potential value surge within the coming days, pushed by encouraging on-chain information.

Key metrics from Glassnode point out a decline in ETH inflows into exchanges, suggesting that traders are holding onto their property fairly than promoting. This development usually factors to elevated accumulation and will foreshadow a bullish breakout.

Associated Studying

Because the broader crypto market evolves, Ethereum traders stay vigilant, anticipating a bullish reclaim that would propel costs greater. The lower in change inflows may signify that merchants are positioning themselves for a possible upward motion, as they appear extra inclined to retain their holdings throughout this significant section.

Ought to Ethereum efficiently break above essential resistance ranges, it may reignite bullish momentum and entice additional funding. The subsequent few days will probably be pivotal for ETH, as merchants intently monitor value motion and on-chain metrics for indicators of a resurgence. With the suitable situations, Ethereum could set its sights on new highs, reinforcing the general optimistic sentiment available in the market.

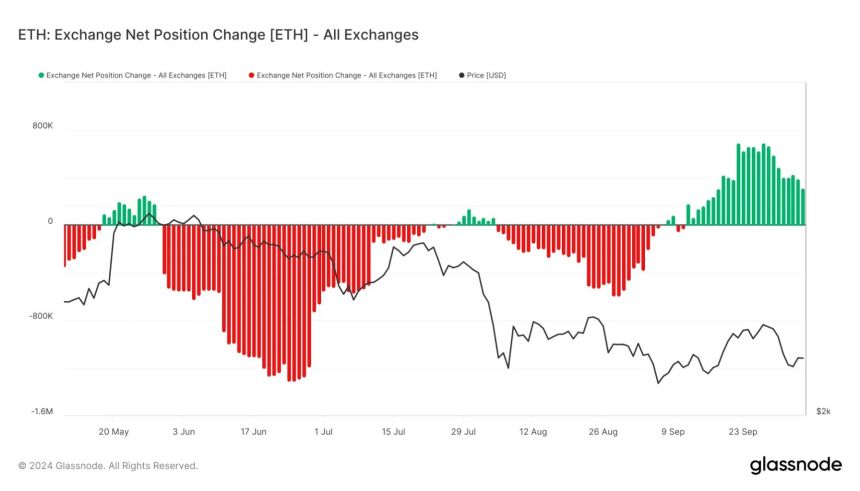

Ethereum Exchanges’ Internet Place Change Decreases

Ethereum (ETH) is at the moment at an important value stage following a 15% dip from its native highs. The broader crypto trade is brimming with anticipation for a large rally after the Federal Reserve’s resolution to chop rates of interest a few weeks in the past. Nonetheless, regardless of the optimistic outlook, costs have struggled to climb greater, leaving many traders on edge.

Thankfully, on-chain information from Glassnode suggests a discount in promoting strain, which may enhance market sentiment and pave the best way for a possible ETH rebound. One key metric to think about is the Ethereum Exchanges’ Internet Place Change indicator, which has been downward since mid-September. This indicator tracks the stream of ETH into and out of exchanges, and its current decline signifies that inflows have dropped considerably.

Decrease inflows usually point out decreased promoting strain, as fewer traders are transferring their property onto exchanges to promote. This shift in momentum displays a optimistic change in market sentiment, suggesting that traders could also be much less inclined to liquidate their positions at present value ranges.

As promoting exercise decreases, Ethereum may acquire some much-needed respiratory room to get well from its current decline.

Furthermore, elevated confidence amongst traders may result in upward value motion within the coming days. Ethereum could also be positioned for a resurgence if this development continues, doubtlessly setting the stage for a bullish breakout as market dynamics shift in its favor. As merchants stay vigilant, all eyes will probably be on ETH to see if it could possibly capitalize on this improved sentiment and regain upward momentum.

ETH Testing Essential Provide Ranges

Ethereum (ETH) is buying and selling at $2,448 after dealing with rejection on the 4-hour 200 exponential transferring common (EMA) at $2,516. The value additionally struggled to keep up momentum above the 4-hour 200 transferring common (MA) at $2,458, indicating a essential second for ETH. If Ethereum fails to reclaim each of those key ranges within the coming days, it might be at severe threat of dropping in the direction of the $2,200 space, doubtlessly triggering a deeper correction.

Conversely, if ETH manages to interrupt above and maintain these essential indicators, it may sign a bullish development reversal, opening the door for a surge towards the $2,700 resistance space. The end result within the subsequent few days will probably be important for figuring out Ethereum’s trajectory.

Associated Studying

Merchants and traders will intently monitor these ranges, as the power to reclaim them may present the momentum wanted for ETH to regain power and try to check greater value ranges. The present value motion displays the uncertainty available in the market, making it crucial for ETH to claim itself decisively to encourage confidence and drive a rally.

Featured picture from Dall-E, chart from TradingView