- A recap of how Ethereum has been lagging behind in comparison with a few of its prime rivals.

- Why Bitcoin dominance may very well be the important thing to ETH unlocking explosive development.

Ethereum [ETH] grew to become the topic of criticism just lately, with many accusing the king of altcoins of underperforming. However issues might change quickly — one major catalyst may very well be Bitcoin’s [BTC] dominance.

Ethereum gained roughly $100.61 billion in its market cap from its lowest level to this point this month. In distinction, Bitcoin gained over $480 billion in market cap throughout the identical interval.

Maybe the most important measure of its underperformance was the truth that Ethereum has not achieved new ATHs.

As has been the case with a few of its prime rivals. For instance, its TVL peaked at $66.77 billion on the twelfth of November. Nonetheless, this was nonetheless decrease than its June TVL peak at $72.72 billion.

Transaction knowledge additionally painted an analogous image. Ethereum’s on-chain transactions peaked at 1.29 million transactions on the twelfth of November. This was the very best single day transactions it achieved final week.

Nonetheless, the quantity was nonetheless decrease than its peak every day transaction depend in October, which peaked at 1.32 million transactions on the 18th of October.

One other main space the place folks thought it has been lagging behind was the value motion. Be aware that ETH truly delivered a bullish efficiency to this point in November.

It rallied by 44.61% from its lowest to its highest worth within the final two weeks. Nonetheless, Bitcoin has been in worth discovery, whereas ETH was nonetheless miles away from its historic ATH.

Ethereum might redeem itself if…

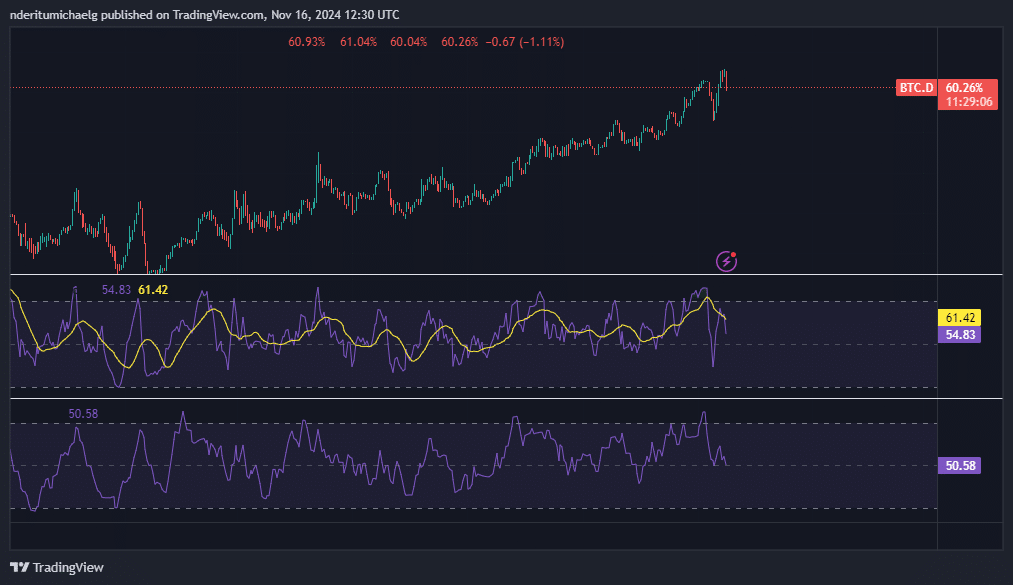

Bitcoin dominance has been on the rise for months, thus indicating that many of the liquidity coming into crypto went into BTC. Nonetheless, this may occasionally quickly change if Bitcoin dominance begins declining.

Bitcoin dominance was already trying prefer it was prepared for some draw back on the time of writing. This was courtesy of some draw back within the final 24 hours and a bearish divergence sample with the RSI.

Additionally, its cash stream indicator confirmed that liquidity flows might already be in favor of altcoins.

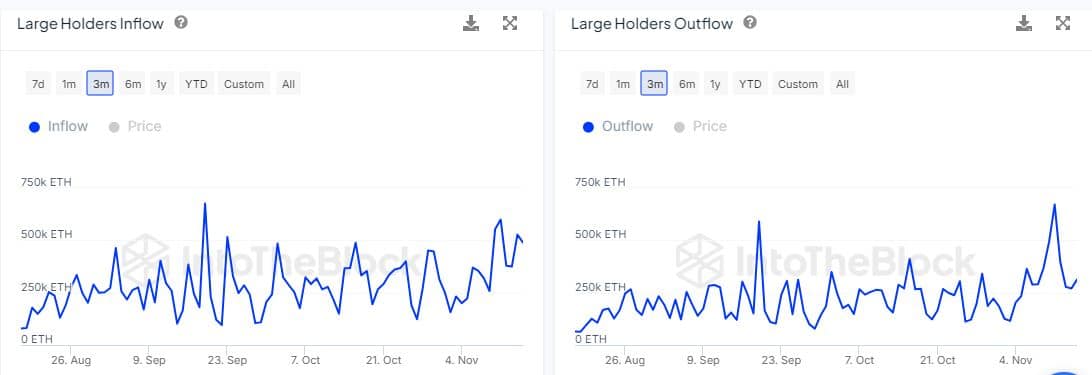

The liquidity stream into Ethereum might already be happening. The hole between giant holder inflows and outflows has been widening.

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

Giant holder inflows have been notably greater at over 488,000 ETH as of the fifteenth of November. Nonetheless, giant holder outflows have been notably greater at 312,430 ETH throughout the identical buying and selling session.

This might point out that ETH is increase extra momentum as BTC dominance begins declining.