Ethereum is below stress at press time, tumbling roughly 15% from March 2024. As sellers press on, reversing all positive aspects posted from Might 20, on-chain information factors to a bullish image.

Ethereum HODLers Scoop 298,000 ETH In 24 Hours

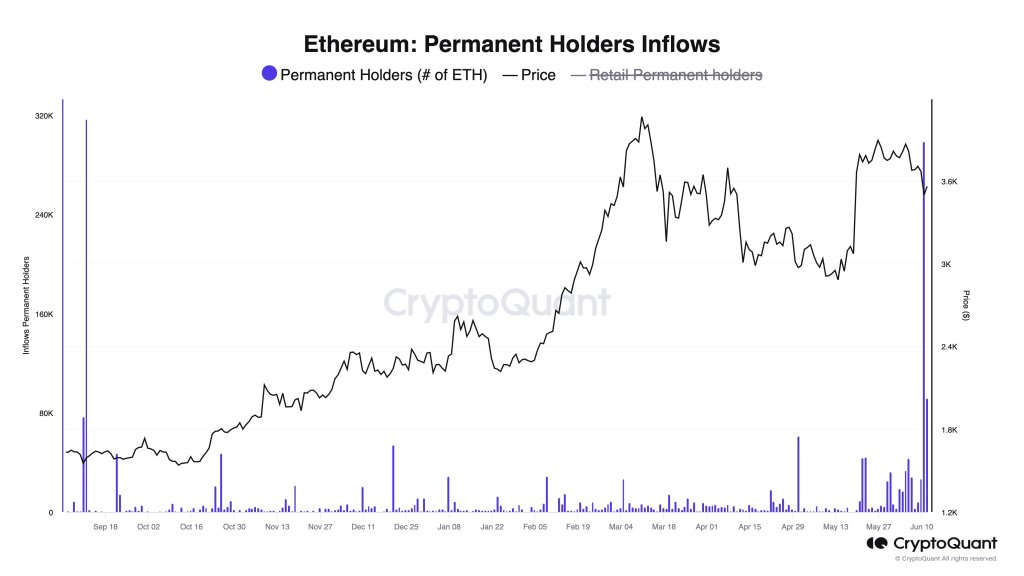

Taking to X, one analyst notes a spike in ETH demand, particularly from everlasting holders. Most probably, these everlasting holders are establishments with deeper pockets and are keen to hold on. Not like retailers, these entities can usually select to carry for longer and gained’t be shaken out by market volatility.

Citing CryptoQuant information, the analyst stated these everlasting holders, based on data, are chargeable for the second-highest day by day buy. On June 12, when costs briefly rose, they purchased a staggering 298,000 ETH. Impressively, this determine simply falls wanting the all-time excessive of 317,000 ETH bought on September 11, 2023.

In mild of this, regardless of the wave of decrease lows clear within the day by day chart, the surge in demand factors to sturdy bullish sentiment.

Associated Studying

Additionally, contemplating the quantity of ETH scooped from the markets, it might sign that establishments, probably hedge funds or billionaires, are starting to place themselves out there.

They seem like benefiting from the decrease costs.

At press time, there’s weak spot in Ethereum, evident within the day by day chart. Even with the bounce on June 12, bulls didn’t utterly reverse losses of June 11. The dip on June 13 means sellers are again within the equation, and costs might align towards the conspicuous June 11 bar.

From the candlestick association within the day by day chart, $3,700 is rising as a resistance stage. After the breakout on June 7, ETH has been free-falling to identify charges, actively filling the Might 20 hole.

If the dump continues, it’s possible that ETH, even with all of the optimism throughout the crypto scene, will as soon as extra re-test $3,300.

Spot ETFs To Start Trading This Summer season: Gensler

Whether or not costs will get better from present ranges or slip in the direction of $3,300 stays to be seen. Total, the market is upbeat, based on feedback from Gary Gensler, the chair of the US Securities and Trade Fee (SEC).

Showing in a senate listening to, Gensler stated the spot Ethereum exchange-traded fund (ETF), whose 194-b kinds had been accepted in Might, could start buying and selling at a tentative time in summer season. BlackRock has already resubmitted its S-1 submitting and is ready for approval.

Associated Studying

If the product is accepted within the subsequent few weeks, will probably be a significant liquidity increase for ETH. Like spot Bitcoin ETFs, establishments will possible channel billions to ETH, permitting their shoppers to get publicity.

Function picture from DALLE, chart from TradingView