- Ethereum sees a poor efficiency towards Bitcoin, with the ETH/BTC pair reaching a four-year low.

- ETH has declined by 2.48% over the previous 24 hours.

Over the previous months, Ethereum [ETH] has struggled to maintain an upward momentum, whereas Bitcoin [BTC] has regularly made new highs.

As such, Ethereum has continued to battle towards Bitcoin as BTC.Dominance pushed the pair to current lows.

In actual fact, as of this writing, ETH/BTC was buying and selling at $0.031, hitting a four-year low for the pair. This dip raises considerations about Ethereum’s future prospects and whether or not it will probably reverse its fortunes.

Ethereum continues to battle towards Bitcoin

All through the previous 12 months, Bitcoin has made important good points, rising by 144.45%. This marked an increase from $40K to $101K on the time of writing, whereas BTC has reached an ATH of $109K over the identical interval.

As compared, Ethereum has made average good points over the identical interval, rising by 30.27% to $3219 at press time. Over this era, ETH remained roughly 33% beneath its ATH of $4891 recorded in 2021.

With the ETH/BTC ratio dropping to 0.031, it has erased all good points realized over the previous 4 years. Traditionally, the pair peaked at 0.087 in 2021, when the market noticed a powerful upsurge in altcoins.

Nonetheless, since reaching this degree, the altcoin has skilled sturdy downward stress.

Components behind this decline

Numerous components have resulted in Ethereum’s underperformance towards Bitcoin. Notably, the king coin has skilled excessive choice from establishments and governments.

On this regard, many governments have thought-about establishing Bitcoin reserves, inflicting BTC to see increased choice and adoption charges in comparison with different crypto belongings.

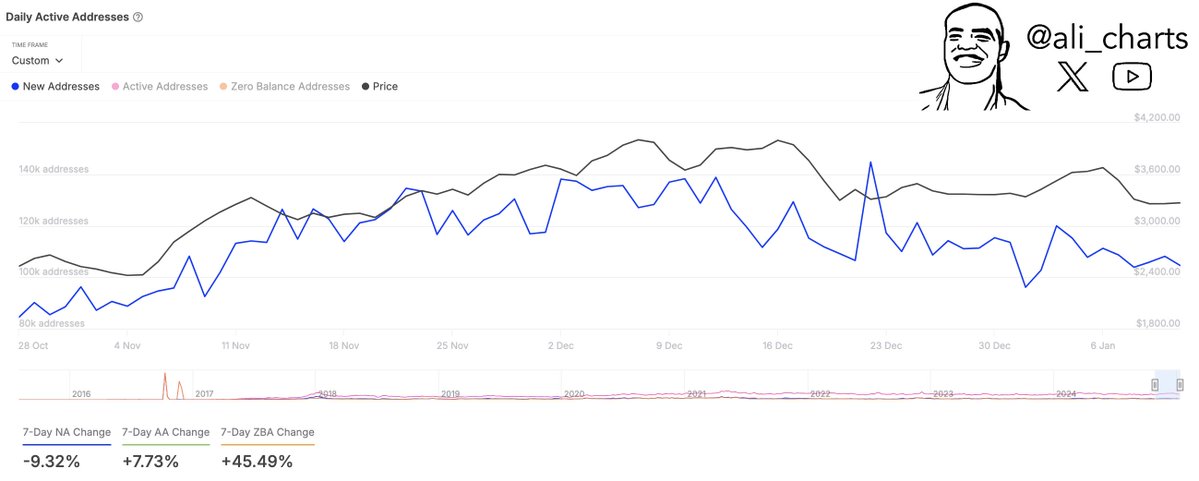

Ethereum, alternatively, has skilled an adoption fee decline, with new addresses dipping by 9.32%.

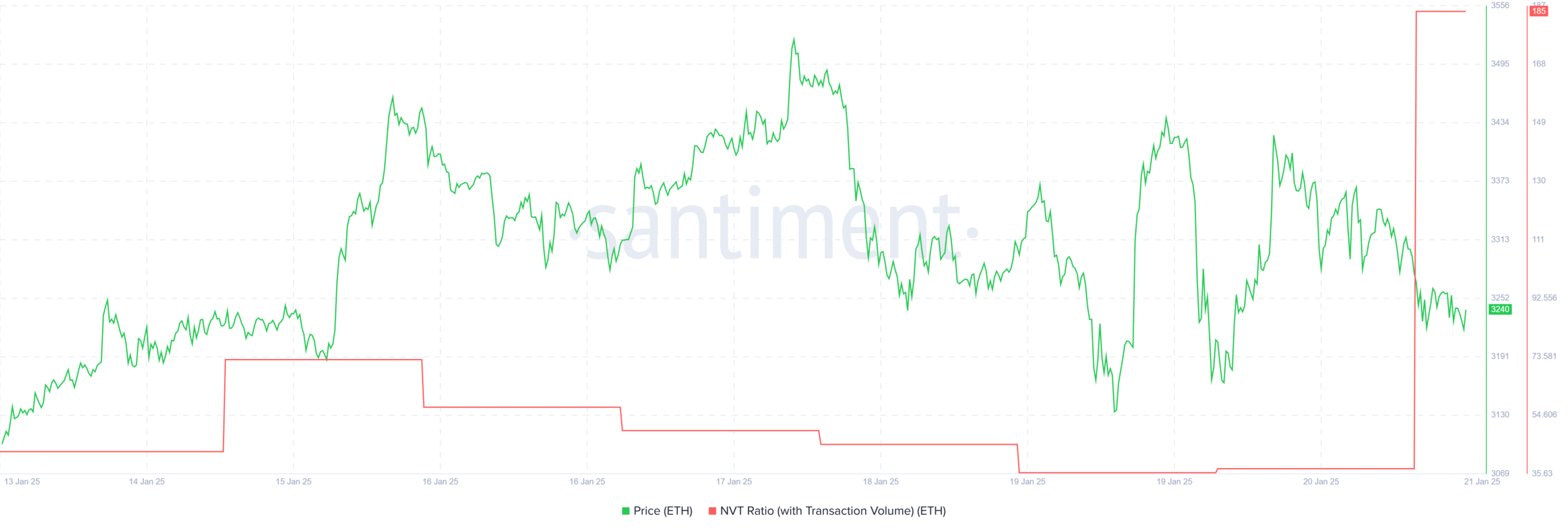

This drop in addresses is additional evidenced by a rising NVT ratio, which has spiked to 185.5, signaling lowered transaction exercise. As such, transactions on the Ethereum community have regularly lowered.

This drop in community exercise raises overvaluation considerations, thus extending ETH’s poor efficiency.

What lies forward?

With lowered market choice, ETH might see extra losses, and its poor efficiency towards Bitcoin might proceed.

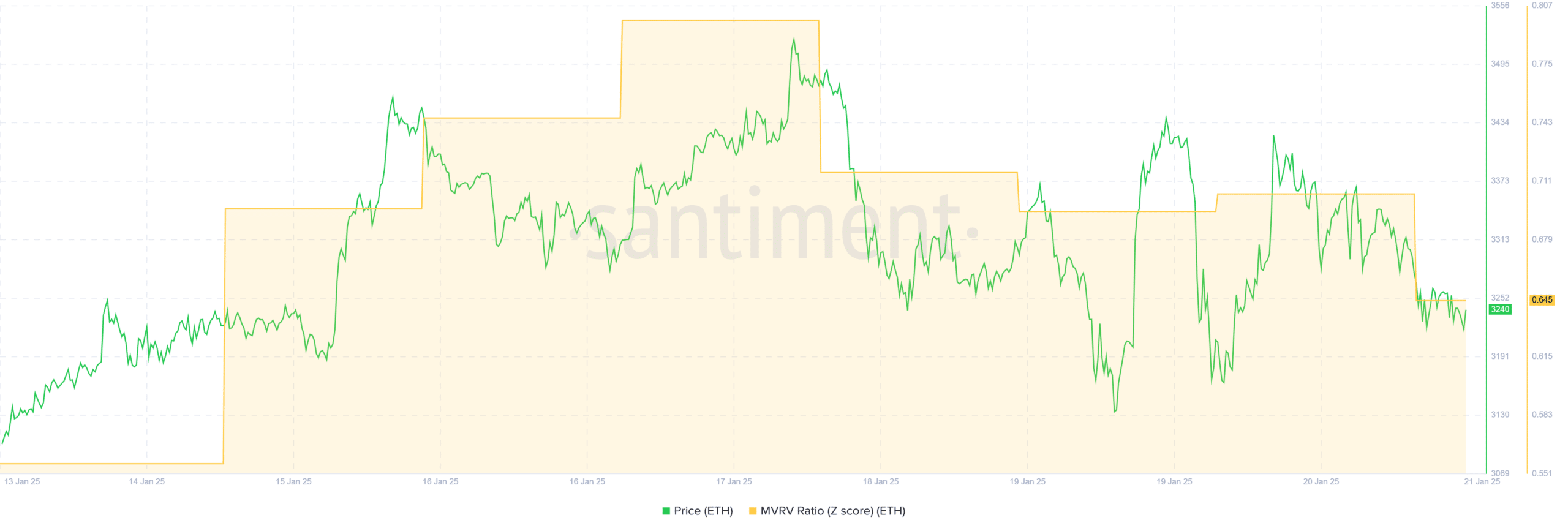

This potential drop is supported by the truth that the MVRV ratio has dropped to 0.64. Such a drop implies that buyers are bearish and have low confidence in short-term value restoration.

Real looking or not, right here’s ETH’s market cap in BTC’s phrases

Subsequently, within the quick time period, Ethereum is dealing with sturdy bearish sentiment which might see ETH drop to $3160. Nonetheless, if consumers take this drop as a shopping for alternative, ETH will reclaim $3300 and try $4k.

This can strengthen the ETH/BTC pair and push it to reclaim $0.04.