Market Overview: S&P 500 Emini Futures

The weekly chart shaped an Emini consecutive bear bar, one thing that has not occurred since October 2023. The bulls wish to get not less than a small retest of the prior development excessive excessive (Mar 21), even when it solely results in a decrease excessive. The need bears have to proceed creating sturdy consecutive bear bars to point that they’re again in management.

S&P500 Emini futures

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was a bear bar closing close to its low and beneath final week’s low.

- Final week, we stated that merchants will see if the bears can create respectable follow-through promoting. In the event that they do, it might result in the beginning of a two-legged pullback lasting not less than a number of weeks.

- This week was a follow-through bear bar, one thing that has not occurred since October 2023.

- The bulls have a powerful rally within the type of a good bull channel.

- They hope that the rally will result in months of sideways to up buying and selling after a pullback.

- They wish to get not less than a small retest of the prior development excessive excessive (Mar 21), even when it solely results in a decrease excessive (thereby resulting in a decrease excessive main development reversal).

- Due to the climactic nature of the transfer, a pullback can start at any second. It might be underway.

- If a pullback begins, the bulls need it to be sideways and shallow, stuffed with bull bars, doji(s) and overlapping candlesticks.

- The bears desire a reversal from the next excessive main development reversal and a big wedge sample (Feb 2, July 27, and Mar 28).

- They see a parabolic wedge within the third leg up since October (Dec 28, Feb 12, and Mar 21), an embedded wedge (Feb 12, Mar 8, and Mar 21) and a micro wedge prime (Mar 21, Mar 28, and Apr 4).

- They hope that the sideways tight buying and selling vary (ioi sample in March) would be the closing flag of the rally.

- They hope to get a TBTL (Ten Bars, Two Legs) pullback of not less than 5-to-10%. They need not less than a take a look at of the 20-week EMA.

- The bears managed to get follow-through promoting this week, which will increase the percentages that the sideways to down pullback might be underway.

- They might want to proceed creating sturdy consecutive bear bars to point that they’re again in management.

- Since this week’s candlestick is a bear bar closing close to its low, it’s a promote sign bar for subsequent week.

- The market continues to be All the time In Lengthy. Nonetheless, the rally has lasted a very long time and is barely climactic.

- Merchants are searching for indicators of a pullback and profit-taking. It might be underway.

- The market having extra overlapping value motion since February is a sign of a lack of momentum.

- Merchants will see if the bears can create extra follow-through promoting subsequent week. In the event that they do, it might be the beginning of a two-legged pullback lasting not less than a number of weeks.

- If the pullback part is underway, merchants will see the energy of the promoting, whether or not the pullback is shallow and sideways or deep with sturdy bear bars.

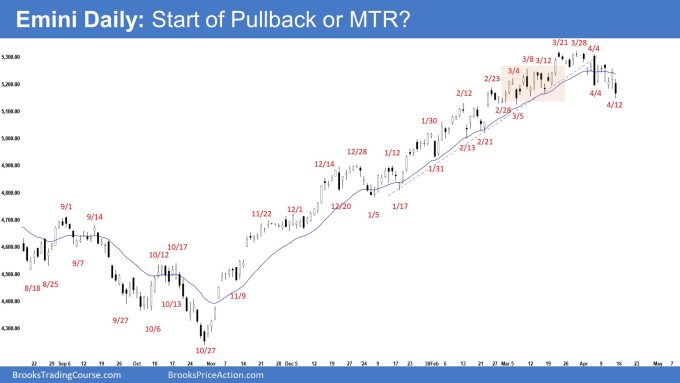

The Day by day S&P 500 Emini chart

- The market broke above the ioi sample earlier within the week however reversed to interrupt beneath it on Wednesday. The market traded larger on Thursday however opened decrease Friday closing again beneath the 20-day EMA.

- Final week, we stated that the bulls desire a breakout above, whereas the bears desire a breakout beneath the ioi sample. The primary breakout can fail 50% of the time.

- The bulls acquired a good bull channel making new all-time highs.

- They hope that the present rally will type a spike and channel which is able to final for a lot of months after a deeper pullback.

- They acquired 3 pushes up because the January low, due to this fact a wedge (Feb 12, Mar 8, and March 21).

- The third leg up (since Feb 21 low) consists of three pushes (Mar 4, Mar 8, and Mar 21) due to this fact an embedded wedge. Additionally they see a micro wedge prime forming (Mar 21, Mar 28, and Apr 4).

- The danger of a profit-taking occasion is elevated.

- The bulls need not less than a small sideways to up leg to retest the present development excessive excessive (now March 21), even when it kinds a decrease excessive (thereby forming a decrease excessive main development reversal).

- The bears desire a reversal from the next excessive main development reversal, a big wedge sample (Feb 2, July 27, and Mar 21) and a parabolic wedge (Dec 28, Feb 12, and Mar 21).

- Additionally they see an embedded wedge within the present leg up (Mar 4, Mar 8, and Mar 21) and a micro wedge prime (Mar 21, Mar 28 and Apr 4).

- They hope that the current sideways tight buying and selling vary (within the first half of March) would be the closing flag of the rally.

- The bears might want to create consecutive bear bars closing close to their lows and buying and selling far beneath the 20-day EMA and the bear development line to point that they’re again in management.

- If the market trades larger, the bears desire a reversal from a double prime or a significant development reversal with the March 21 excessive.

- Merchants will see if the bears can create follow-through promoting beneath the 20-day EMA subsequent week.

- Beforehand, the breakout above the tight buying and selling vary (within the first half of March) was disappointing with poor follow-through shopping for, growing the percentages of a minor reversal from a closing flag.

- Up to now, the promoting stress stays weak (no sturdy consecutive bear bars but, regardless of the market buying and selling beneath the 20-day EMA).

- For now, the market remains to be All the time In Lengthy. Nonetheless, the rally has lasted a very long time and is barely climactic.

- Merchants are searching for indicators of profit-taking and a pullback.

- The bears have to create sustained follow-through promoting buying and selling far beneath the 20-day EMA to indicate that they’re not less than quickly again in management.

- Merchants will even see if there can be not less than a small retest of the prior excessive (Mar 21). If there’s and particularly whether it is weak, the percentages of one other leg down from a decrease excessive main development reversal will improve.

Trading room

Al Brooks and different presenters speak concerning the detailed Emini value motion real-time every day within the BrooksPriceAction.com buying and selling room. We provide a 2 day free trial.

Market evaluation experiences archive

You’ll be able to entry all weekend experiences on the Market Evaluation web page.