- Musk helps Trump’s push for presidential management over the Federal Reserve’s insurance policies.

- Bitcoin positive aspects momentum as a hedge towards inflation amid rising U.S. nationwide debt.

Elon Musk, the influential CEO of Tesla and SpaceX, has lengthy been a vocal supporter of the now-President Donald Trump, significantly throughout his 2024 election marketing campaign.

After Trump’s victory in turning into the forty seventh President of the USA, Musk brazenly endorsed the thought of permitting the president to play a extra direct function in shaping Federal Reserve insurance policies.

Senator Mike Lee on ending Federal Reserve’s energy

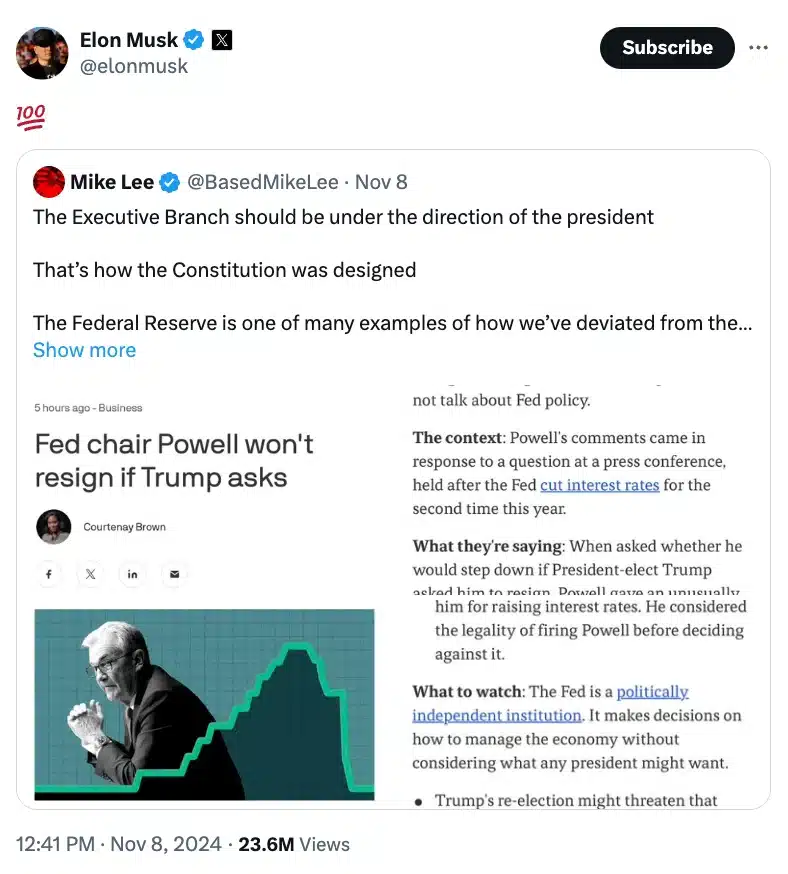

This emerged from a response to a latest put up by Senator Mike Lee, R-Utah, advocating for the Federal Reserve to function underneath the direct management of the president.

Including on to this, Musk signaled his help the next day with a easy “100” emoji, generally used to specific full settlement.

For these unaware, Senator Lee had wrapped up his tweet with the hashtag #EndtheFed, calling for a radical shift in U.S. financial coverage.

He stated,

“The Executive Branch should be under the direction of the president. That’s how the Constitution was designed. The Federal Reserve is one of many examples of how we’ve deviated from the Constitution, in that regard. Yet another reason why we should end the Fed.”

How did this begin?

For context, Lee’s put up was sparked by Federal Reserve Chair Jerome Powell’s refusal to step down even when requested by incoming President Trump, a transfer Lee seen as emblematic of an out-of-control system. As anticipated, Musk’s endorsement of Lee’s place on social media stirred additional debate concerning the function of the Federal Reserve in U.S. financial governance.

Reacting to the scenario the group reacted as highlighted by an X consumer – Reality Justice who stated,

“The end of government corruption.”

The difficulty flared up when Fed Chair Jerome Powell reaffirmed that he wouldn’t step down if requested by President-elect Trump. This advised a renewed friction between the central financial institution and the White Home.

What’s extra?

Traditionally, the Federal Reserve has operated independently to make selections primarily based solely on financial circumstances, however throughout his first time period, Trump often criticized Powell’s insurance policies.

Thus, through the 2024 election marketing campaign, Trump expressed curiosity in exerting extra affect over the Fed’s actions ought to he return to workplace. Remarking on the identical, in August at a press convention at his Mar-a-Lago membership in Florida Trump asserted,

“I feel the president should have at least [a] say in there.”

As anticipated, Musk additionally shared an analogous sentiment in a latest tweet when he argued,

“The unelected and unconstitutional Federal bureaucracy currently has more power than the presidency, legislature or judiciary! This needs to change.”

How is Bitcoin the savior?

With the U.S. nationwide debt exceeding $35 trillion, Bitcoin [BTC] is rising as a possible hedge towards inflation pushed by years of cash printing. Figures like Florida CFO Jimmy Patronis and Senator Cynthia Lummis are pushing for BTC investments to guard buying energy.

Moreover, Trump has additionally advised utilizing Bitcoin to handle the nationwide debt, highlighting its rising function in U.S. financial technique. Due to this fact, as the controversy on Bitcoin’s monetary influence intensifies, its potential as an inflation hedge positive aspects rising consideration.

The truth is, an X consumer put it finest when he stated,