- Elon Musk reacts to Bitcoin’s pullback, highlighting market volatility and investor sentiment.

- Bitcoin’s 46% development reveals bullish sentiment, regardless of uncertainty round Cramer’s affect on worth.

Amidst the whirlwind of headlines surrounding Tesla CEO Elon Musk, whose web value has surged to a record-breaking $348 billion following Donald Trump’s victory within the U.S. presidential election, one other intriguing growth has caught the eye of the crypto world.

Jim Cramer’s crypto stance and neighborhood response

Musk lately expressed amusement over Bitcoin’s [BTC] sudden pullback in worth, a shift that got here on the heels of monetary analyst Jim Cramer’s bullish stance on the cryptocurrency.

In a current put up on X, Musk responded with a laughing face and a “100%” emoji, reacting to a satirical tackle the “Inverse Cramer” development.

For these unfamiliar, the “Inverse Cramer” development is predicated on the concept that following the other of monetary analyst Jim Cramer’s recommendation may yield optimistic returns.

This idea gained sufficient traction that, in 2022, an exchange-traded fund (ETF) was launched, enabling buyers to wager in opposition to Cramer’s predictions.

Nonetheless, the ETF was finally shut down earlier this yr resulting from restricted success.

Including to the fray was a crypto analyst — Ali Martinez, who famous,

“Another sell signal.”

What occurred to this point?

Recently, Bitcoin skilled a formidable rally, reaching practically $99,860 on main U.S. change Coinbase.

Nonetheless, the optimism surrounding this surge may very well be fleeting, particularly with monetary knowledgeable and TV host Jim Cramer expressing a bullish stance on the cryptocurrency.

Whereas the notion of counter-trading Cramer’s predictions has gained consideration, there stays no conclusive proof to counsel it’s a constantly worthwhile technique.

Actually, as of the newest knowledge, BTC was buying and selling at $98,074.06, reflecting a modest 0.72% improve prior to now 24 hours, with a exceptional 46% development over the previous month.

Bitcoin’s future…

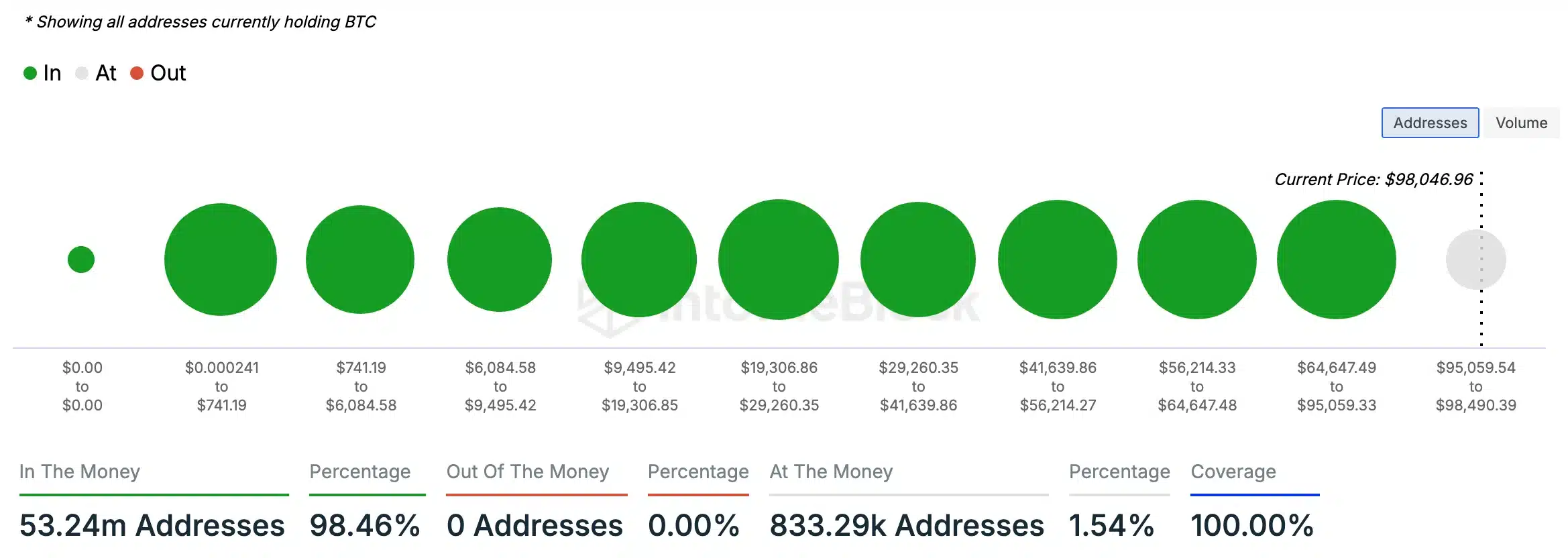

In line with IntoTheBlock knowledge analyzed by AMBCrypto, 98.46% of Bitcoin holders are presently in revenue, with their tokens valued greater than the acquisition worth. This implies a prevailing bullish sentiment.

In distinction, there have been no BTC holders “out of the money.”

Thus, whereas Bitcoin’s future actions stay unsure, these traits spotlight the impression of market sentiment and exterior elements on its worth course.