- DMM Bitcoin misplaced 4,502.9 BTC to hackers, planning a major buyback to cowl losses.

- AMBCrypto analyzed the attainable affect of this buy on the Bitcoin market

On Could thirty first, DMM Bitcoin, a outstanding Japanese cryptocurrency change, encountered a major safety breach ensuing within the lack of roughly 48 billion yen ($305 million) price of Bitcoin [BTC] .

The breach led to 4,502.9 BTC being illicitly transferred out of the change’s reserves, as reported by safety analysts from Blocksec. Analysts famous that stolen funds had been cut up into batches of 500 BTC throughout ten totally different wallets.

DMM Bitcoin’s plan to undo a hacker’s payday

In response to this substantial monetary hit, DMM Bitcoin has initiated a complete restoration technique geared toward compensating affected prospects with out disrupting the broader Bitcoin market.

The platform disclosed plans to safe 50 billion yen ($321 million) to buy Bitcoin misplaced. This transfer is a part of a broader initiative to stabilize the change’s operations and restore consumer belief.

Notably, the hack, ranked because the seventh-largest crypto theft by Chainalysis, prompted instant regulatory motion.

Japan’s Monetary Companies Company has required DMM Bitcoin to totally examine the incident. A report on each the breach’s origins and the corporate’s buyer compensation technique was additionally requested.

In the meantime, Finance Minister Shunichi Suzuki has dedicated to bolstering preventative measures towards future safety breaches within the cryptocurrency sector.

Thus far, the corporate has secured a 5 billion yen mortgage. It’s within the technique of a major capital increase amounting to 48 billion yen.

Attainable affect

Whereas it may appear noteworthy {that a} crypto change is about to buy hundreds of thousands in Bitcoin, the fact is that DMM’s deliberate $320 million funding is unlikely to shake the market considerably.

This buy will solely account for about 4,500 BTC, a mere 0.023% of the present circulating provide of roughly 19.7 million cash, based on Coingecko information.

As compared, U.S. spot Bitcoin ETFs are making purchases over $500 million, which genuinely affect Bitcoin’s value dynamics.

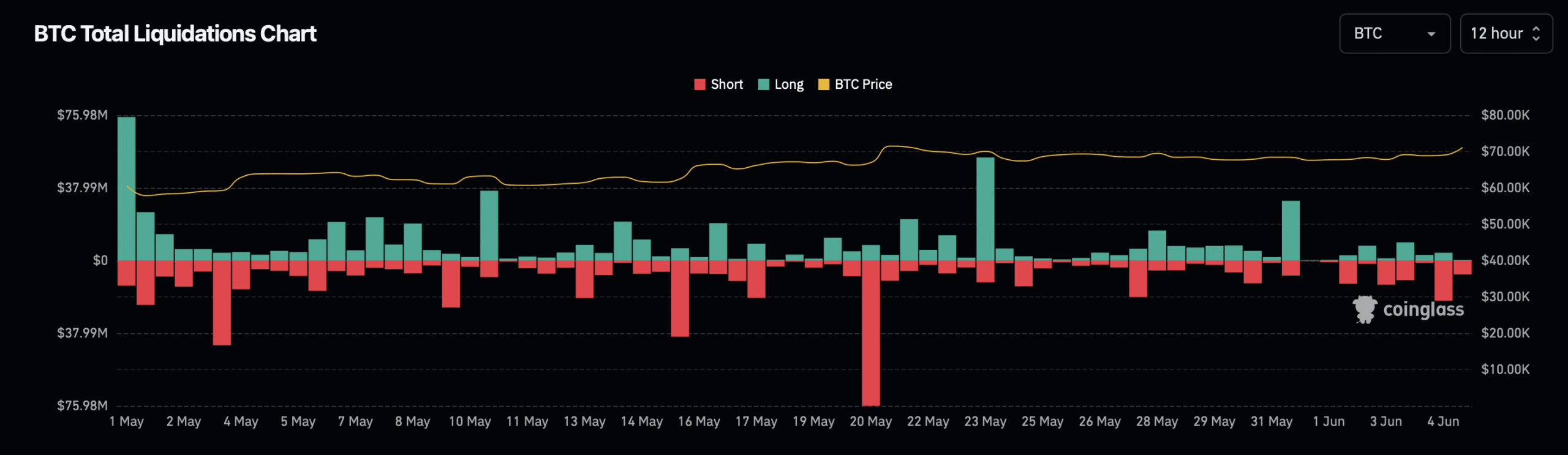

As of now, Bitcoin’s value is barely above $71,000. BTC rose by 2.9% prior to now day and 4.6% over the previous week. Regardless of these positive aspects, the rise has led to over $30 million in liquidations out there, per Coinglass.

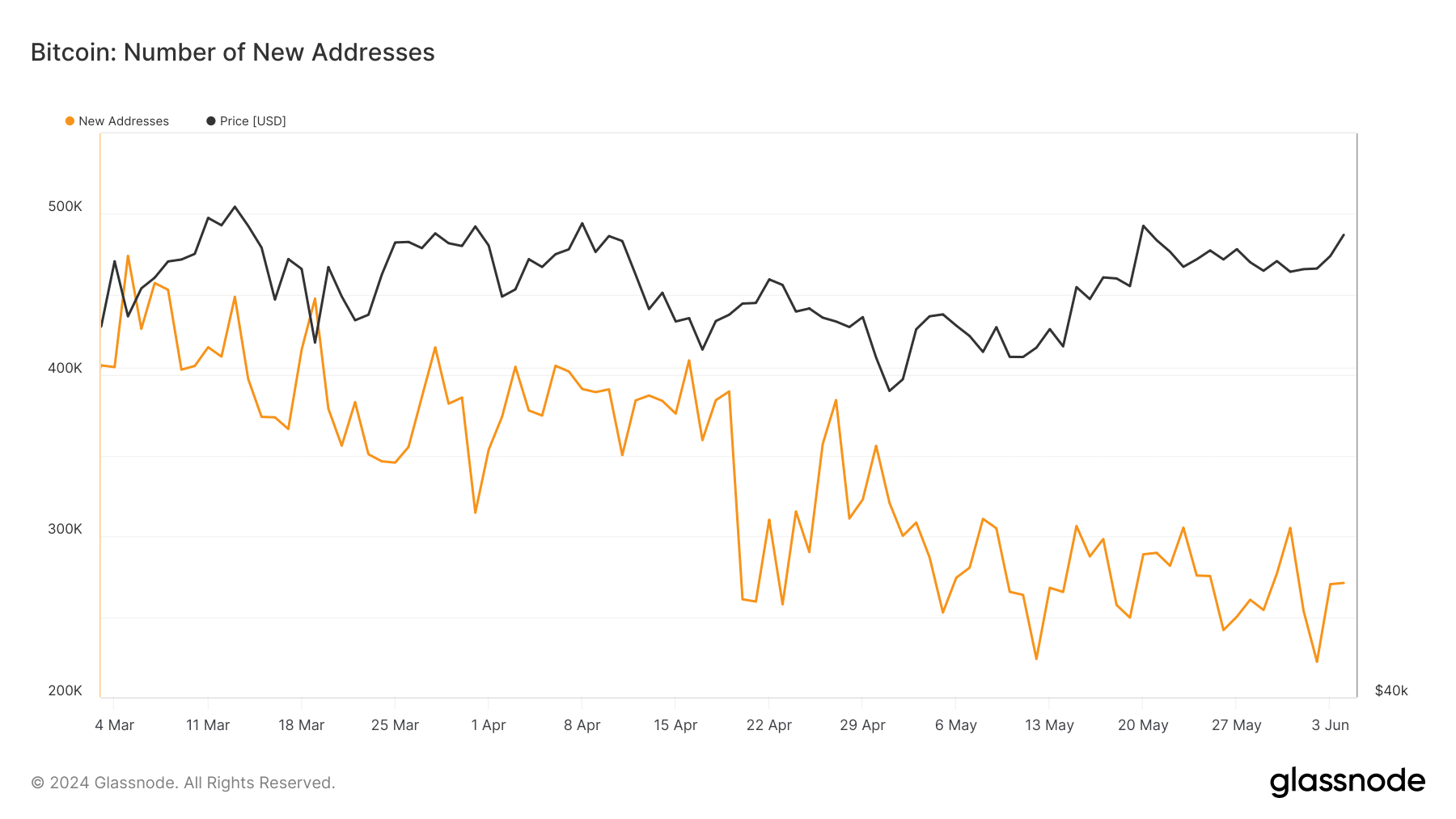

This value rise correlates with a noticeable uptick within the variety of new Bitcoin addresses proven in information from Glassnode, suggesting a renewed curiosity and probably increased future valuation.

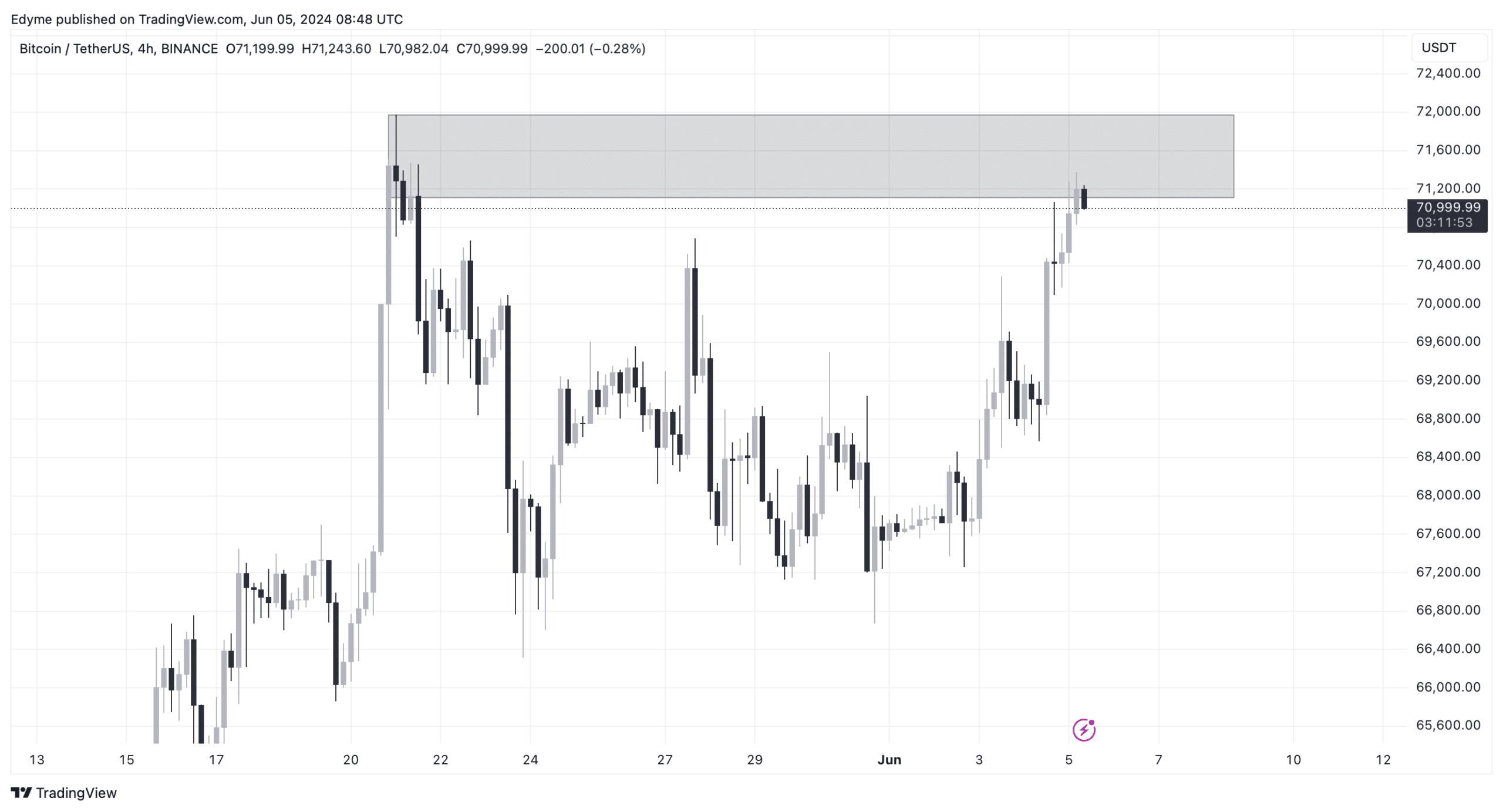

Furthermore, present technical evaluation signifies that Bitcoin is trying to interrupt via a major resistance stage on the day by day chart. A profitable breach may probably provoke a serious rally, catapulting the asset’s value to new heights.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

In one other evaluation, AMBCrypto reviews that the Community Worth to Transactions ratio, which is the market capitalization divided by the transacted quantity, has been trending increased.

This metric means that BTC may at the moment be overvalued primarily based on its transaction capabilities.