Earlier as we speak, the USA Securities and Alternate Fee (SEC) authorised 19b-4 fillings for eight spot Ethereum exchange-traded funds (ETFs), paving the best way for the extremely anticipated institutional adoption of the second most precious coin.

The choice comes after months of uncertainty and fewer than six months after the regulator authorised spot Bitcoin ETFs. For all that the crypto neighborhood can bear in mind this week, the regulator uncharacteristically “scrambled” and rapidly communicated to identify ETF issuers to make amends to their purposes.

Associated Studying

Did MicroStrategy Make A Mistake Selecting Bitcoin Over Ethereum?

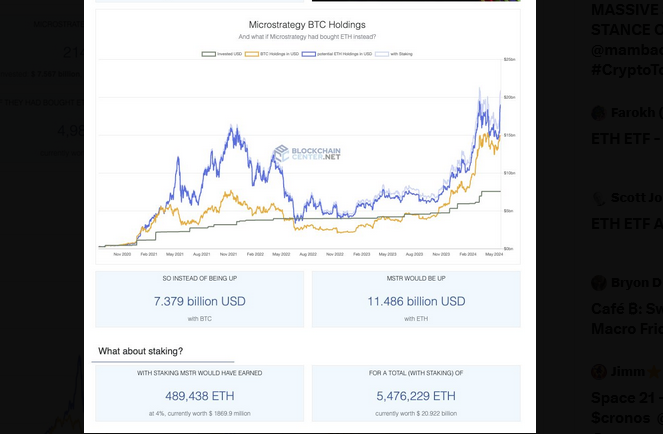

With spot Ethereum ETFs prone to be issued within the subsequent few weeks, one analyst on X now thinks Michael Saylor, the previous CEO of MicroStrategy, missed massive rewards by selecting Bitcoin over Ethereum. As of Might 24, MicroStrategy, a enterprise intelligence agency and now one of many greatest public firms in the USA, has been rising its BTC holdings over time.

In line with Bitcoin Treasuries, MicroStrategy is the most important public firm holding BTC, controlling 214,400 BTC value over $14 billion at press time.

Nonetheless, with the USA SEC setting the ball rolling for spot Ethereum ETFs, the analyst is now declaring a hypothetical state of affairs. If MicroStrategy had chosen ETH over BTC, their holding would have been value over $19 billion at spot charges.

This stage means MicroStrategy could be up over $4 billion. Assuming the enterprise intelligence agency had chosen to purchase and never maintain however stake, their complete holdings could be value over $20.9 billion as of late Might 2024.

ETH Trading At A Large Low cost: Will It Replicate BTC’s Success?

Trying on the aftermath of the approval and buying and selling of spot Bitcoin ETFs, it turns into obvious that Ethereum costs is perhaps considerably undervalued at spot charges. After a short dip in mid-January, BTC costs surged, propelling Ethereum to a excessive of $4,100. In distinction, the world’s most precious coin soared to breach $70,000 and set all-time highs at round $74,000.

With 19b-4 types from eight ETF issuers, together with BlackRock and Constancy, authorised, the one hurdle is the approval of S-1 registration statements. There is perhaps delays on this spherical. Nonetheless, the USA SEC inexperienced lights, spot Ethereum ETF shares will start buying and selling.

Associated Studying

Nonetheless, you will need to observe that spot Ethereum ETF issuers will maintain ETH through a regulated custodian and never stake.

Function picture from DALLE, chart from TradingView