Diagonal spreads are like vertical spreads within the sense that you really want them to maneuver In-The-Cash (ITM). An extended diagonal unfold is nothing greater than a vertical unfold with a longer-term lengthy possibility. With this in thoughts, max revenue will be greater than the width of the diagonal unfold, because the brief possibility will expire previous to the lengthy possibility.

The lengthy possibility will maintain extrinsic worth because the brief possibility expires, which is how we consider the commerce – like a vertical unfold with a possible extrinsic worth enhance within the lengthy possibility.

If a protracted diagonal unfold is displaying a loss, meaning the unfold is transferring out-of-the-money (OTM) and each the lengthy and brief choices are shedding worth. Since there’s a time distinction between the lengthy and brief possibility, there are many defensive ways we are able to deploy to proceed to hedge and scale back the price of the lengthy possibility that is still. This will contain rolling the brief possibility out in time nearer to the lengthy possibility’s expiration, rolling the brief possibility nearer to the lengthy possibility vertically in the identical expiration, or a mix of each.

Diagonal Bull Name Unfold Development

- Purchase 1 Lengthy-Time period ITM Name

- Promote 1 Close to-Time period OTM Name

Restricted Upside Revenue

The best state of affairs for the diagonal bull name unfold purchaser is when the underlying inventory value stays unchanged and solely goes up and past the strike value of the decision bought when the long run name expires. On this state of affairs, as quickly because the close to month name expires nugatory, the choices dealer can write one other name and repeat this course of each month till expiration of the long term name to cut back the price of the commerce. It could even be doable in some unspecified time in the future in time to personal the long run name “for free”.

Below this ideally suited state of affairs, most revenue for the diagonal bull name unfold is obtained and is the same as all of the premiums collected for writing the near-month calls plus the distinction in strike value of the 2 name choices minus the preliminary debit taken to placed on the commerce.

Restricted Draw back Danger

The utmost doable loss for the diagonal bull name unfold is proscribed to the preliminary debit taken to placed on the unfold. This occurs when the inventory value goes down and stays down till expiration of the long term name.

Lengthy put and name diagonal spreads are outlined threat in nature, the place the max loss potential is the debit paid up entrance if the lengthy possibility expires nugatory. Losses previous to expiration will be seen if the inventory strikes within the flawed route and the unfold strikes additional OTM, the place each choices lose extrinsic worth.

The brief possibility in a diagonal unfold works to hedge in opposition to the price of the lengthy possibility, and likewise in opposition to unfavorable strikes, however the brief possibility is just price a fraction of the lengthy possibility, so the hedge is just short-term.

If the brief possibility has misplaced most of its worth or has expired, one other brief possibility will be bought in opposition to the lengthy to proceed decreasing price foundation. Simply be aware of the width of the unfold, and to make sure that the web debit nonetheless doesn’t exceed the width of the unfold if the brief strike is moved nearer to the lengthy strike.

The unfold will be bought to shut previous to expiration for lower than max loss if the dealer’s assumption has modified, or they don’t consider the unfold will transfer again ITM previous to the expiration of the lengthy possibility.

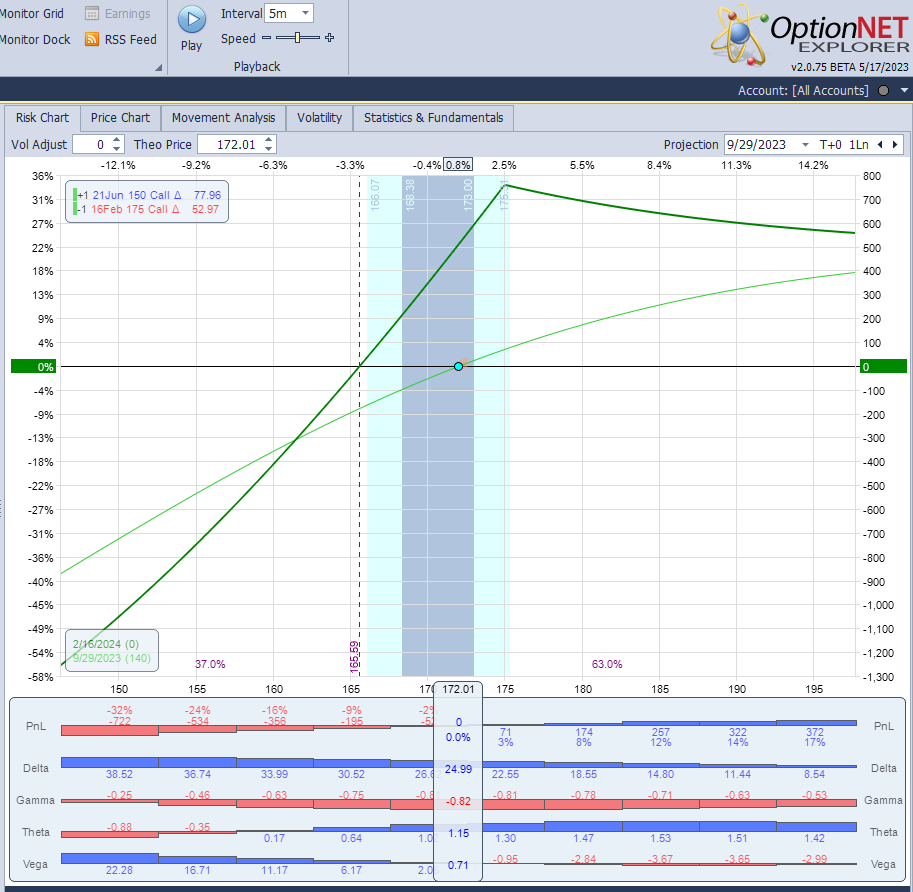

Instance

An choices dealer believes that AAPL inventory buying and selling at $172 goes to rise steadily for the subsequent 4 months. He enters a diagonal bull name unfold by shopping for a June 2024 150 name and writing a Feb 2024 175 name for. The online funding required to placed on the unfold is a debit of $2200.

That is how the P/L chart appears to be like like:

The inventory value of AAPL goes as much as $175 within the subsequent 4 months. As every near-month name expires, the choices dealer writes one other name of the identical or barely larger strike.

Time decay influence on a Diagonal Unfold

Time decay, or theta, will positively influence the front-month brief name possibility and negatively influence the back-month lengthy name possibility of a name diagonal unfold. Usually, the objective is for the brief name choice to expire out-of-the-money. If the inventory value is beneath the brief name at expiration, the contract will expire nugatory. The passage of time will assist scale back the total worth of the brief name possibility.

The time decay influence on the back-month possibility just isn’t as important early within the commerce, however the theta worth will improve quickly because the second expiration approaches. This will affect the choice associated to exiting the place.

Adjusting a Diagonal Unfold

Name diagonal spreads will be adjusted in the course of the commerce to extend credit score. If the underlying inventory value declines quickly earlier than the primary expiration date, the brief name possibility will be bought and bought at a decrease strike nearer to the inventory value. This can accumulate extra premium, however the threat will increase to the adjusted unfold width between the strikes of the near-term expiration contract and long-term expiration contract if the inventory reverses. If the brief name possibility expires out-of-the-money, and the investor doesn’t want to shut the lengthy name, a brand new place could also be created by promoting one other brief name possibility.

The power to promote a second name contract after the near-term contract expires or is closed is a key part of the decision diagonal unfold. The unfold between the brief and lengthy name choices would have to be a minimum of the identical width to keep away from including threat. Promoting a brand new name possibility will accumulate extra credit score, and will even result in a risk-free commerce with limitless upside potential if the web credit score obtained is greater than the width of the unfold between the choices.

Project threat

One of many frequent questions is: what occurs if the inventory rises and the brief calls develop into ITM? Is there an project threat?

The reply is that project threat turns into actual solely when there’s little or no time worth within the brief choices. This can occur provided that they develop into deep ITM and we get near expiration. When it occurs, you may roll the brief choices or shut the commerce. In any case, this isn’t a difficulty as a result of even when we’re assigned brief inventory, the brief inventory place is hedged by the lengthy calls.

In case of the upcoming dividend, there’s some project threat provided that the remaining time worth of the brief calls is lower than the dividend worth.

After all there is no such thing as a project threat if the calls are OTM or round ATM.

Associated articles: