- The Concern and Greed Index reached lows not seen in a yr.

- The decline in Social Quantity and constructive engagement outlined the market despondence.

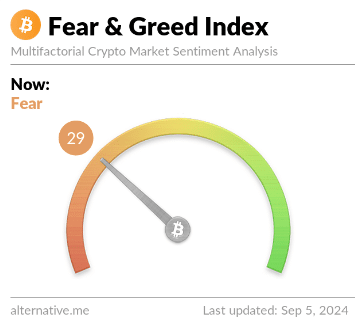

The Crypto Concern and Greed index stood at 29 at press time.

It confirmed concern was prevalent available in the market, however was nonetheless higher than the earlier month when heavy value corrections affected the market-wide sentiment, worse than the latest drop under $60k.

Supply: Various.me

The overwhelmingly damaging sentiment available in the market noticed a week-long, hefty torrent of outflows from the Bitcoin [BTC] spot ETFs. Alternatively, El Salvador continued to purchase 1 BTC a day.

The weakest sentiment in a yr

The Concern and Greed Index is a useful gizmo that provides traders an thought of when to purchase and when to promote. Excessive concern readings are usually a great purchase alternative in crypto, whereas euphoric markets are likely to mark value tops.

The Index values are calculated based mostly on the habits of Bitcoin, because the king coin largely dictates the crypto market habits. This consists of volatility, market momentum, and social media engagement.

Supply: Various.me

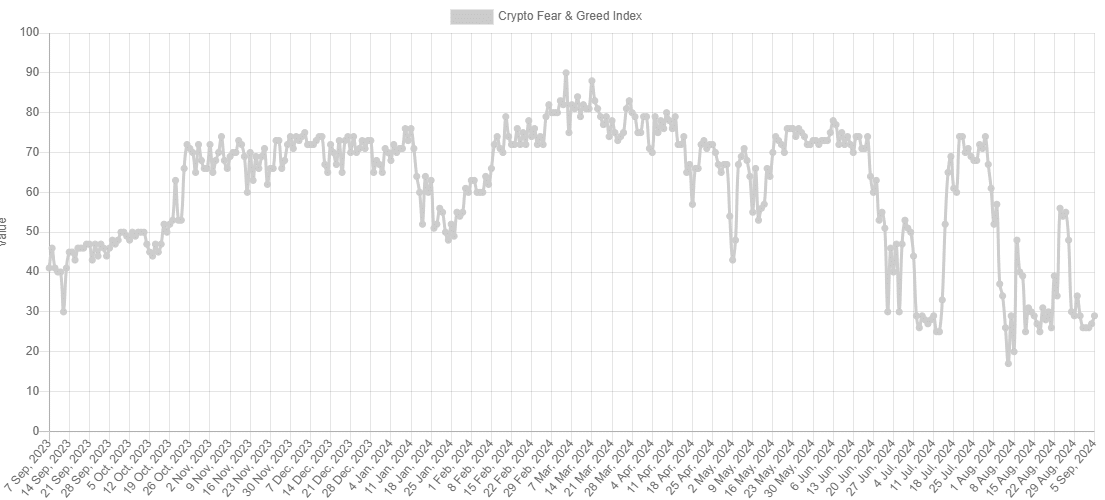

The Crypto Concern and Greed Index had been fairly hopeful in Might, however the sentiment has soured since then.

The promised bull run after the halving occasion in April didn’t take off instantly, however the continued downtrend since March has crypto traders very fearful.

In July and once more in early August, the Index values reached lows under 30 that weren’t seen for a yr.

At press time, the worth of 29 was additionally a considerably low one, but it surely is likely to be a shopping for alternative for the following 6–12 months.

Analyzing Bitcoin’s metrics

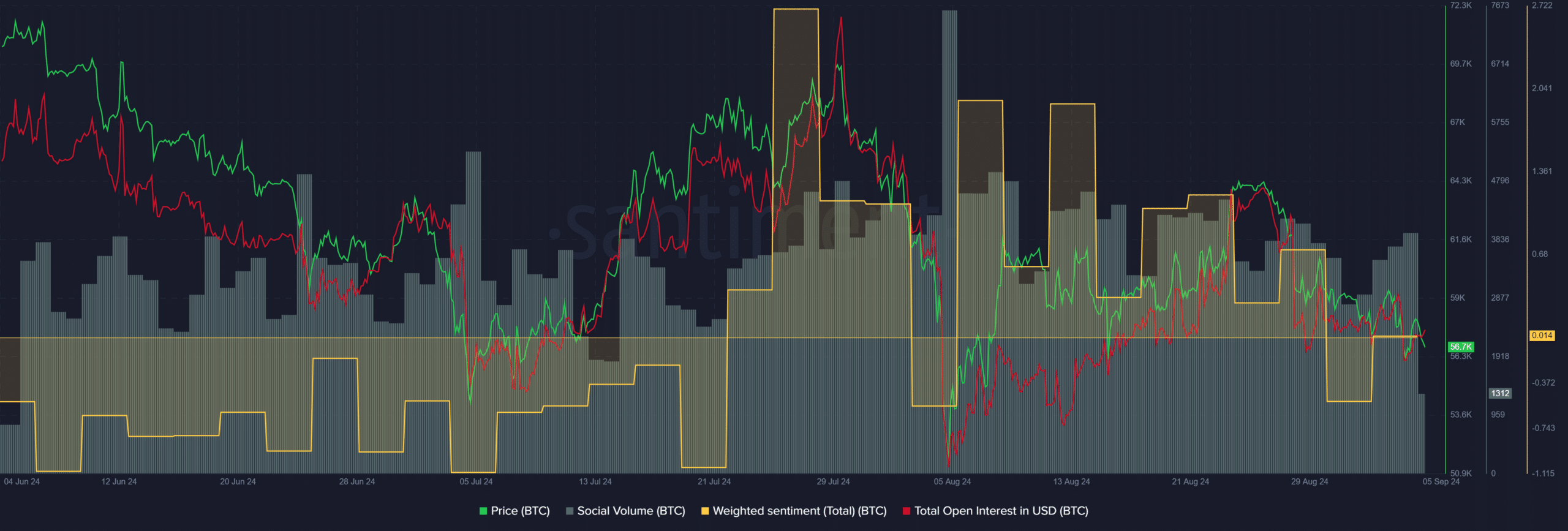

Supply: Santiment

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Bitcoin’s Social Quantity has slowly declined over the previous month. The Weighted Sentiment, which had been constructive when Bitcoin reclaimed the $60k degree in mid-August, started to climb decrease prior to now three weeks.

The Open Curiosity additionally fell swiftly when BTC was rejected on the $64k resistance zone. Total, the market sentiment was bearish and people trying to purchase have been within the minority.