- Bitcoin’s restoration triggered a rally in crypto shares.

- Amid rising reputation, the Minneapolis Fed President thought of BTC nugatory.

After the “Uptober” prospects appeared to dwindle following Bitcoin’s [BTC] decline under the crucial $60,000 mark final week, the king coin has now made a exceptional comeback.

On the 14th of October, BTC hit a excessive of $66,500, the very best value since July.

This value hike catalyzed a double-digit rally for publicly traded crypto-linked companies within the U.S.

CleanSpark (CLSK)—a Bitcoin mining firm, posted the very best beneficial properties of 12.72% as per Google Finance. This was intently adopted by Coinbase (COIN), which appreciated by 11.32%.

Different notable gainers had been LM Funding America (LMFA) up by 10.94%, TeraWulf (WULF) rising 6.65%, and Marathon Digital Holdings (MARA) climbing 5.60%.

At press time, Bitcoin was buying and selling at $65,657, gaining 9.04% over the previous month and greater than 144% within the final yr.

Why is BTC going up?

The crypto shares rally comes as Bitcoin advantages from heightened investor curiosity, fueled partially by anticipation surrounding the upcoming U.S. presidential elections.

Notably, each the Republican and Democratic events have adopted a pro-crypto stance.

This, in flip, has elevated the potential of additional upside for Bitcoin no matter whether or not Donald Trump or Vice President Kamala Harris secures the presidency.

Trump, who beforehand expressed skepticism about cryptocurrency, has rebranded himself as a pro-crypto candidate and even launched his crypto-related challenge, as reported by AMBCrypto.

Then again, Harris is more and more positioning herself as a crypto advocate. Her current proposal centered on cryptocurrency enjoying a key position in fostering financial empowerment.

Questions come up over BTC’s worth

Regardless of the rising acceptance and help from the bigger group, BTC continues to face skepticism from conventional monetary leaders and establishments.

On the 14th of October, Minneapolis Federal Reserve Financial institution President Neel Tushar Kashkari mentioned that Bitcoin stays nugatory after 12 years.

Kashkari emphasised that regardless of the longevity of digital belongings, crypto has not been capable of set up itself as a viable foreign money.

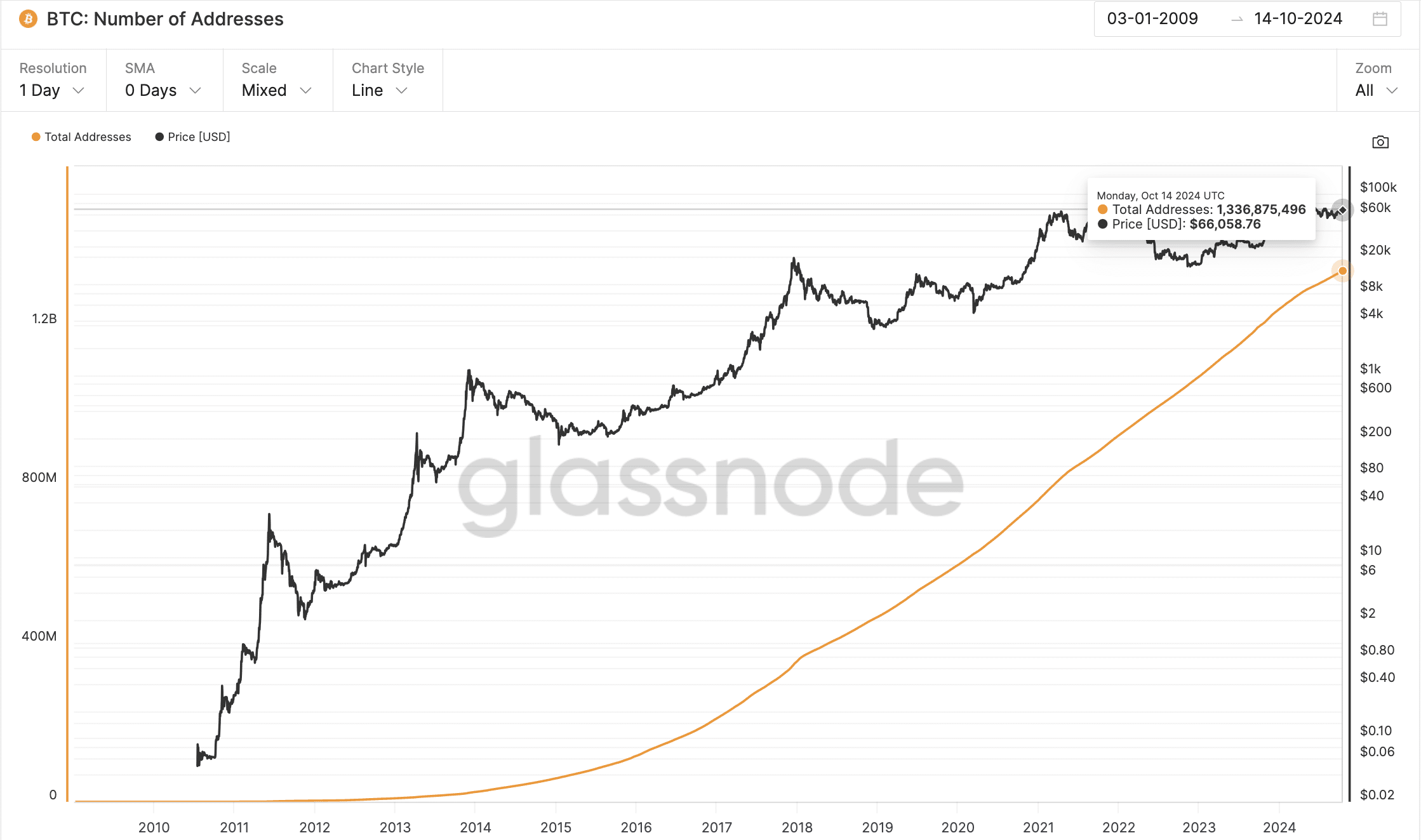

Nevertheless, Bitcoin’s efficiency tells a special story—its $1.3 trillion market cap and 1.3 billion addresses, as per Glassnode, spotlight its broad adoption, market confidence, and recognition as a worthwhile digital asset regardless of criticisms.