- Ripple CLO has referred to as for an finish to SEC overreach in 2025.

- Variant Fund CLO cautioned of a sluggish however constructive crypto regulation outlook.

US crypto executives anticipated higher regulatory readability in 2025 underneath the brand new Trump administration.

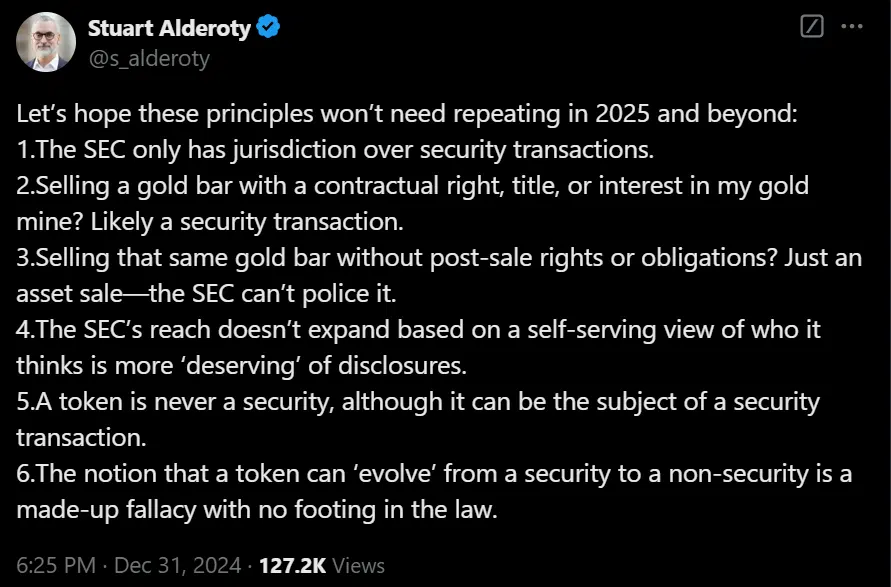

In a current X (previously Twitter) submit, Stuart Alderoty, Ripple’s chief authorized officer, referred to as for an finish to SEC overreach in 2025.

Some points highlighted are linked to the continuing Ripple-SEC lawsuit. For the uninitiated, the company sued Ripple for promoting XRP with out safety registration.

Though the courts decided that the XRP sale on exchanges didn’t represent a ‘security’ supply, the institutional sale was safety.

The regulator is due for an attraction in mid-January. Nonetheless, with pro-crypto SEC chair Paul Atkins, most analysts anticipate that the brand new administration will dismiss the attraction.

2025 crypto regulation outlook: Sluggish however constructive

Regardless of being hopeful, Jake Chervsinsky, CLO of crypto VC Variant Fund, warned neighborhood members to decrease their expectations of a radical, fast-tracked coverage shift. He stated,

“The market may overestimate what can be done in a day. DC moves slowly, and real change takes time and hard work. But all the stars are aligned for crypto in 2025.”

On his half, Coinbase CLO Paul Grewal gave a recap of crypto regulation in 2024 and acknowledged,

“If the most lasting contribution from crypto in 2024 is the reminder that US law comes from Congress, not agencies, as enforced by courts—I’m good with that.”

Put otherwise, he bolstered that the actual coverage shift begins with the US Congress.

Curiously, the business understood this and drove a large lobbying effort within the 2024 US elections. Now, the house is ready to have probably the most pro-crypto Congress and President in historical past.

The sector’s resounding resolve behind the pro-crypto Trump candidacy was knowledgeable by the reported SEC overreach and notorious rules by enforcement method.

Aside from Ripple, the SEC sued Coinbase and Binance and supposed to indict DeFi leaders like Uniswap.

Nonetheless, all these might change when President Donald Trump formally resumes workplace on the twentieth of January, no less than per the neighborhood expectations.

That stated, the sector has pushed for higher crypto regulation by way of Stand With Crypto (SWC), a world crypto advocacy group.

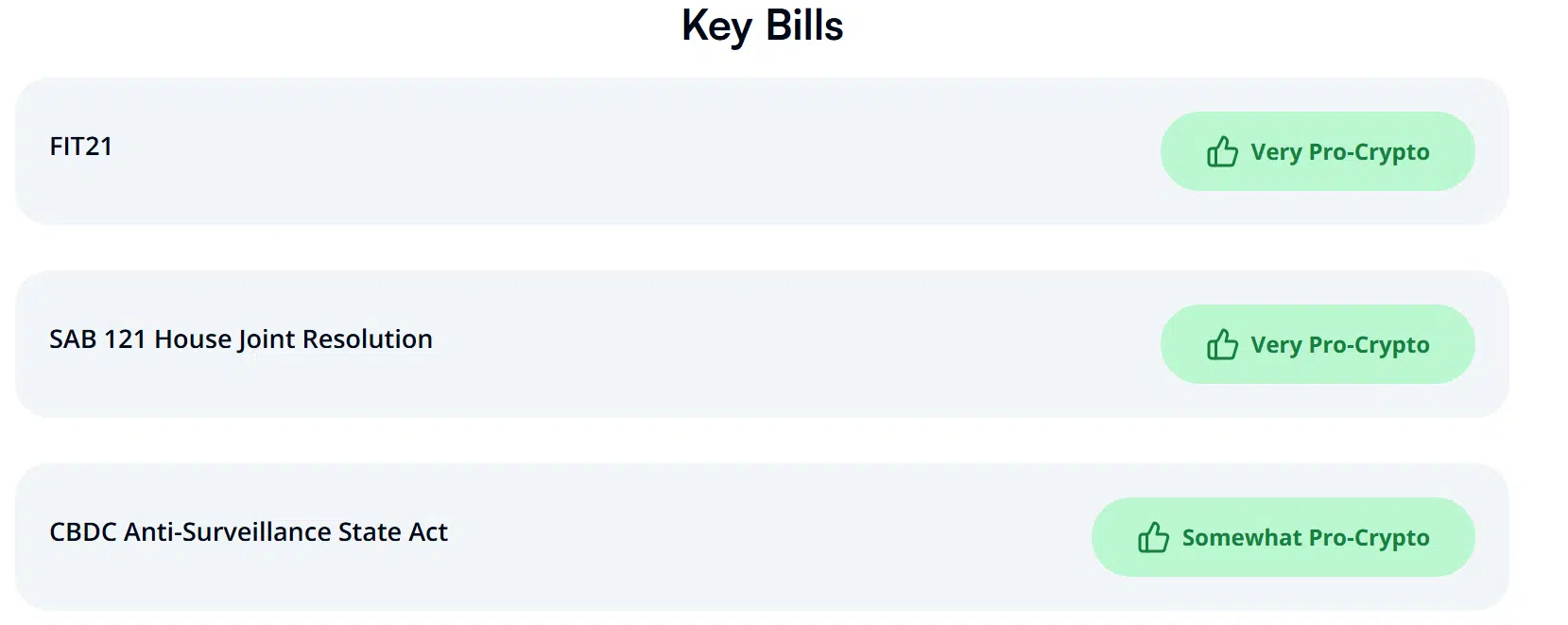

A number of the prime crypto payments embrace the market construction invoice, dubbed the FIT21 Act, the SAB 121 Joint Decision, and the CBDC Anti-Surveillance State Act.

Extra regularity readability might enable the US to catch as much as the EU’s MiCA tips, which turned efficient on the thirtieth of December 2024.