- Crypto liquidations hit almost $300 million in simply 24 hours, pushed by Bitcoin’s sudden value surge.

- Quick positions confronted the most important losses, with over $206 million liquidated as Bitcoin broke key resistance ranges.

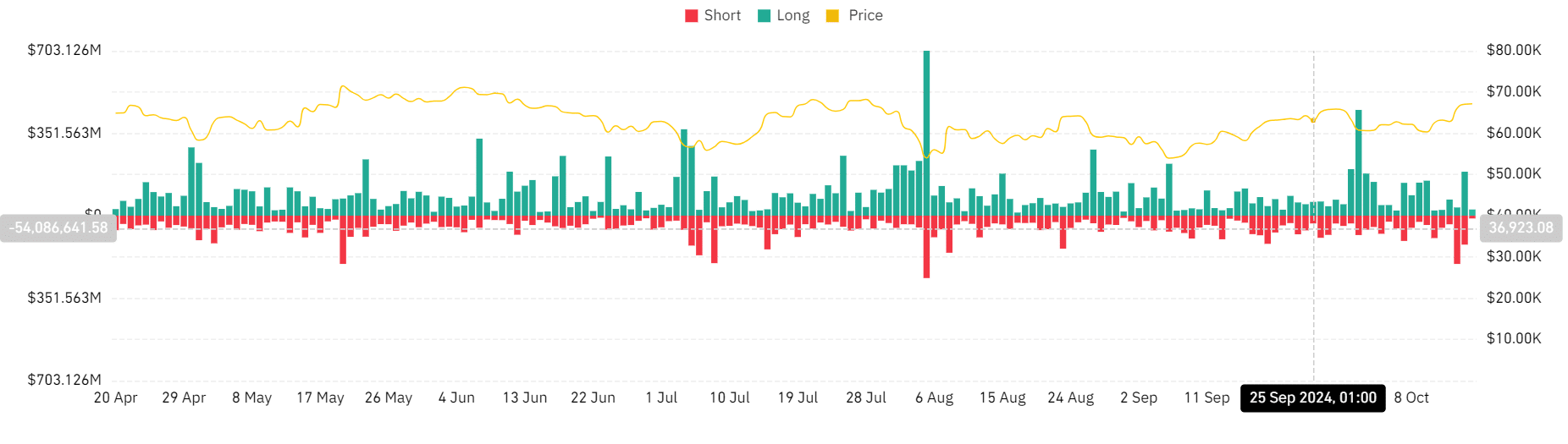

Up to now few days, each lengthy and brief positions have skilled important liquidations, with crypto liquidations reaching almost $300 million in simply 24 hours.

The catalyst for this surge in liquidations was a sudden value leap in Bitcoin [BTC], which broke by means of a key resistance degree, inflicting a wave of compelled liquidations throughout the market.

Crypto liquidations close to $300 million

Knowledge from Coinglass revealed that crypto liquidations climbed to virtually $240 million on the 14th of October.

Quick positions have been hit the toughest, with roughly $206 million in liquidations, whereas lengthy positions accounted for about $35 million.

Nevertheless, the state of affairs shifted within the following buying and selling session. The following day, lengthy place liquidations surged to over $187 million. Quick positions continued to really feel the strain, dealing with over $123 million in liquidations.

This mixed complete represented the second-largest liquidation occasion of the month, trailing solely behind the huge $500 million liquidation that occurred on the first of October.

As of this writing, lengthy positions proceed to endure, with greater than $25 million in liquidations already recorded within the present buying and selling session.

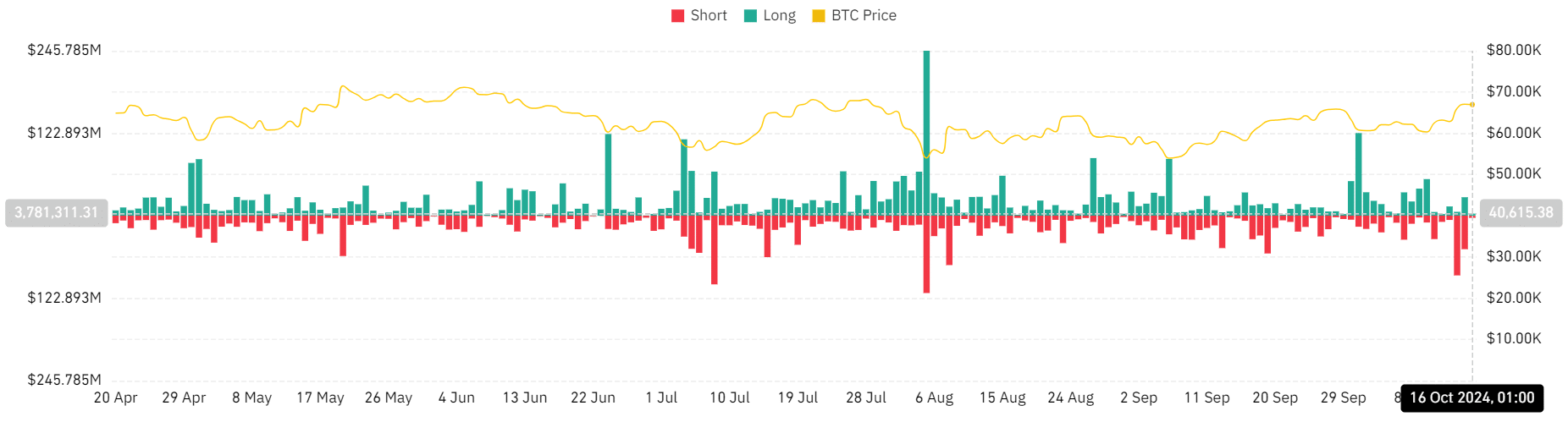

Bitcoin liquidations present sturdy consistency

The speedy value motion in Bitcoin triggered the current wave of crypto liquidations. After a protracted interval of minimal value motion, Bitcoin surged, resulting in a sequence of liquidations, particularly for brief positions.

AMBCrypto’s evaluation of the liquidation chart confirmed that on the 14th of October, Bitcoin liquidations totaled over $94 million. Quick positions bore the brunt, accounting for $89 million.

Within the following session, brief liquidations dropped to virtually $50 million, whereas lengthy liquidations climbed to $27 million.

This sample means that Bitcoin’s current value surge has disproportionately affected brief merchants because it continues to construct momentum.

Bitcoin value developments

Wanting on the Bitcoin’s value chart, on the 14th of October, the worth surged by greater than 5%. This precipitated a serious affect on brief positions, which noticed over $200 million in liquidations.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The next day, Bitcoin continued its upward momentum, posting a 1% improve. This time, lengthy positions took nearly all of the hits within the liquidation market.

At press time, Bitcoin was buying and selling within the $67,000 value vary, displaying a slight improve and additional including to the complexity of the crypto liquidations development.