- Bitcoin and Ether drop amid U.S. commerce tariff announcement, triggering vital market volatility.

- Regardless of the downturn, Bitcoin held above $90K, with many traders urging to “buy the dip.”

Amid escalating issues over a possible international commerce warfare, Asian inventory markets skilled vital declines.

This adopted U.S. President Donald Trump’s announcement of sweeping tariffs on Canada, China, and Mexico. The financial uncertainty despatched shockwaves by means of the markets, affecting cryptocurrencies as effectively.

Main digital property, together with Bitcoin [BTC] and Ethereum [ETH], witnessed steep drops. BTC briefly fell to a three-week low of $91,441.89, whereas ETH plummeted by 24%, reaching its lowest worth since September.

The downturn continued into the weekend, with Bitcoin slipping additional by 7%. The CoinDesk 20 Index, which tracks the highest 20 cryptocurrencies, noticed a pointy 19% drop.

As investor sentiment weakened, issues about future stability have risen.

Tariff warfare sends shockwaves in crypto

In reality, the crypto market has skilled its largest liquidation so far.

Commenting on this, a crypto investor often called ‘The Wolf of All Streets’ pointed out,

“$2B liquidated in 24 hours. That’s a record. More than the Covid dump. More than the FTX collapse. Epic.”

Including to the fray was one other X (previously Twitter) person who mentioned,

“Be fearful when others are greedy, be greedy when others are fearful.”

Nevertheless, regardless of the latest downturn, Bitcoin has managed to carry above the $90K mark. As per CoinMarketCap, BTC was buying and selling at $95,375, at press time, after a 4.36% drop prior to now 24 hours.

Whereas some traders, like ‘The Wolf of All Streets,’ expressed cautious optimism about additional value dips, emphasizing a reluctance to promote in such an oversold market, the broader crypto neighborhood stays hopeful.

Group stays optimistic amidst huge crypto liquidation

Many are urging others to ‘buy the dip,’ suggesting a optimistic outlook for Bitcoin’s long-term potential even amidst the present volatility.

Echoing related sentiments was one other X person who added,

“I haven’t lost hope in the market yet, I’d say this was just a MASSIVE liquidity sweep, BTC has bounced off a long term support.The whole market is oversold.”

He continued,

“I wouldn’t be surprised if the market continues downwards but we will see a recovery withing the coming week.”

Not too long ago, Robert Kiyosaki, famend writer of Wealthy Dad, Poor Dad, described Bitcoin’s latest dip following Trump’s tariffs as a “buying opportunity.”

He sees this market correction as a pretty likelihood for traders.

Nevertheless, Kiyosaki additionally emphasizes that the U.S. fiscal debt stays a much more urgent subject, one that can proceed to drive curiosity in property like Bitcoin, gold, and silver as protected havens throughout occasions of monetary uncertainty.

He mentioned,

“Trump tariffs begins: Gold, silver, Bitcoin may crash. Good. Will buy more after prices crash. Real problem is DEBT…which will only get worse. Crashes mean assets are on sale. Time to get richer.”

What lies forward for Bitcoin?

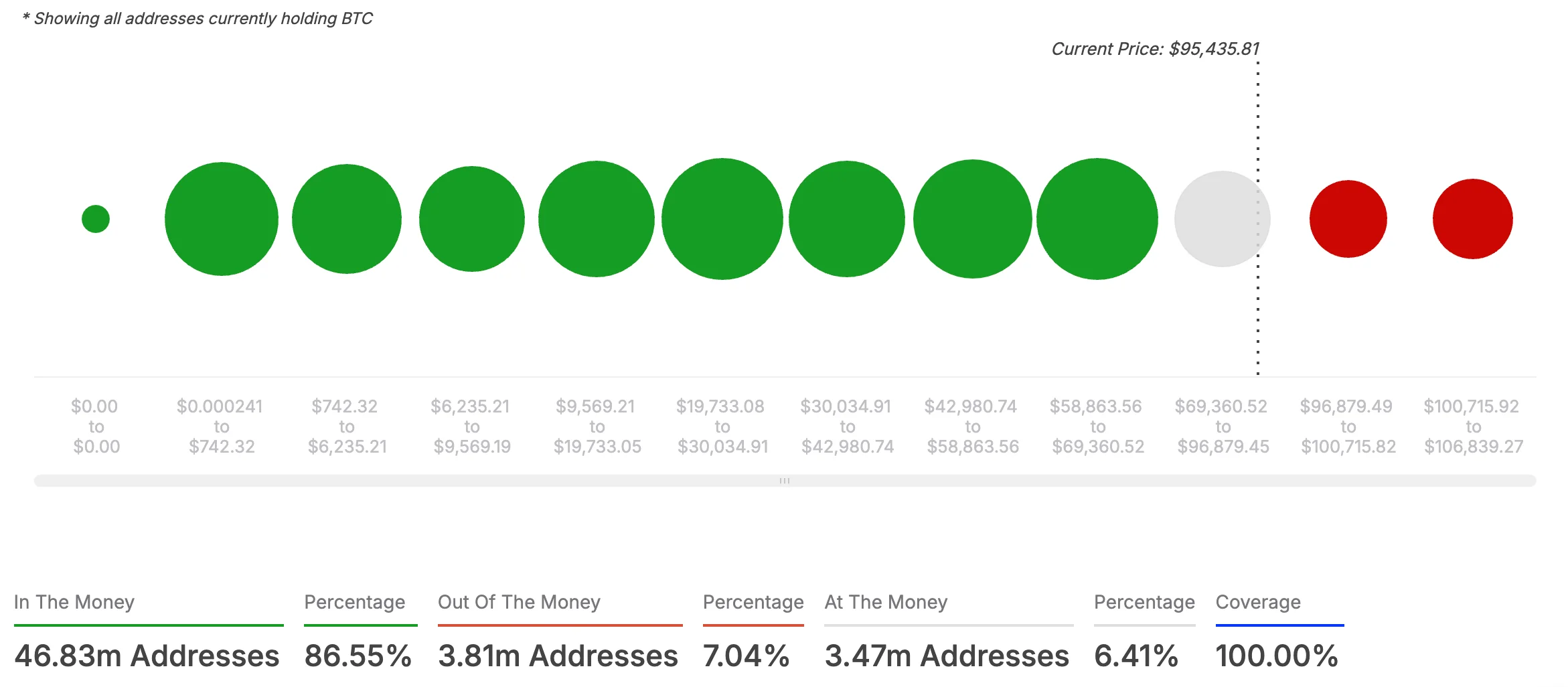

Moreover, latest knowledge from AMBCrypto, based mostly on IntoTheBlock’s insights, reveals a largely optimistic sentiment within the Bitcoin market.

A big 86.55% of Bitcoin holders are presently “in the money,” holding tokens valued above their buy value, which alerts optimism and potential for a value surge.

In distinction, solely 7.04% of holders are “out of the money,” with their tokens valued decrease than their authentic buy value.

This disparity displays rising bullish sentiment within the cryptocurrency neighborhood, regardless of exterior pressures like rising commerce tensions and market volatility.

When evaluating latest occasions to main market crashes in cryptocurrency historical past, the liquidation figures in the course of the FTX collapse in November 2022 are notably notable.

In that occasion, the market noticed over $2.8 billion in liquidations inside 24 hours, surpassing even the $1 billion liquidations in the course of the COVID-19 market downturn in March 2020. This highlights the severity of market reactions to vital occasions.

It additionally serves to underline the resilience of the crypto market, with many traders persevering with to see Bitcoin and different digital property as long-term alternatives regardless of the continuing volatility.