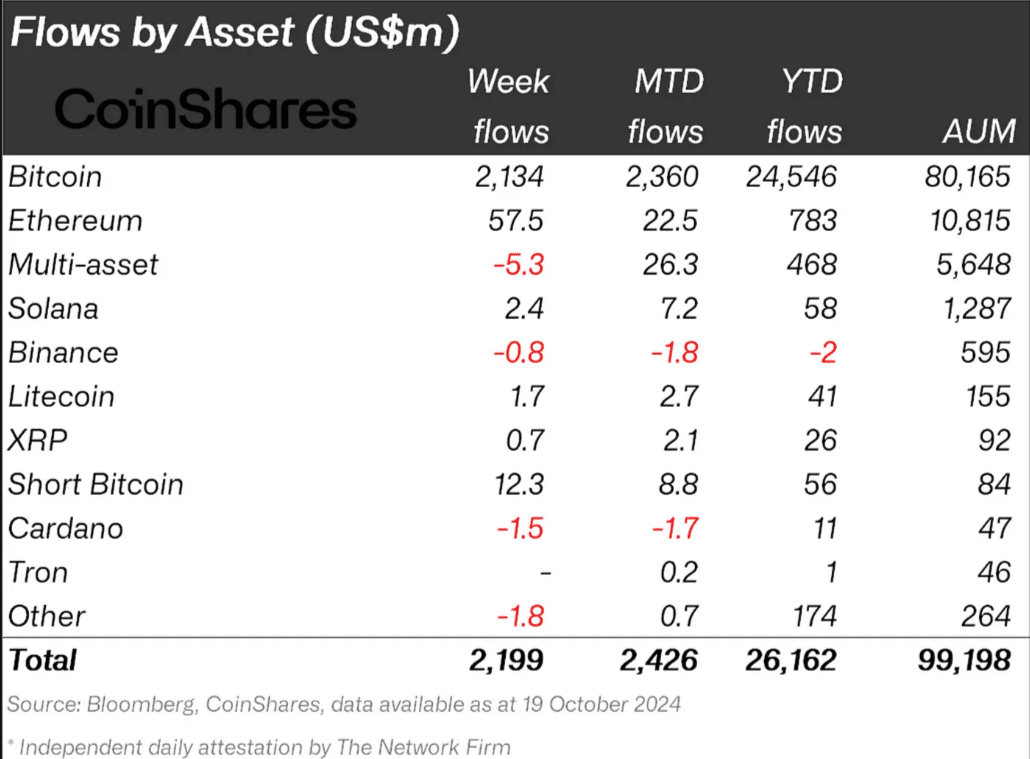

- Crypto funding merchandise netted $2.2 billion in inflows final week.

- Bitcoin dominated the inflows amid elevated possibilities of Trump profitable the U.S. elections.

Final week, crypto market traders had been closely in risk-on mode, as famous by a whopping $2.2 billion inflows.

In keeping with CoinShares knowledge, this was the biggest surge since July, underscoring a renewed bullish sentiment witnessed previously few days.

Trump’s influence on BTC

Bitcoin [BTC] dominated practically 99% of the weekly inflows, raking in $2.13 billion, making it the spotlight of traders’ curiosity.

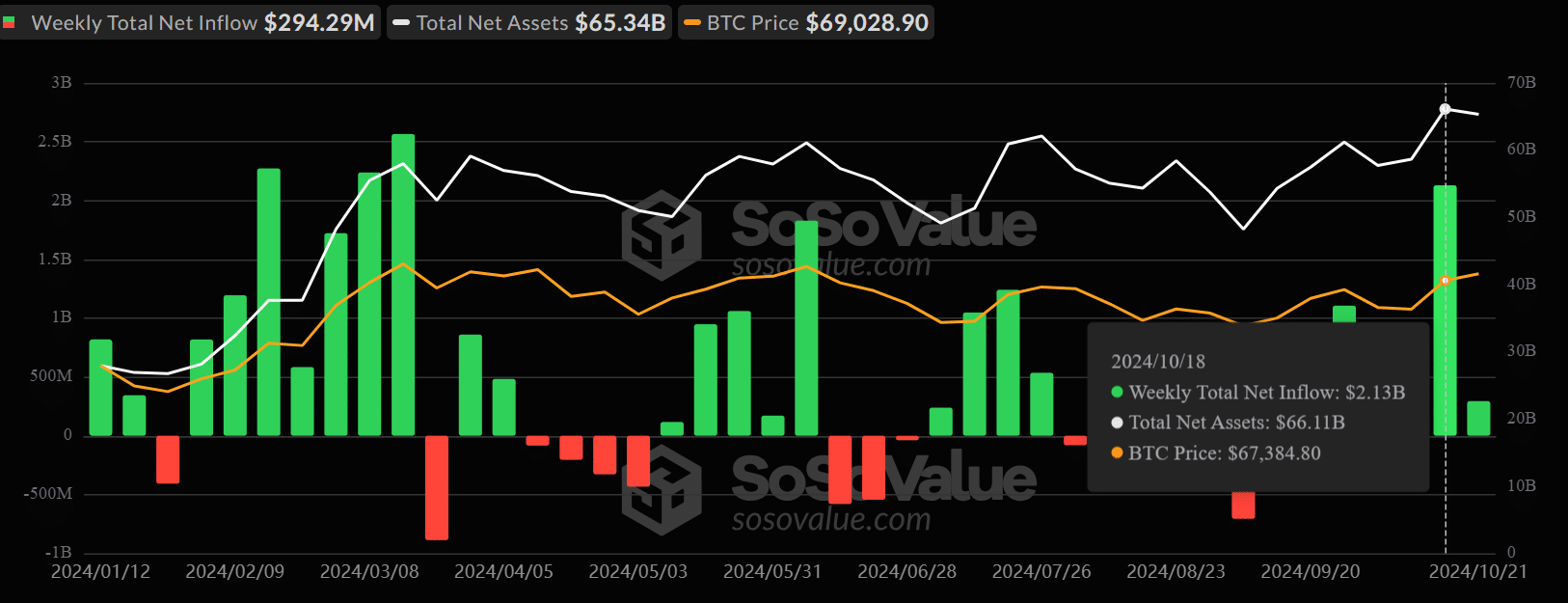

The influence of the large inflows was additionally evident on the worth charts, because the world’s largest digital asset rallied practically 10%, rising from $62.4K to over $69K.

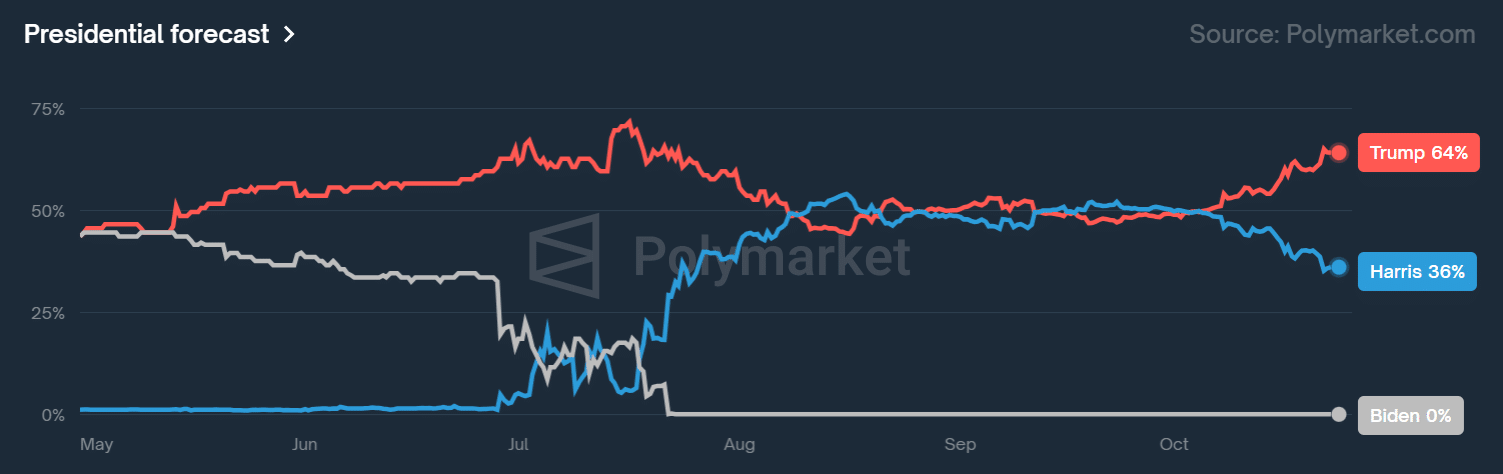

In keeping with CoinShares’ James Butterfill, the renewed market optimism was linked to growing odds of Donald Trump profitable the US presidential elections. He stated,

“We believe this renewed optimism stems from growing expectations of a Republican victory in the upcoming US elections, as they are generally viewed as more supportive of digital assets. This, in turn, has led to positive price momentum.”

For context, final week, Trump’s odds of profitable on the prediction website Polymarket topped 60% for the primary time since July.

It stood at 64% at press time, a 28-point lead towards Kamala Harris’s 34%.

In keeping with Presto Analysis’s analyst Min Jung, the momentum might proceed within the coming weeks beneath two situations.

“If Trump’s dominance continues and the Fed signals a more dovish stance, we could see renewed momentum for Bitcoin in the weeks following these events.”

That stated, sturdy demand from US spot BTC ETFs additionally pushed the merchandise to a brand new excessive in web property held. It crossed $66.1 billion in complete web property beneath administration (AUM).

Different altcoins additionally confirmed renewed traction, with Ethereum [ETH] logging $57.5 million and Solana [SOL] tapping $2.4 million.

With solely about two weeks to the US elections, will the bullish streak within the crypto markets proceed?

Properly, crypto buying and selling agency QCP Capital was assured that the uptrend might prolong, citing choices knowledge. It said,

“Markets are bracing for a volatile #Election: While #BTC skews towards bullish calls despite trading 8% below its peak, the S&P 500 hedges with put protection ahead of a potential 1.8% post-election swing.”

It meant that crypto traders had been optimistic about upside potential (shopping for name choices) whereas the US inventory market feared pullback (shopping for put choices).