- Japanese agency Metaplanet added $10.4 million in Bitcoin, bringing its holdings to over 1,000 BTC.

- Market indicators, together with rising open curiosity and MVRV ratio, sign potential for Bitcoin’s continued bullish momentum.

Following a dip in Bitcoin [BTC] worth late final week, the cryptocurrency is displaying indicators of a rebound, with costs returning above $68,000 as the brand new week begins.

As of Monday morning, Bitcoin was buying and selling at roughly $67,953, marking a 1.3% enhance over the previous 24 hours and peaking at $68,210 in early hours of at present.

Metaplanet provides to its Bitcoin holdings

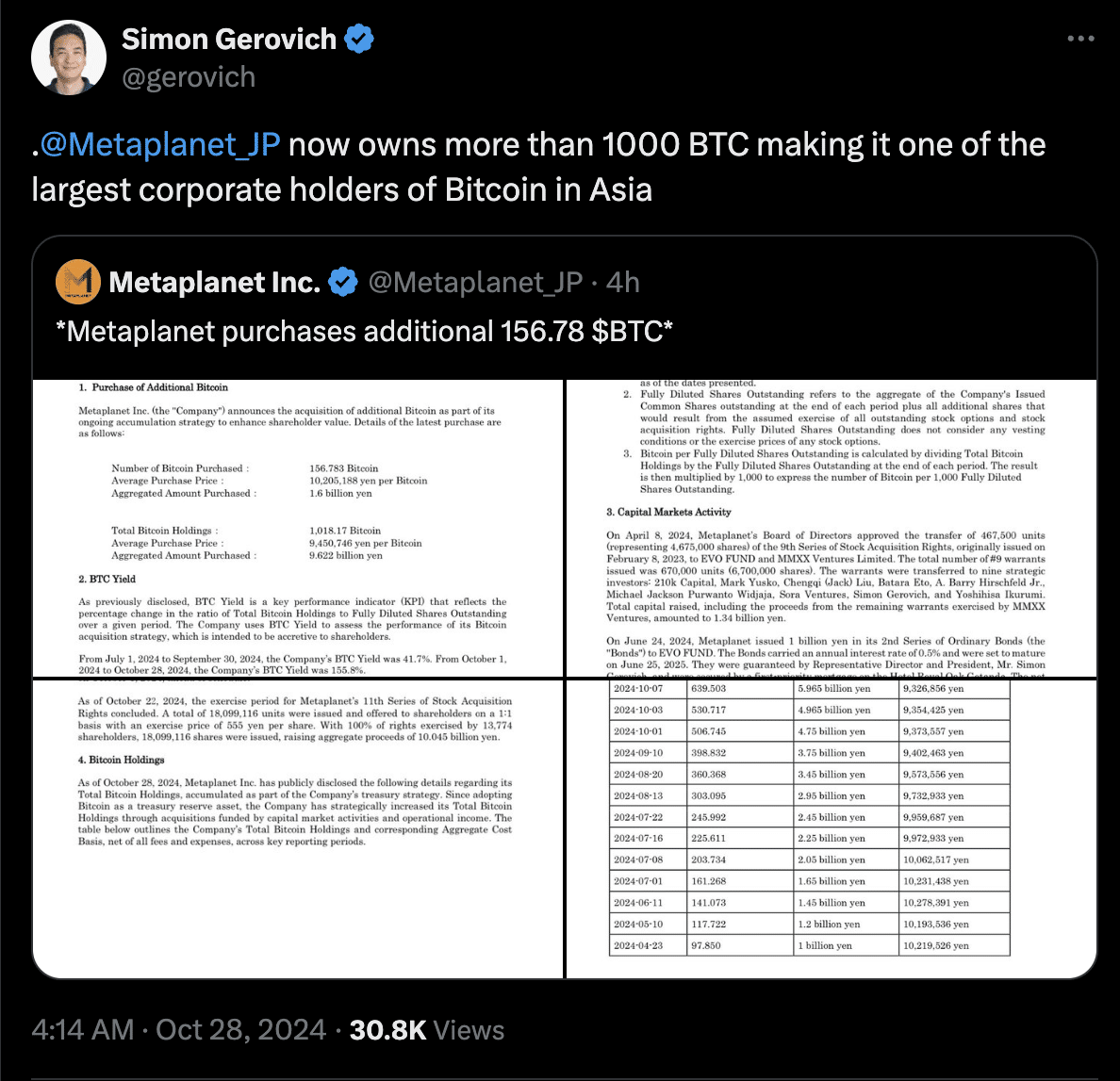

This restoration coincides with a big growth: Japanese funding agency Metaplanet Inc has introduced one other giant Bitcoin buy, including $10.4 million value of BTC to its holdings.

This latest acquisition brings the agency’s Bitcoin reserves to over 1,000 BTC, positioning Metaplanet among the many high company Bitcoin holders in Asia.

Metaplanet’s renewed dedication to BTC displays a broader pattern of firms adopting cryptocurrency as a strategic treasury asset.

Following its preliminary announcement in Could, Metaplanet has steadily gathered BTC, rising its reserves from 141.07 BTC on the finish of June to a considerable 1,018.17 BTC at present.

This dedication is bolstered by the agency’s capital market actions, together with a latest $66 million elevate by its eleventh inventory acquisition program.

CEO Simon Gerovich shared that Metaplanet’s intention to take care of BTC as a major reserve aligns with its long-term outlook on digital property. Nonetheless, the agency clarified that holding shares doesn’t present shareholders with any direct declare to the BTC in reserve.

BTC’s rising market indicators sign doable worth stability

Along with constructive momentum from company shopping for, Bitcoin’s technical indicators are pointing to elevated investor curiosity.

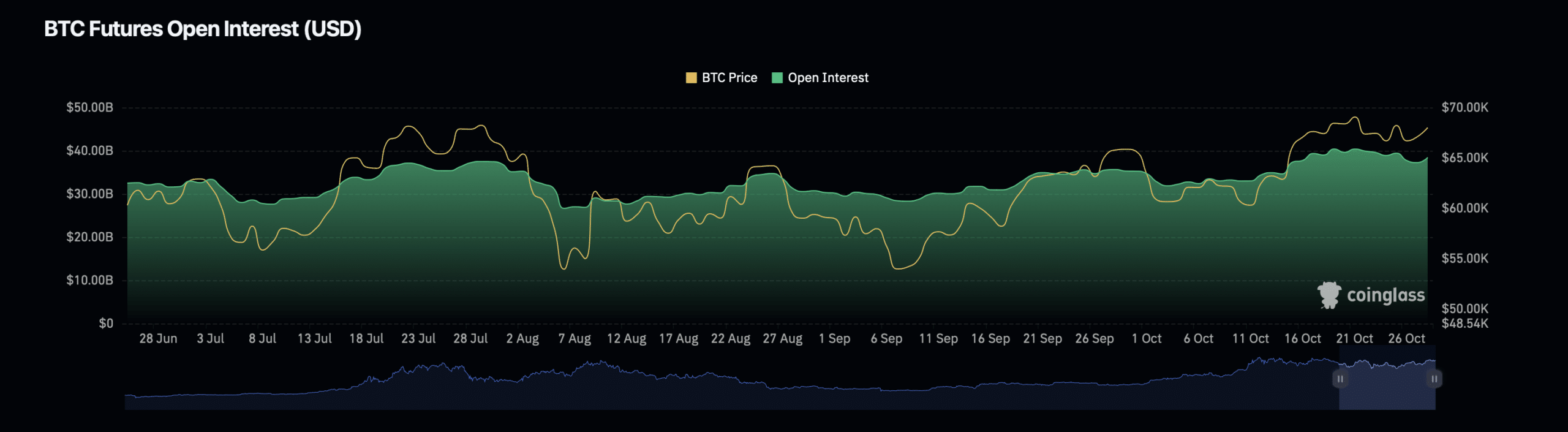

Information from Coinglass reveals that Bitcoin’s open curiosity has grown by 4.26%, reaching $38.89 billion, with open curiosity quantity seeing a considerable 61.13% enhance, at present valued at $33.77 billion.

Open curiosity refers back to the whole variety of excellent by-product contracts, corresponding to futures and choices, that haven’t but been settled.

An uptick in open curiosity can point out increased market exercise, suggesting that buyers anticipate additional motion in Bitcoin’s worth. When open curiosity rises in tandem with a worth enhance, it might sign a buildup of bullish sentiment.

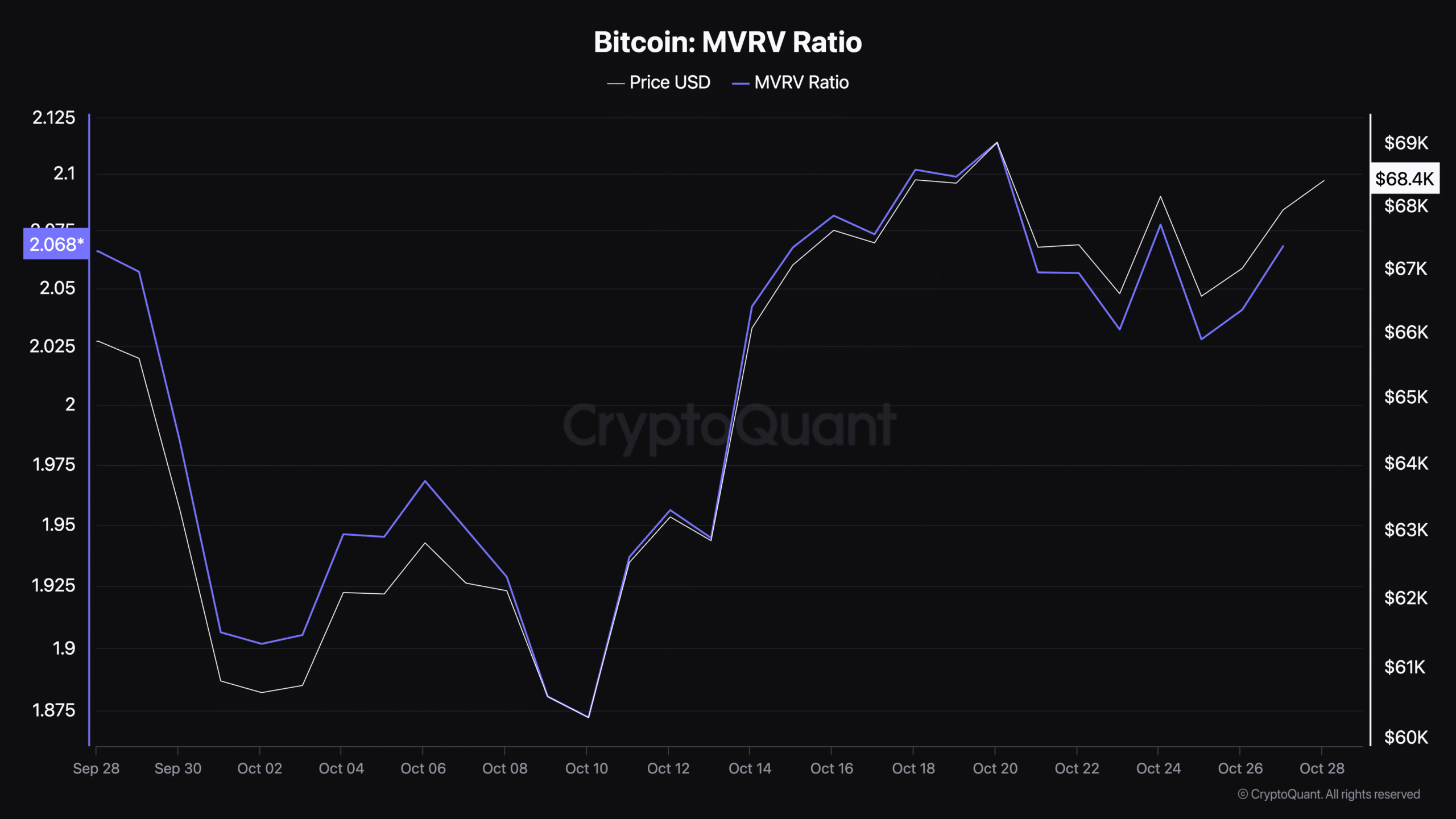

Moreover, Bitcoin’s Market Worth to Realized Worth (MVRV) ratio has just lately climbed to 2.06, as per CryptoQuant knowledge. This metric compares Bitcoin’s present market worth to its common realized worth, offering perception into whether or not it’s overvalued or undervalued relative to its historic efficiency.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

An MVRV ratio above 1 typically indicators that BTC is valued increased than its buy price, suggesting the potential for investor profit-taking.

Nonetheless, an increase within the MVRV ratio, particularly throughout a interval of worth stability or enhance, can mirror constructive sentiment available in the market, because it implies buyers are prepared to carry onto their positive aspects somewhat than promote.